Page added on February 22, 2014

OPEC and oil prices: Leaky barrels

SEEN one way, economic recovery in Europe and America is good for the Organisation of the Petroleum Exporting Countries (OPEC). Oil stocks in industrialised countries are at their lowest for five years; the latest monthly report from the International Energy Agency (IEA), a club of oil-consuming countries, anxiously urges producers to keep pumping to replenish them.

But the longer-term future for OPEC, which produces about a third of the world’s daily consumption of 90m barrels of crude oil, is another matter. Often described as a cartel, it is better seen as an anti-glut group. When demand is weak, its members can curb production to prevent the price plummeting. But when demand is healthy, its ability to curb new producers is limited. And new producers abound.

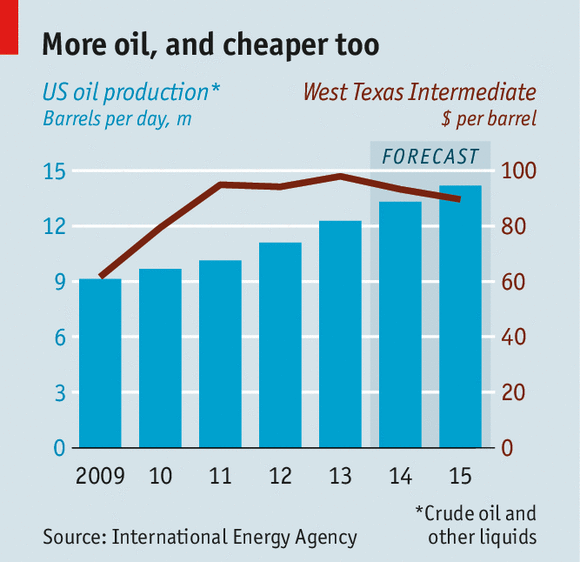

America’s domestic production of crude (and gas, which displaces some oil) is rocketing. The IEA says the country will produce 14m barrels a day (b/d) next year, on a par with Saudi Arabia (see chart). That has reduced America’s imports, as well as boosting exports of fuels (exports of crude oil are mostly banned). That frees crude from other places, such as West Africa, to go to Europe instead. Similarly, Latin American and Middle Eastern oil that once would have gone to America now goes to Asian customers.

For the oil-rich, even worse is in store. Other factors that have propped up the price over the past decade are likely to wane in importance. Even the slightest easing of sanctions helps Iran, potentially a huge producer. It increased its exports by 100,000 b/d in January—the third consecutive monthly rise. Iraqi oil exports, stricken by the war and its aftermath, are also set to increase. The Economist Intelligence Unit (our sister company) forecasts a “significant boost” in 2014 from 2.4m b/d last year. This assumes new investment pays off, and a deal with the semi-autonomous Kurdish region. Libya could be another source of production: its exports have collapsed to only a few hundred thousand barrels a day, against 1.6m in June last year.

These downward pressures on the oil price present OPEC with a tricky decision. Its natural response would be to cut production from the current target of 30m b/d to support prices near the level of recent years, of around $100 a barrel. But OPEC’s record of enforcing quotas on its 12 members is patchy. Another option would be for Saudi Arabia and its Gulf allies, the group’s biggest producers, to cut production unilaterally. But that would cede market share to their hated rivals, Iran and Iraq. An alternative would be to increase production sharply. That would send the price down: painful for the kingdom, but even more painful for higher-cost producers (not least America, where the “tight oil” now coming on stream requires prices of $50 and above to be profitable).

OPEC’s best hope is continued American protectionism. Any easing of the restrictions on the export of liquefied natural gas (LNG) or crude will exert more downward pressure on the oil price. That might be good for the world economy, but it is not a priority for American consumers, who would like cheaper petrol for cars and propane for heating, especially during cold snaps like the recent one. “Chickens are dying,” noted an American speaker at an event put on by Argus Media, an energy-information group, during the International Petroleum Week in London. “Farmers are asking, ‘Why are we exporting propane when we could be burning it here?’”

9 Comments on "OPEC and oil prices: Leaky barrels"

Nony on Sun, 23rd Feb 2014 2:09 pm

If SA wants to punish us with $50 oil, go ahead. I will sacrifice Hamm to the overall GDP. @Rock is rich enough too.

rockman on Sun, 23rd Feb 2014 5:32 pm

I’m sorry but I’ve had enough of these idiots that ignore the simple facts. The KSA and the rest of OPEC are not threatened by increases in production in the US, Iran and Iraq. First, all but the KSA are producing flat out and many have passed their PO. Even Indonesia has become a net oil importer. Second, even for OPEC members that have seen decreased production levels their incomes have soared from just 10 years ago. KSA income has increased from $60 billion/year to well above $300 billion/year.

And the cause of the increase was the same factor leading to increases in US production and the anticipated increases in Iran/Iraq: higher oil prices. The KSA could reduce it’s production bbl for bbl with ever increase from all other produces, keep prices where they are currently and still have income significantly greater than they had not long go. And the kicker: besides retaining more of their FINITE RESERVE BASE the KSA wouldn’t have the need to spend hundreds of $billions to ramp up additional production.

IMHO the bigger concern for the KSA and OPEC isn’t a decrease in oil price but a significant increase. The world is currently able to buy a record level of oil and do so paying the highest annual average price ever seen. Why would any exporter want to damage that dynamic? Let oil prices spike up and a repeat of the 80’s global economic recession seems likely. The only place “$50/bbl oil” has in the conversation is in the context of such a global recession IMHO.

So I’ll repeat: IMHO the significant increase in US oil production is one of the clearest indication of the PO world we’re facing. With the exception of us in the oil patch the increase in domestic production is nothing to be pleased about. Just like every drunk who feels good at the time that feeling is lost when they wake up with a hangover. For the American consumer the hangover arrived with the 300% increase in oil price that slapped them upside the head. LOL.

bobinget on Sun, 23rd Feb 2014 5:42 pm

“Why are we exporting Propane”? Cause foreign prices for propane are double that of what you dumb farmers pay, that’s why.

Religious differences in the present day Mideast will no doubt whatsoever prevent OPEC from ever again being

an important factor in world oil pricing.

“The Economist” ignores two proxy civil wars,

one near civil war raging among top FOUR members. In Syria we see Russia (not an OPEC member but top producer) Iraq and Iran supporting Syria’s

bloody dictatorship, while fellow OPEC members Saudi Arabia (and other Gulf States) support the opposition

with tons of oil money and arms.

Add the fact that the US and Israel are also involved in this mess and tell me oil will ever slip back below $90, the price all deeply religious parties to this FFF* need to support Western and Chinese arms purchases.

Those arms are a serious detriment to PEACEFUL economic expansion. WE are talking hundreds of billions in armaments instead of alternative industries

designed to support a post oil, post food, post water, populations.

The ‘near civil war’ which most certainly will disrupt

oil shipments to China, I refer to Venezuela.

IN fairness, Venezuela’s conflict is not religious but economic, (political) in nature. Catholics will be killing fellow Catholics in Venezuela with regard to social standing only. Because in many respects, Venezuela’s difficulties are economic and Not religious

in nature, Venezuela’s problems are potentially solvable.

Too many have Mid-Easterners have perished

in support of their tightly held religious beliefs for

this long emergency to be settled any time soon.

Of course a pro arms, oil and manufacturing rag like “The Economist” is not about to insult their biggest advertisers.

*Fossil Fuel Freakout

westexas on Sun, 23rd Feb 2014 6:59 pm

Copy of my post on the Economist website:

It’s always interesting when the Economist, which in 1999 suggested that we would see $5 oil prices, talks once again about oil prices falling.

In any case, a data base I compiled from EIA data show that Global Net Exports of oil (GNE*) have been below the 2005 rate of seven straight years, through 2012 (2013 data not available yet). Furthermore, developing countries, led by China, have been consuming an increasing share of a post-2005 declining volume of GNE. For more information, you can search for: Export Capacity Index.

For information directly on topic, you can search for: Why is Saudi Arabia not a threat to fracking?

*GNE = Combined net exports from top 33 net exporters in 2005, total petroleum liquids + other liquids, EIA

Northwest Resident on Sun, 23rd Feb 2014 7:12 pm

“For the American consumer the hangover arrived with the 300% increase in oil price that slapped them upside the head.”

And the American consumer still has a big date with the Porcelain God.

GregT on Mon, 24th Feb 2014 12:50 am

Hmmm,

I think that the average American consumer, (or every other consumer for that matter) is still hanging out at the bar running up a tab, doing shots of Jack Daniels and tequilla, and singing songs about BAU and free market capitalism. When they finally wake up, even the Porcelain God won’t take away the hangover. The hangover will become the new sobering reality.

Davy, Hermann, MO on Mon, 24th Feb 2014 1:18 am

@Rock – “IMHO the bigger concern for the KSA and OPEC isn’t a decrease in oil price but a significant increase. The world is currently able to buy a record level of oil and do so paying the highest annual average price ever seen. Why would any exporter want to damage that dynamic?”

True Rock!

I cannot emphasis enough the perilous state of the global economic system at this moment. It is not overtly evident. Sure, everyone knows about the various problems. Most people deap down are uneasy but there is still confidence. We are a frog in boiling water. We are seeing manipulation in markets and distortions of economic numbers with little consequences. We are seeing the moral hazards by governments of maintaining the corruption and exploitation of the TBTF global elite people and companies. In the meantime we are pretty much peak everything in regards to what is necessary to grow. The growth now is a skim from the bellow to the top in the form of the “first contact of money” If you are lucky enough to have access to the “money creations” then you are guaranteed a cut or “money for nothing” Now ask me “Davy how does this relate to Opec oil?” Well it doesn’t but it does relate to the all-important financial system. I guarantee you if oil slips or rises out of the goldilocks price range we will have consequences. We are in a new normal financially. For the new status quo BAU to operate properly we must have low interest rates and favorable market news. Oil has a way of turning economies upside down very quickly. Do any of you think the cyclical nature of the oil market is over? Do you think they have that market in their bag too? I don’t think so. The oil segment of the world economy is the one truly global market that touches just about everyone. It is an amazing thing and it is very dangerous if left to its own devises. How long will it be before some kind of intervention occurs? I know we don’t hear about Heinberg’s Oil protocol anymore but we should!

Northwest Resident on Mon, 24th Feb 2014 1:23 am

I probably have a warped sense of humor, but somehow the image of humanity with a splitting headache, crawling across the sticky booze-stained floor to lift itself up and puke repeatedly into the Porcelain God(dess) seems to me like a pretty good analogy for what we have to look forward to.

Nony on Mon, 24th Feb 2014 6:27 pm

Given the inelastic nature of demand, if I am OPEC, I prefer 150/bbl over 100/bbl. A 50% price rise does not cause a 33% drop in demand. I make more money at higher price. (Same as when it went from 20 to 100.) Sure, at some point total demand drops so low that higher price is not my friend. But for now? 105 is better than 100. 100 is better than 95. Etc.

Tight oil is nothing for SA to be scared of (unless it goes worldwide and even then, they have supply at 1/5 the cost…they will always sell their product.) But it still limits how much money they make. It just makes the peak world more tolerable for consumers. (Not “good”, but “less bad”.)