Page added on July 25, 2016

Gail Tverberg: Overly Simple Energy-Economy Models Give Misleading Answers

Does it make a difference if our models of energy and the economy are overly simple? I would argue that it depends on what we plan to use the models for. If all we want to do is determine approximately how many years in the future energy supplies will turn down, then a simple model is perfectly sufficient. But if we want to determine how we might change the current economy to make it hold up better against the forces it is facing, we need a more complex model that explains the economy’s real problems as we reach limits. We need a model that tells the correct shape of the curve, as well as the approximate timing. I suggest reading my recent post regarding complexity and its effects as background for this post.

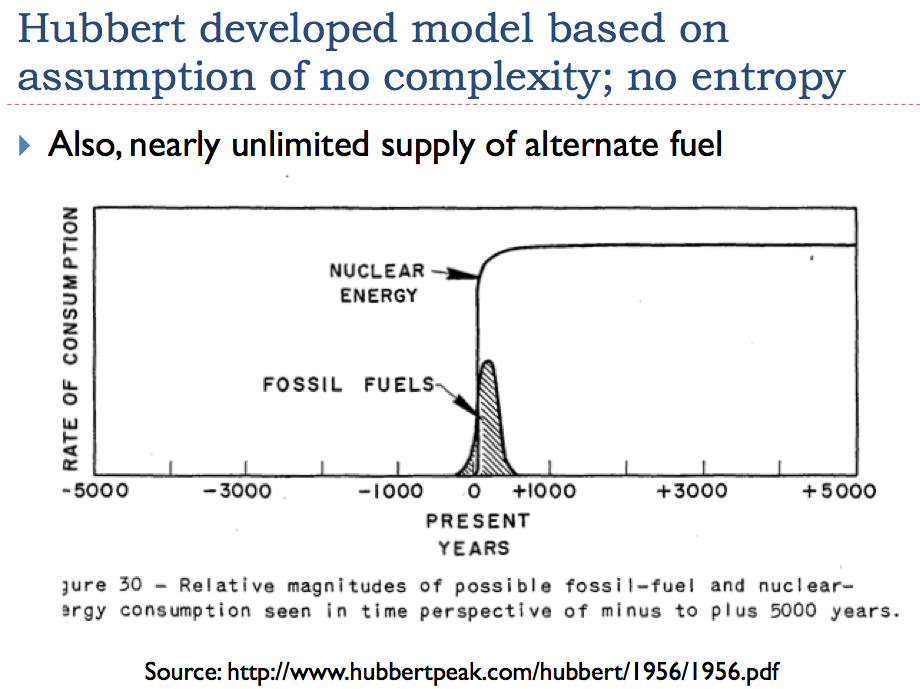

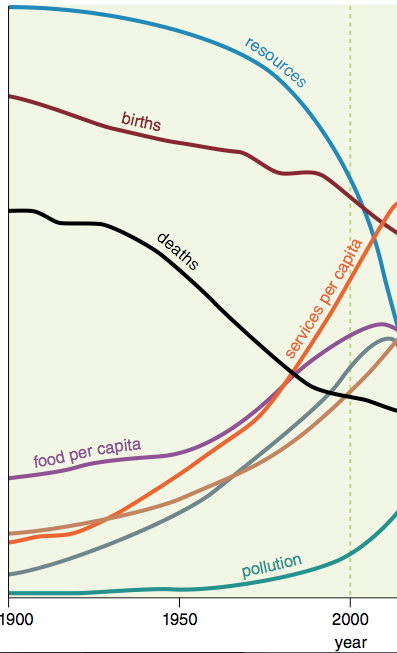

The common lay interpretation of simple models is that running out of energy supplies can be expected to be our overwhelming problem in the future. A more complete model suggests that our problems as we approach limits are likely to be quite different: growing wealth disparity, inability to maintain complex infrastructure, and growing debt problems. Energy supplies that look easy to extract will not, in fact, be available because prices will not rise high enough. These problems can be expected to change the shape of the curve of future energy consumption to one with a fairly fast decline, such as the Seneca Cliff.

Figure 1. Seneca Cliff by Ugo Bardi. This curve is based on writings in the 1st century C.E. by Lucius Anneaus Seneca, “It would be of some consolation for the feebleness of our selves and our works if all things should perish as slowly as they come into being; but as it is, increases are of sluggish growth, but the way to ruin is rapid.”

It is not intuitive, but complexity-related issues create a situation in which economies need to grow, or they will collapse. See my post, The Physics of Energy and the Economy. The popular idea that we extract 50% of a resource before peak, and 50% after peak will be found not to be true–much of the second 50% will stay in the ground.

Some readers may be interested in a new article that I assisted in writing, relating to the role that price plays in the quantity of oil extracted. The article is called, “An oil production forecast for China considering economic limits.” This article has been published by the academic journal Energy, and is available as a free download for 50 days.

A Simple Model Works If All We Are Trying to Do Is Make a Rough Estimate of the Date of the Downturn

Are we like the team that Dennis Meadows headed up in the early 1970s, simply trying to make a ballpark estimate of when natural resource limits are going to become a severe problem? (This analysis is the basis of the 1972 book, Limits to Growth.) Or are we like M. King Hubbert, back in 1956, trying to warn citizens about energy problems in the fairly distant future? In the case of Hubbert and Meadows, all that was needed was a fairly simple model, telling roughly when the problem might hit, but not necessarily in what way.

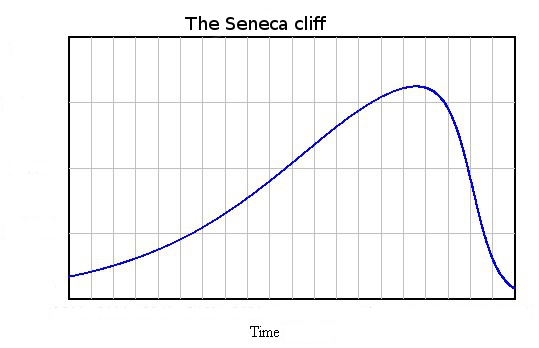

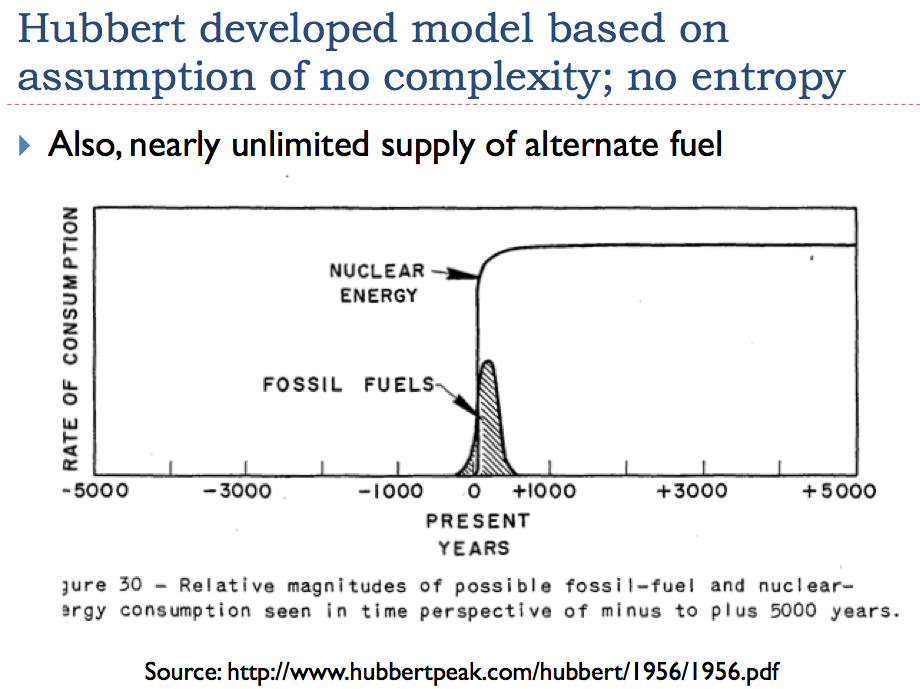

I have criticized Hubbert’s model for being deficient in some major respects: leaving out complexity, leaving out entropy, and assuming a nearly unlimited supply of an alternate fuel. Perhaps these issues were not important, however, if all he was trying to do was warn people of a distant future issue.

Figure 2. Slide 29 from my complexity presentation at the 2016 Biophysical Economics Conference. Hubbert’s model omitted complexity, entropy.

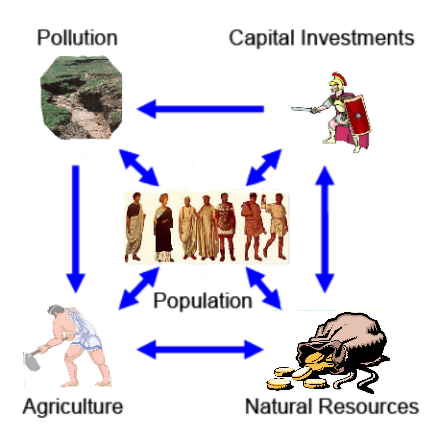

The model underlying the 1972 book, Limits to Growth, was also quite simple. Ugo Bardi has used this image by Magne Myrtveit to represent how the 1972 Limits to Growth model worked. It does not include a financial system or debt.

Figure 3. Image by Magne Myrtveit to summarize the main elements of the world model for Limits to Growth.

As such, this model does not reflect the major elements of complexity, which I summarized as follows in a recent post:

Figure 4. Slide 7 from my recent complexity presentation. Basic Elements of Complexity

Thus, the model does not forecast the problems that can be expected to occur with increasingly hierarchical behavior, including the problems that people who are at the bottom of the hierarchy can be expected to have getting enough resources for basic functions of life. These issues are important, because people at the bottom of the hierarchy are very numerous. They need to be fed, clothed, housed, and have transportation to work. All of these things take natural resources, including energy products. If the benefit of available natural resources doesn’t make it all of the way down to the bottom of the hierarchy, death rates spike. This is one of the forces that can be expected to change the shape of the curve.

Figure 5. Slide 17 from my complexity presentation. People at the bottom of a hierarchy are most vulnerable.

Dennis Meadows does not claim that the model that his group put together will show anything useful about the “shape” of the collapse. In fact, in an article about a year ago, I cut off part of the well-known Limits to Growth forecast to eliminate the part that is likely not particularly helpful–it just shows what their simple model indicates.

Figure 6. Limits to Growth forecast, truncated shortly after production turns down, since modeled amounts are unreliable after that date.

Anthropologist Joseph Tainter’s View of Collapse

If we read what anthropologist Joseph Tainter says in his book, the Collapse of Complex Societies, we find that he doesn’t consider “running out” to be the cause of collapse. Instead, he sees growing complexity to be what leads an economy to collapse. These are two of the points Tainter makes regarding complexity:

- Increased complexity carries with it increased energy costs per capita. In other words, increased complexity is itself a user of energy, and thus tends to drain away energy availability from other uses. Thus, in my opinion, complexity will make the system fail more quickly than the Hubbert model would suggest–the complexity part of the system will use part of the energy that the Hubbert model assumes will be available to fund the slow down slope of the economy.

- Increased investment in complexity tends to reach declining marginal returns. For example, the first expressway added to a highway system adds more value than the 1000th one. Eventually, if countries are trying to create economic growth where little exists, governments may use debt to fund the building of expressways with practically no expected users, simply to add job opportunities.

Ugo Bardi quotes Joseph Tainter as saying,

“In ancient societies that I studied, for example the Roman Empire, the great problem that these economies faced was that they eventually would incur very high costs just to maintain the status quo. They would need to invest very high amounts to solve problems that didn’t yield a net positive return; instead these investments simply allowed the economies to maintain the level that they were at. This increasing cost of maintaining the status quo decreased the net benefit of being a complex society.”

View of Collapse Based on a Modeling Approach

In the book Secular Cycles, Peter Turchin and Surgey Nefedov approach the problem of what causes civilizations to collapse using a modeling approach. According to their analysis, the kinds of things that caused civilizations to collapse very much corresponded to the symptoms of increasing complexity:

- Problems tended to develop when the population in an area outgrew its resource base–either the population rose too high, or the resources become degraded, or both. The leaders would adopt a plan, which we might consider adding “complexity,” to solve the problems. Such a plan might include raising taxes to be able to afford a bigger army, and using that army to invade another territory. Or it might involve a plan to build irrigation, so that the current land becomes more productive. A modern approach might be to increase tourism, so that the wealth obtained from tourists can be traded for needed resources such as food.

- According to Turchin and Nefedov, one problem that arises with the adoption of the new plan is increased wealth disparity. More leaders are needed for the new complex solutions. At the same time, it becomes more difficult for those at the bottom of the hierarchy (such as new workers) to obtain adequate wages. Part of the problem is the underlying problem of too many people for the resources. Thus, for example, there is little need for new farmers, because there are already as many farmers as the land can accommodate. Another part of the problem is that an increasing share of the output of the economy is taken by people in the upper levels of the hierarchy, leaving little for low-ranking workers.

- Food and other commodity prices may temporarily spike, but there is a limit to what workers can pay. Workers can only afford more, if they take on more debt.

- Debt levels tend to rise, both because of the failing ability of workers to pay for their basic needs, and because governments need funding for their major projects.

- Systems tend to collapse because governments cannot tax the workers sufficiently to meet their expanded needs. Also, low-ranking workers become susceptible to epidemics because they cannot obtain adequate nutrition with low wages and high taxes.

How Do We Fix an Overly Simple Model?

The image shown in Figure 3 in some sense shows only one “layer” of our problem. There is also a financial layer to the system, which includes both debt levels and price levels. There are also some refinements needed to the system regarding who gets the benefit of energy products: Is it the elite of the system, or is it the non-elite workers? If the economy is not growing very quickly, one major problem is that the workers at the bottom of the hierarchy tend to get squeezed out.

Figure 7. Author’s depiction of changes to non-elite workers’ share of the output of economy, as costs for other portions of the economy keep rising. The relative sizes of the various elements may not be correct; the purpose of this chart is to show a general idea, not actual amounts.

Briefly, we have several dynamics at work, pushing the economy toward collapse, rather than the resources simply “running out”:

- Debt tends to rise much faster than GDP, especially as increasing quantities of capital goods are added. Added debt tends to reach diminishing returns. As a result, it becomes increasingly difficult to repay debt with interest, creating a major problem for the financial system.

- The cost of resource extraction tends to rise because of diminishing returns. Wages, especially of non-elite workers, do not rise nearly as quickly. These workers cannot afford to buy nearly as many homes, cars, motorcycles, and other consumer goods. Without this demand for consumer goods made with natural resources, prices of many commodities is likely to fall below the cost of production. Or prices may rise, and then fall back, causing serious debt default problems for commodity producers.

- Because of growing complexity of the system, the “overhead” of the system (including educational costs, medical costs, the wages of managers, the cost of government programs, and the cost of resource extraction) tends to increase, leaving less for wages for the many non-elite workers of the world. With lower wages, the non-elite workers can afford less. This dynamic tends to push the system toward collapse as well.

The following is a list of variables that might be added to the overly simple model.

- Debt. As capital goods are added to work around resource shortages, debt levels will tend to rise quickly, because workers need to be paid before the benefit of capital goods can be obtained. Debt levels also rise for other reasons, such as government spending without corresponding tax revenue, and funding of purchases deemed to have lasting value, such as college educations and investments in research and development.

- Interest rates are the major approach that politicians have at their disposal to try to influence debt levels. In general, the lower the interest rate, the cheaper it is to buy cars, homes, and factories on credit. Thus, the amount of debt can be expected to rise as politicians lower interest rates.

- Wages of non-elite workers. Non-elite workers play a dual role: (a) they are the primary creators of the goods and services of the system, and (b) they are the primary buyers of the goods that are made using commodities, such as food, clothing, homes, and transportation services. Thus, their wages tend to determine whether the economy can grow. In general, we would expect wages of workers to rise, if their wages are being supplemented by more and more fossil fuel energy in the form of bigger and better machinery to help the workers produce more goods and services. If the wages of non-elite workers fall too low, we would expect the economy to slow, and commodity prices to fall. To some extent, rising debt (through manipulation of interest rates, or through government spending in excess of tax revenue) can be used to supplement the wages of non-elite workers to allow the economy to continue to grow, even if wages are stagnating.

- The affordable price level for commodities in the aggregate depends primarily on the wage level of non-elite workers and debt levels. A particular commodity may increase in price, but in the aggregate, the total “package” of costs represented by commodity prices must remain affordable, considering wage and debt levels of workers. If wage levels of non-elite workers are rising, the overall affordable price level of commodities will tend to rise. But if wage levels of non-elite workers are falling, or if debt levels are falling, affordable price levels are likely to fall.

- The required price level for commodity production in the aggregate to continue to grow at the previous rate. This required price level will depend on many considerations, including: (a) the rising cost of extraction, considering the impacts of depletion, (b) wage levels, (c) tax requirements, and (d) other needs, including payment of interest and dividends, and required funding for new development. Clearly, if the affordable price level falls below the required price level for very long, we can eventually expect total commodity production to start falling, and the economy to contract.

- The energy needs of the “overhead” of the system. Increasing complexity tends to make the overhead of the system grow much faster than the system as a whole. Energy products of various kinds are needed to support this growing overhead, leaving less for other purposes, such as to increasingly leverage the labor of human workers. Some examples of growing overhead of the system include energy needed (a) to maintain the electric grid, internet, roads, and pipeline systems; (b) to fight growing pollution problems; (c) to support education, healthcare, and financial systems needed to maintain an increasingly complex society; (d) to meet government promises for pensions and unemployment insurance; and (e) to cover the rising energy cost of extracting energy products, water, and metals.

- Available energy supply based on momentum and previous price levels. A few examples explain this issue. If a large oil project was started ten years ago, it likely will be completed, whether or not the oil is needed now. Oil exporters will continue to pump oil, as long as the price available in the marketplace is above their cost of production, because their governments need at least some tax revenue to keep their economies from collapsing. Wind turbines and solar panels that have been built will continue to produce electricity at irregular intervals, whether or not the electric grid actually needs this electricity. Renewable energy mandates will continue to add more wind turbines and solar panels to the electric grid, whether or not this electricity is needed.

- Energy that can actually be added to the system, based on what workers can afford, considering wages and debt levels [demand based energy]. Because matching of supply and demand takes place on a short-term basis (minute by minute for electricity), in theory we need a matrix of quantities of commodities of various types that can be purchased at various price levels for short time-periods, given actual wage and debt levels. For example, if more electricity is dumped on the electric grid than is needed, how much impact will a drop in prices have on the quantity of electricity that consumers are willing to buy? The intersections of supply and demand “curves” will determine both the price and quantity of energy added to the system.

The output of the model would be three different estimates of whether we are reaching collapse:

- An analysis of whether repayment of debt with interest is reaching limits.

- An analysis of whether affordable commodity prices are falling below the level needed for commodity consumption to grow, likely leading to falling future commodity production.

- An analysis of whether net energy per capita is falling. This would reflect a calculation of the following amount over time:

If net energy per capita is falling, the ability to leverage human labor is falling as well. Thus productivity of human workers is likely to stop growing, or perhaps decline. The total amount of goods and services produced is likely to plateau or fall, leading to stagnating or declining economic growth.

If net energy per capita is falling, the ability to leverage human labor is falling as well. Thus productivity of human workers is likely to stop growing, or perhaps decline. The total amount of goods and services produced is likely to plateau or fall, leading to stagnating or declining economic growth.

The important thing about the added pieces to this model is that they emphasize the one-way nature of the system. The economy needs to grow, or it collapses. The price of energy products cannot rise much at all, because wages of workers don’t rise correspondingly. This means that any energy substitute must be very cheap. The system needs to keep adding debt, especially when capital goods are added. The benefit of this debt reaches diminishing returns. The combination of these diminishing returns with respect to investments made with debt, and the interest that needs to be paid on debt, means that it is very difficult for energy products based on capital goods to “save” the system.

Complexity Adds Unforeseen Problems

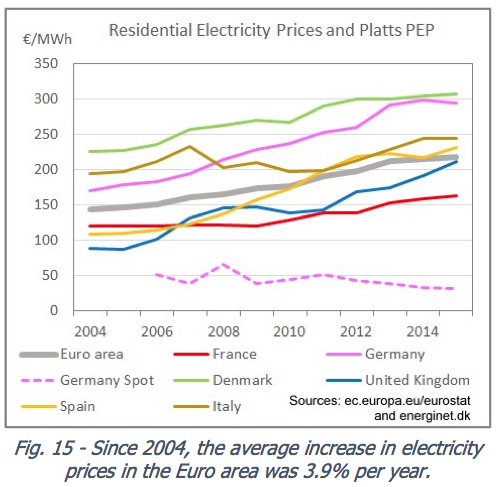

One issue that people working solely in the energy sector may not notice is that our current system for setting market-based electricity prices is not working very well, with the addition of feed-in tariffs and other subsidy programs. There is evidence that subsidizing renewable electricity tends to lead to falling wholesale electricity prices. In a sense, if we subsidize electricity prices for one type of electricity producer, we find it also necessary to subsidize electricity prices for other types of electricity producers. (Also in California.)

Figure 8. Residential Electricity Prices in Europe, together with Germany spot wholesale price, from http://pfbach.dk/firma_pfb/references/pfb_towards_50_pct_wind_in_denmark_2016_03_30.pdf

Inadequate prices for electricity producers and a need for ever-rising subsidies for electricity production could, by themselves, cause the system to fail. In a sense, this pricing problem is a complexity-related outcome that economists have overlooked. Their models are also too simple!

Conclusion

It is easy to rely on too-simple models. Perhaps the biggest issue that is missed is that energy prices can’t rise endlessly. Because of this, a large share of natural resources, including oil and other energy products, will be left in the ground. Furthermore, because prices do not rise very high, energy products that are expensive to produce can’t be expected to work, either, no matter how they are disguised. Substitutes that cannot be inexpensively integrated into the electric grid are not likely to work either.

I talked about low-ranking workers being a vulnerable part of the system. It is clear from Joseph Tainter’s comments that another vulnerable part of our current system is the various “connectors” that allow us to have our modern economy. These include the electric grid, roads and bridges, the pipeline systems, the water and sewer systems, the internet, the financial system, and the international trade system. Even government organizations such as the Eurozone might be considered vulnerable connecting systems. The energy cost of maintaining these systems can be expected to continue to rise. Rising costs for these systems are part of what makes it difficult to maintain our current economic system.

The focus on “running out” has led to a focus on finding ways to extend our energy supply with small quantities of high-priced alternatives. This approach doesn’t really get us very far. What we need to keep the economy from collapsing is a growing supply of cheap-to-produce energy and other natural resources. Ideally, these new resources should require little debt, and not cause pollution problems. These requirements are exceedingly difficult to meet in a finite world.

8 Comments on "Gail Tverberg: Overly Simple Energy-Economy Models Give Misleading Answers"

penury on Mon, 25th Jul 2016 12:15 pm

Relying on simple models is necessary because over 98 per cent of the readers cannot understand simple models, if more information is included reading and comprehension drop accordingly.

marmico on Mon, 25th Jul 2016 2:00 pm

The Turdburger energy supply model.

How many shit sandwiches can one eat before uncontrollable belly laughs prevent same?

rockman on Mon, 25th Jul 2016 3:55 pm

penury – And another way to look at it. Models are useful but can’t predict the future. With one exception: every model requires an input of specific ASSUMPTIONS. If one knows exactly what the correct assumption are the it is no longer a model but a calculation. IOW if X + Y + Z = 10 and you know for a fact that X = 5, Y = 3 and Z = 2 then you know the CALCULATION is correct.

But if you don’t know what X, Y and Z are you need to make assumptions. And this is where models can be very useful in determining the CRITICAL ASSIMPTIONS. But only if the model is properly constructed.

Obvious any MODEL of future oil prices, for example, require some very big assumptions: future production rate, economic demand, amount of physical oil left in the ground, etc. None of those parameters are known FACTS. Assumptions must be made.Assumption with a range of possibilities. By inputting the extremes of those ranges will highlight which parameters are CRITICAL to a future state as well as those which will have insignificant impact if estimated wrong.

But again that still depends on a properly constructed model. And that’s leads to another level of debate: even if correct assumptions are made an improperly designed model will still produce crap.

And as the Rockman has stated many times: modeling is like masterbating: nothing is wrong with either, As long if you don’t start thinking either is the real thing.

Jerry McManus on Mon, 25th Jul 2016 4:45 pm

From the very end of the article:

“What we need to keep the economy from collapsing is a growing supply of cheap-to-produce energy and other natural resources. Ideally, these new resources should require little debt, and not cause pollution problems. These requirements are exceedingly difficult to meet in a finite world.”

Well, that says it all right there!

You can pretty much skip all the rest of it, especially her tired and worn-out rants about Hubbert and Meadows et. al. and how “simplistic” their models are because they didn’t include debt.

Yawn. Gail does tend to parrot herself quite often.

IPissOnLosers on Mon, 25th Jul 2016 7:51 pm

This women is total idiots.

She gives the following fourman

(Total energy consumption)-(Energy consumed defined by broadly overhand)/population

No where in her paper she defines what (Energy consumed defined by broadly overhand) is and neither she gives some examples. It you put an equation into a scientific paper you have to define the variables and gives some example, She does none of that

Her writing is at the same level of a first year hight school student.

GregT on Tue, 26th Jul 2016 1:09 am

“This women is total idiots.”

“She gives the following fourman”

“Her writing is at the same level of a first year hight school student.”

Several grades above yourself, it would certainly appear.

Rodster on Tue, 26th Jul 2016 1:03 pm

“This women is total idiots.

She gives the following fourman

(Total energy consumption)-(Energy consumed defined by broadly overhand)/population

No where in her paper she defines what (Energy consumed defined by broadly overhand) is and neither she gives some examples. It you put an equation into a scientific paper you have to define the variables and gives some example, She does none of that

Her writing is at the same level of a first year hight school student.”

Good grief, you rag on the woman and your rant reads more like a 5th grade student.

Truth Has A Liberal Bias on Tue, 26th Jul 2016 9:26 pm

“when populations outgrow resources, people at the bottom of hierarchy are the most vulnerable”.

I beg to differ. The people who don’t have physical prowess and weapons are most vulnerable. The rich old man might find that once the system collapses it is the man who was a minimum wage security guard of the gated community that now runs the ship. When systems collapse there’s a fight. The winner is the best fighter.