Page added on September 15, 2016

The Elephant In The Low-Growth Room

The global economy is stuck in low gear, signaling more years of subpar yields and risk-on/risk-off market skirmishes. So we offer some ideas on how equity investors can get their portfolios battle ready.

The potential GDP growth of the developed world has halved over the past 20 years, from just below 2% per year to less than 1% today. The drop across emerging markets has been similarly dramatic.*

We see several megatrends at work: aging world populations, rising income inequality and deglobalization are structurally depressing productivity and, in turn, economic growth. By deglobalization, we mean the unraveling of the over 20-year advance of global trade and cross-border capital investment.

Globalization In Retreat

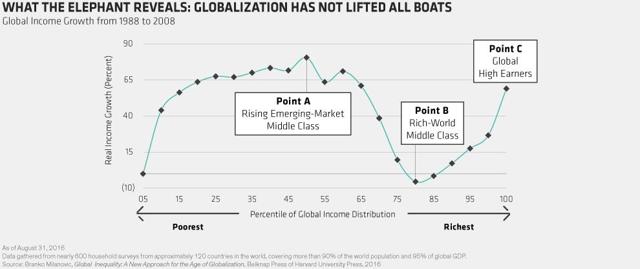

One prominent driver of deglobalization could have lasting effects: the growing political backlash against globalization in advanced nations (witness Brexit and the rising protectionism in the US and eurozone). What’s behind this pendulum swing? For context, let’s look at the “elephant chart,” so called because of its distinct shape (Display). Based on research from economist Branko Milanovic, the chart reveals the stark divide between the winners and losers of globalization.

The chart ranks the global population from the lowest to the highest percentiles of household income, and measures each percentile’s real income growth between 1988 and 2008. The biggest beneficiaries by far have been emerging-market middle classes (Point A) and the richest 1% in developed markets (Point C), half of which are Americans. Those on the losing end (Point B) are the working and middle classes of the US, Japan and Western Europe, where incomes have stagnated.

Globalization is too well entrenched to be stopped completely. And we’re seeing a steady increase in regional trade pacts. Even so, the slowdown in global trade and the dearth of cross-border investment are feeding back on each other, and could continue to be significant drags on the global economy.

Given the higher probability of a prolonged period of low global growth, investors will need strategies that can persevere in that scenario. We offer three criteria:

1. Identify New Pockets Of Growth

Low growth doesn’t mean no growth anywhere. New markets will emerge, and the companies at the forefront of these markets will be more prized in a growth-scarce world. Examples of potential growth sources include technological innovations across the broad e-commerce domain and shifts in consumer tastes and preferences, such as the growing demand for healthy foods and lifestyles.

Two other examples: the shrinking working-age population is likely to boost demand for productivity-improvement tools and services via software-assisted solutions, while increased geopolitical instability could drive higher defense spending.

2. Focus On Profitability With Staying Power

In a low-growth world, demand for products and services can easily evaporate. So look for companies with durable competitive advantages that enable them to maintain high and predictable profitability for longer than the market gives them credit for. The sources of this sustainability can vary – from a well-defended network effect to a hard-to-replace service or beloved brand to a low-cost production process.

3. Stick With Shrewd Capital Managers

In times of stronger economic activity, over-investments in capacity are eventually absorbed as demand grows, essentially bailing out the managers who made those bad decisions. In a low-growth world, there is far less wiggle room. Today, investment-worthy businesses achieve scale cheaply and allocate capital judiciously. A strong balance sheet provides a solid line of defense in times of greater uncertainty.

Investors face a tough slog ahead. Corporate managements and investors need to understand and adapt to the broader context. In today’s market, we believe that a selective, active approach, focused on sustainable profitability at an attractive price, is the best way forward. For the vigilant and nimble investor, there will be opportunities for the taking, even in a sustained low-growth world.

7 Comments on "The Elephant In The Low-Growth Room"

makati1 on Thu, 15th Sep 2016 7:03 pm

Alpha is dead and rotting. The smell is getting stronger as the capitalist system breaks down into the cesspool of greed it has become. Anyone still playing the market has lost all common sense and greed drives their insanity. Shades of 1929.

Davy on Thu, 15th Sep 2016 7:27 pm

Typical superficiality of a market oriented analysis. In this case it is trade barriers and changing demographics. Globalism is seen as the answer and anything contrary to globalism is a problem. Income inequality was mentioned but without the full picture of wealth transfer within a shrinking pie. Here income.inequality is a factor of turning away from globalism and a product of poor policy. The real reason is decay, deflation, and depletion.

Globalism is to blame on more than one level. The obvious is low wage exploitation but there is also systematic distortions. Efficiency and homogeneous living arrangements are being promoted through market actions. This is destroying local culture and local productivity. Eventually this market destruction is leaving many areas economically neutralized. Once a local economy has been disrupted and damaged globalism takes over often with the same outcome of exploitation then departure to greener pastures. We are caught in a trap and that trap is globalism. It is supporting us and killing us. Which of these two diametrically opposed forces will win out? I think we know the answer. Globalism is not only destroying the social fabric it is destroying the natural fabric. That is the real tragedy. We can make another civilization we can create a new earth.

penury on Thu, 15th Sep 2016 9:10 pm

I think that even the elites are beginning to see the problems with globalization. There will always be winners and losers. No nation can be a constant loser without a change in elites. Hit them where it hurts in the pocket book and perhaps some degree of independence and freedom will be returned to the people.

MikeX11.2 on Fri, 16th Sep 2016 8:14 am

THE DUMBASSES PICKED HAYEK.

The right wing nuts picked Hayek, and used the Greek Crisis to bail out banks instead of restoring the Greek economy. Then there was no real “keynesian” stimulus, because “government solutions don’t work”.

Try dumbass policy and you fail.

Don’t vote Conservative globally, and don’t vote Dumbass Republican nationally.

ghung on Fri, 16th Sep 2016 8:37 am

“1. Identify New Pockets Of Growth”

Sounds like Identify New Pockets Of Cheap-to-produce Oil

2. Focus On Profitability With Staying Power

Sounds like; Focus On Profitability With Staying Power By Finding New Pockets Of Cheap-to-produce Oil

I expect that “New Pockets Of Growth” will be as hard to find as “New Pockets Of Cheap-to-produce Oil” since these things are all inter-connected. Of course, growth monkeys won’t allow limits to growth on their radar. They have no choice but to insist that growth can be de-coupled from resources, environment and climate. The only path to ongoing growth is to redefine what growth really is, which has been happening for a while now; increase the debt and call that “growth”. Silly neo-capitalist parasites….

Sissyfuss on Fri, 16th Sep 2016 9:12 am

Right on, Ghung. You nailed it.

Boat on Sat, 17th Sep 2016 1:06 pm

Developed countries are saturated with products. Their homes are remodeled vrs tore down and replaced. The markets are huge but efficiency is taking its bite out of GDP.

Lets take the tv, who in the developed world dosent have one. In the last 20 years prices have dropped dramaticly. Replacement cost hurts GDP but no loss to quality of life.

Modern equipment to heat and cool your home will pay for itself in energy savings many times over in many cases. There are hundreds of examples of these GDP killers while maintaining and improving life styles while using less energy.