China has put the world’s traditional financial centers on notice that it wants to develop its raw material markets as hubs for setting prices, seeking to marry the country’s commercial heft with a much greater say in determining how much commodities cost.

“We’re facing a chance of a lifetime to become a global pricing center for commodities,” Fang Xinghai, vice chairman of the China Securities Regulatory Commission, said at the Shanghai Futures Exchange’s annual conference in the city on Wednesday. “On the way to realize this goal, we’ll see very intense competition. We have the advantage of trading size and economic growth, but our legislation is still not sound and we lack enough talent.”

China is the world’s largest user of metals and energy, but its traders and companies rely on financial centers outside the country — typically London and New York — to set benchmark prices for most of the commodities they handle and consume. While raw materials trading in the nation remains largely off-limits to overseas investors — who also face currency restrictions — China has long pledged to open up. Fang vowed to press on with that process, while also seeing tough challenges from rival centers as it does so.

‘Starting Point’

“We plan to use crude oil, iron ore and natural rubber futures as the starting point in our efforts to open the domestic market to more foreign investors,” Fang told the audience. China shouldn’t underestimate “the determination of current pricing centers to maintain their status,” he said.

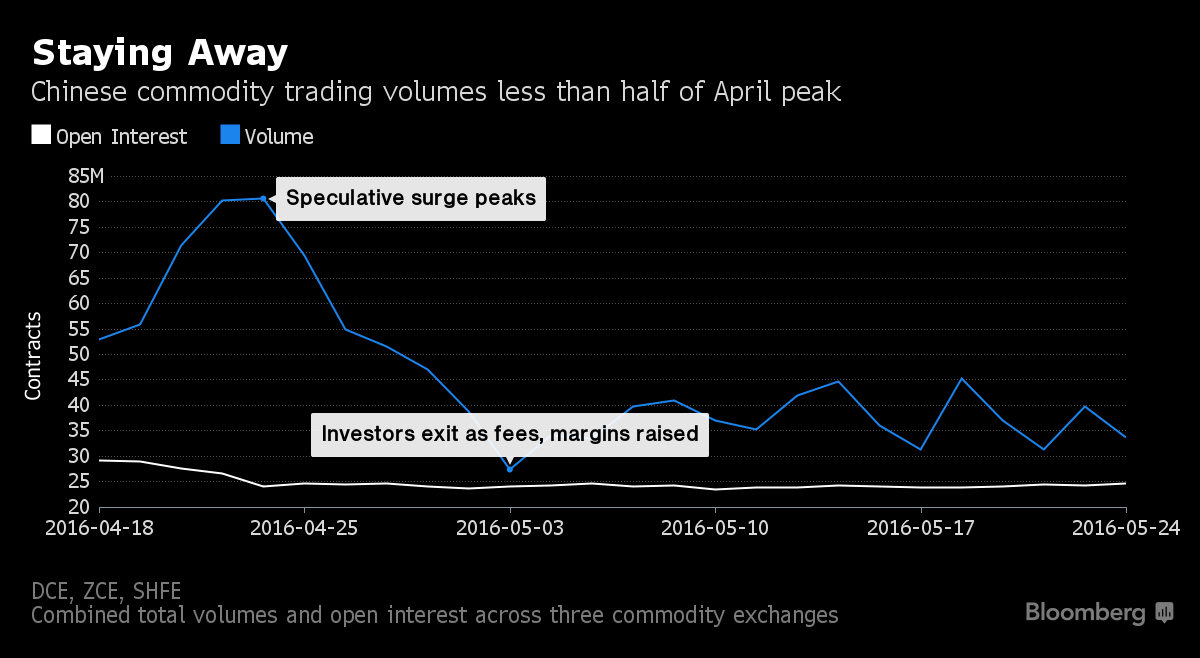

Raw-material futures markets in Asia’s top economy became a focal point earlier this year after being engulfed in a speculative frenzy, with a rapid run-up in prices and unprecedented volumes in March and April. The outburst prompted a crackdown from the CSRC and exchanges, which tightened rules and raised fees. The intervention was successful, and for China to now expand its role as a global center, effective supervision is critical, according to Fang.

“Recently, we experienced huge volatility and trading volumes in some commodity futures,” said Fang. “We supervised the exchanges to take measures, which have seen a notable effect.”

Data from the three biggest commodity exchanges in China show that aggregate volumes are less than half of what they were at the peak of the fever. Still, Chinese speculators will probably continue to seek very short-term commodity exposure thanks to easy credit access and the poor performance of alternative investments, according to Morgan Stanley.

makati1 on Wed, 25th May 2016 7:50 pm

And the beat goes on…

rockman on Thu, 26th May 2016 6:00 am

No commodity buyer can set the market price…all they can do is set the price they are willing to pay. Just as commodity sellers (excluding a truly effective cartel) can’t set the price but only how much they are willing to sell at a given price.

But if a commodity buyer can acquire a very significant quantity it gives them a much stronger negotiation position. Essentially the retail/wholesale dynamic that has always existed in trade.

makati1 on Thu, 26th May 2016 6:07 am

rock, how is the price that a buyer will pay, NOT setting the price of a product? They either get it at that price or the provider goes out of business. Which is what is happening in the oily business today. It may take a while but it will eventually shut down the whole industry. Most of the world cannot afford oil at any price, and that number is growing by the millions every day.

Davy on Thu, 26th May 2016 7:19 am

China is wanting to set commodity prices because many of the Chinese businesses that speculated, hypothecated and rehypothicated collateral represented by various commodities are now underwater financially. This is a HUGE Chinese problem and part of the reason why so many large state owned firms are insolvent. We have massive Chinese non performing loans and many are tied to commodities.

This is just a long list of economic control the inept Chinese leadership has instituted. The Chinese are digging a hole they will never get out of. The rest of the major economic powers are in the same boat but the level the Chinese are at is historic.

rockman on Thu, 26th May 2016 9:25 am

mak – “rock, how is the price that a buyer will pay, NOT setting the price of a product?” Easy peasy: if Buyer A is only willing to pay $40/unit and all the other buyers are willing to pay the seller $50/unit then Buyer A ain’t going to buy shit because the price will be set at $40/unit. Again: why isn’t the KSA demanding that all its buyers pay $60/bbl for its oil? again easy peazy: there are plenty of producers willing to sell for much less.

But as I pointed out if Buyer A is buying a significant amount of the commodity it gives them a better negotiating position. I BestBuy is selling $500 million/yr of Apple products they can cut a better deal the some local shop selling $20k/yr. That local will pay Apple 100% of what it wants or he doesn’t get any of their business. Same deal with you buying a car from Ford and Company X buying 5,000 cars for its fleet: you ain’t going to get they price Company A can negotiate.

Davy on Thu, 26th May 2016 1:20 pm

Trade wars are firing up

“Furious China Slams “Irrational” US Trade War, Warns “Will Take Steps”

http://www.zerohedge.com/news/2016-05-26/furious-china-slams-irrational-us-trade-war-warns-will-take-steps

“corrosion-resistant steel from China will face final U.S. anti-dumping and anti-subsidy duties of up to 450%.”

Rick Bronson on Thu, 26th May 2016 5:24 pm

They have established the Gold Benchmark in the Shanghai Exchange with gram being the unit and its priced in Yuan.

This is backed by physical gold while the London market is backed by paper gold.

The next target for China is to establish Oil benchmark and this will most likely be in Tons or KWh and this will prove far superior to the current Brent, WTI, Dubai which is priced in barrels.

makati1 on Thu, 26th May 2016 9:10 pm

rockman, that is circling around the answer that only the ability to buy sets the price. I don’t give a damn about “negotiating”. At some point the low quantity purchased will not make it possible to continue supplying. We are fast approaching that point now. The number of oily companies going bankrupt proves the cliff is in sight.