The information here is from a paper called “Shale 2.0: Technology and the Coming Big-Data Revolution in America’s Shale Oil Fields” was released in May by Mark P. Mills, senior fellow for the Manhattan Institute and faculty fellow at Northwestern’s McCormick School of Engineering and Applied Sciences

Technological progress, particularly in big-data analytics, has the U.S. shale industry poised for another, longer boom, a “Shale 2.0.”

We’re not at the end of this shale era, we’re at the very beginning.

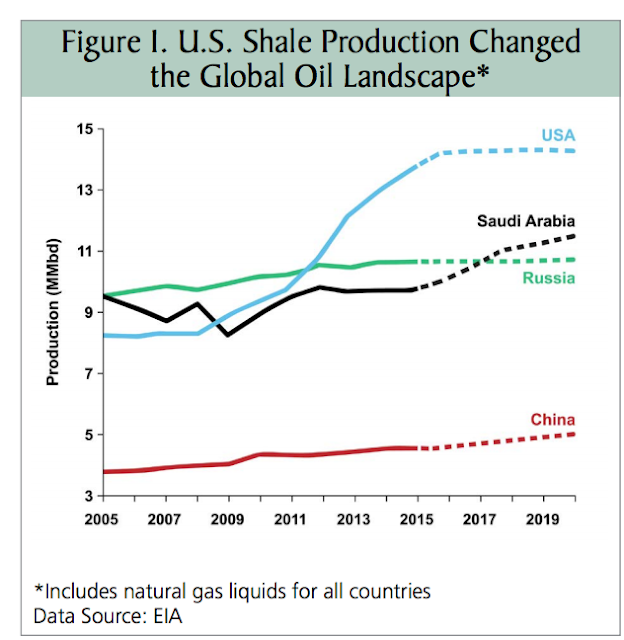

The shale industry is unlike any other conventional hydrocarbon or alternative energy sector, in that it shares a growth trajectory far more similar to that of Silicon Valley’s tech firms. In less than a decade, U.S. shale oil revenues have soared, from nearly zero to more than $70 billion annually (even after accounting for the recent price plunge). Such growth is 600 percent greater than that experienced by America’s heavily subsidized solar industry over the same period

The transition to Shale 2.0 will take the following steps:

1. Oil from Shale 1.0 will be sold from the oversupply currently filling up storage tanks.

2. More oil will be unleashed from the surplus of shale wells already drilled but not in production.

3. Companies will “high-grade” shale assets, replacing older techniques with the newest, most productive technologies

in the richest parts of the fields.

4. As the shale industry begins to embrace big-data analytics, Shale 2.0 begins.

Shale companies now produce more oil with two rigs than they did just a few years ago with three rigs, sometimes even spending less overall. At $55 per barrel, at least one of the big players in the Texas Eagle Ford shale reports a 70 percent financial rate of return. If world prices rise , to $65 per barrel, some of the more efficient shale oil operators today would enjoy a higher rate of return than when oil stood at $95 per barrel in 2012.

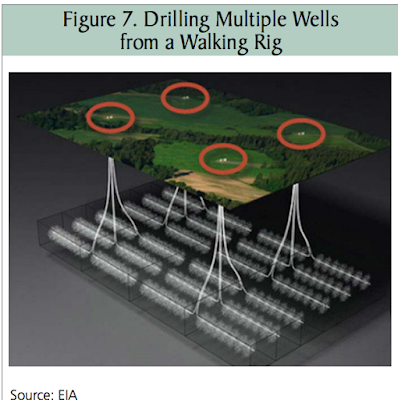

The “walking rig” is one technological advance that has contributed greatly to gains in rig productivity. Rather than drill a single well from a well-pad, a walking rig can move around the pad, drilling multiple wells (sometimes dozens)

Sand used per well has risen, from 5 million to 15 million pounds, on average; the additional sand adds 2 percent to completion costs but boosts output by 40 percent.

Even more oil supply is now, de facto, being stored underground. As noted, production begins with the distinct second stage of well construction. Once a shale site is mapped and long horizontal wells completed, operators can delay the expensive step of fracking. Since the latter constitutes 50–60 percent of total costs, significant spending can be deferred with no loss of the core asset. The oil is simply left stored, in situ, until markets and prices make retrieval more attractive.

In January 2016, there are probably over 5000 wells awaiting completion.

It takes only a few months to complete a well, such wells, once completed, could swiftly add 2–3 million barrels per day to U.S. supply.

Incremental and dramatic improvements will continue in all aspects of the many technologies used in shale production: logistics, planning, seismic imaging, well-spacing, fluid and sand handling, chemistry, drilling speed, pumping efficiency, instrumentation, sensors, and high-power lasers. Shale fields will increasingly be developed using advanced automation, mobile computing, robotics, and industrial drones. At present, barely 10 percent of projects use fully automated drilling and pressure-control systems, for example.

Big Data can make oil fracking 4 times more efficient

Many companies are keeping their big-data projects proprietary, some information is publicly available. Halliburton reports that its analytic tools achieved a 40 percent reduction in the cost of delivering a barrel of oil. Baker Hughes says that analytics have helped it double output in older wells.

At present, each long horizontal well is typically stimulated in 24–36 stages, with, on average, only one-fourth to one-third of those stages productive. At present, in other words, about 20 percent of stages generate 80 percent of output.

The current state of stimulation technology means that, on average, at least 300–400 percent more oil is not extracted. Bringing analytics to bear on the complexities of shale geology, geophysics, stimulation, and operations to optimize the production process would potentially double the number of effective stages—thereby doubling output per well and cutting the cost of oil in half.

SOURCES – Shale 2.0: Technology and the Coming Big-Data Revolution in America’s Shale Oil Fields by Mark P. Mills

Apneaman on Sat, 13th Feb 2016 2:01 pm

“…. astonishing, unexpected growth in U.S. shale output”

Really? The technology was available for a long time. The oil was known to be there for a long time. The price went way way up, so only a fucking idiot would find the boom to be unexpected or astonishing.

Anonymous on Sat, 13th Feb 2016 2:02 pm

lol

Pennsyguy on Sat, 13th Feb 2016 2:18 pm

Reports of magical, physics-defeating technologies appear in proportion to the amount of desperation present. Expect many more. C’mon fusion!

twocats on Sat, 13th Feb 2016 2:21 pm

“At $55 per barrel, at least one of the big players in the Texas Eagle Ford shale reports a 70 percent financial rate of return.

“If world prices rise , to $65 per barrel, some of the more efficient shale oil operators today would enjoy a higher rate of return than when oil stood at $95 per barrel in 2012.

“In January 2016, there are probably over 5000 wells awaiting completion.

“It takes only a few months to complete a well, such wells, once completed, could swiftly add 2–3 million barrels per day to U.S. supply.” [article]

First oil demand has to catch up to supply (late 2016?). Once that happens it seems all but certain oil price will rise and could easily get back to that $55 – 65 / barrel mark. I have trouble believing there would be a 2 mbpd shortfall before such a price point were reached. So by mid-2017 / early 2018 or so this price adjustment will bring back on this reserve supply (which will increase demand because its a self-consuming process – yes we know Short).

In summary, if the above statements are true, we’ve got one more clear crack at a new peak, and should certainly be able to meet the tepid demand for the next 2 – 4 years. It might not be pretty, but if you’re one of the few people with a job and not close to riots life as it exists now should more or less persist.

onlooker on Sat, 13th Feb 2016 2:36 pm

This is techno fix solution mantra has got to stop. As Pennguy said we need physics defying tech now to keep at bay overshoot consequences. Can we create fresh water, soil, energy out of nothing. I do not think so. Our main energy sources now are more difficult to attain as their EROEI is becoming less favorable. Our entire economic system is hopelessly dysfunctional particularly because it is based on debt and growth. Our population numbers by themselves created waves of problems throughout the entire system and societies. So unless one is willing to hasten a great dieoff, humanity is in a bind which will precipitate a substantial dieoff. Nature is waning and humanity will discover no technology is a substitute for Nature.

shortonoil on Sat, 13th Feb 2016 4:27 pm

The shale industry spent over $1 trillion to create an industry with $360 billion in gross sales. If they pay no interest, or dividends on that money and generated a 10% profit margin on gross sales it would take them 27 years to recover the investment. The shale industry is now between a rock and a hard spot. Investors are deserting the ship like rats, and the banks are pulling in their horns. By spring we will see a tsunami of bankruptcies.

Shale has several problems for which there is no techno fix. For starters it has the wrong molecular structure to be a very efficient fuel producing source. Second, because of the first, it has a limited market potential. Third, a result of the second, oil sands production is declining which accounted for a very large share of its market.

Fourth, it is running out of fleecable idiots.

bug on Sat, 13th Feb 2016 4:35 pm

Short,you said “it has limited market potential”. What does that mean?

Does that mean this shale goo comes out of the ground and has relatively fewer buyers? Is is not as good as goo that comes out of the Gulf of Mexico or Russia or anywhere else?

bug on Sat, 13th Feb 2016 4:39 pm

Read all the above comments, all good.

Listen to politicians and they are saying opposite and the people listen to them spout, there lies the problem. Political types and the people want to hear growth and joy, not physics. Should get interesting shortly.

Mark on Sat, 13th Feb 2016 5:26 pm

An soon the government will reveal reverse engineered Alien vacuum energy technology from Area 51….Earth saved!

shortonoil on Sat, 13th Feb 2016 5:28 pm

“Short,you said “it has limited market potential”. What does that mean?”

Most LTO has an API of over 45:

http://www.nrcan.gc.ca/sites/www.nrcan.gc.ca/files/energy/images/eneene/sources/petpet/images/refraf1-lrgr-eng.png

It is mostly feedstock material, and feedstock has a limited market.

Truth Has A Liberal Bias on Sat, 13th Feb 2016 5:41 pm

Soooo cheap energy makes technological advancement possible and technology makes cheap energy possible. Sounds like a perpetual motion machine.

rockman on Sat, 13th Feb 2016 6:25 pm

The condensates from the shales are a vital and very necessary component of the US refining industry. Prior to the shale boom refineries had to import condensate to blend with the heavy kills. Likewise eastern Canadian refineries paid a premium to ship many tens of millions of bbls of Eagle Ford condernsate to blend with their heavier oil imports. And the import of US shale condensates allowed the Canadians to export hundreds of millions of bbl of oil sands production to the US.

Davy on Sat, 13th Feb 2016 6:38 pm

TECH IS NOT GOING TO FIX THIS:

“For now, however, everyone is delaying the inevitable moment of “credit side M&A” (which is a euphemism for prepack reorganizations), in fading hopes oil will somehow surge and be the proverbial deus ex for the sector. It won’t arrive, at which point the “nuclear cockroaches” will finally start emerging.”

“What Energy Bankers Are Really Saying: “We Are Looking To Save Ourselves Now”

http://www.zerohedge.com/news/2016-02-13/what-energy-bankers-are-really-saying-we-are-looking-save-ourselves-now

AND

“Risks are becoming unpinpointable. Problems are global while politics remains inherently local allowing the existing trends to remain unchecked and self-reinforce. Any action causes further problems, which creates a quicksand effect — everyone is both a victim and an accomplice.”

“This Is Wall Street At Its Most Fatalistic: “Markets Are Now Coupled In A “Destructive” Way”

http://www.zerohedge.com/news/2016-02-13/wall-street-its-most-fatalistic-markets-are-now-coupled-destructive%E2%80%9D-way

eugene on Sat, 13th Feb 2016 7:11 pm

My read is the day is coming when companies will pay us to buy whatever. Free everything for everyone. Infinite everything forever.

Plantagenet on Sat, 13th Feb 2016 7:25 pm

We won’t see this technology coming on line during the current oil glut—the price of oil is too low. But down the road when the oil glut ends and the price of oil goes back up, I’m sure we’ll see some of these innovations being applied to drilling TOS.

Cheers!

Outcast_Searcher on Sat, 13th Feb 2016 7:59 pm

Natural Gas has been in a big glut due to horizontal drilling and fracking technologies for over a decade.

NGL’s have been plentiful for quite a few years due to the same technologies, helping spreads in the petrochemical industries.

Now, oil, boosted by panic by the KSA, are seeing supply surpluses.

But let’s pretend it’s all a fairy tail, since that interferes with the doom echo chamber meme.

Source: “The Domino Effect”. (Hint — doomers need to panic and deny the data in this book, since it looks more like a corny reality than a doomer one).

Outcast_Searcher on Sat, 13th Feb 2016 8:00 pm

Make that fairy tale, since editing isn’t permitted here.

Apneaman on Sat, 13th Feb 2016 8:18 pm

Outcast, WTF are you babbling on about? Pretend what is a fairy tale? No one here has denied the increases of fracking, but just because that happened does not mean this retard techno save prediction is automatically true. It actually needs to happen before you have any cause to go whining about doomers. Until that time this prediction is the fairy tale. You really suffer from serious faulty logic quite often.

BTW, king corn, how has the fracking boom helped the greater economy? You know, the one that is tanking yet again? Why not talk about the amount of debt it took to make shale happen? Don’t that count. Wait until April when it’s time to do the books again and watch the bankruptcies mount.

Apneaman on Sat, 13th Feb 2016 8:28 pm

The Fates of Nations – Conclusion

“How does the above idea square with the fact that we are already being told we are going to have to eat less meat to save the planet (eerily echoing the loss of meat consumption faced by our earliest agricultural ancestors). Insects are now being touted as the only way to provide sufficient protein for growing numbers. Wild-caught fish are becoming a delicacy due to declining fish catches, with farm-raised fish lower in vital nutrient as the affordable alternative. Even people in rich Western societies are being treated to horsemeat, and beef is replaced by “pink slime” and “meat glue.” Is this the innovation that the boosters are touting as “progress?”

We see the effect of crowding everywhere we turn. The younger generation has embraced the “tiny house” movement, and even the smallest apartments are unaffordable in big cities such as New York, London and San Francisco, where prices are out of control. The quality of even large houses is terrible, comprised of the same glued-together particle board that makes up our shoddy furniture. Metal has been replaced by plastic, disposable goods quickly fall apart, and our thin fabrics wear holes in them after a few months of wear. Energy efficiency is a good thing, but lets not pretend it is some great product of “innovation” rather than a way to maintain our exorbitant lifestyles in the face of rising numbers and declining resources.

Increased competition due to a lack of niches is causing longer work hours along with a burgeoning prison/guard labor industry to deal with the fallout. The elderly are compelled to work and the youth are being denied entry in the job market. Expensive university education is not a bug, but a feature designed to ensure only children of the affluent will inherit the more desirable niches. Social mobility is long gone, and a caste system has descended. Nepotism is rampant. A repressive police state beyond imagining has been constructed in nearly every Western society in the span of a decade. Even life expectancy is decreasing for some demographics for the first time in over a century.”

more

http://hipcrime.blogspot.de/2016/02/the-fates-of-nations-conclusion.html

onlooker on Sat, 13th Feb 2016 8:50 pm

Yes only the willfully blind cannot see all these things happening that AP refers too. The West is a rotting vessel with leaks everywhere. I myself living in the US, have already for some time given up any illusion of the so called “American Dream” I live as it were in intellectual pursuits and without assigning gravity to anything especially material acquisitions. Peace of mind. Looking forward to leave this madhouse on Planet Earth.

ennui2 on Sat, 13th Feb 2016 9:21 pm

Planty is the only voice of common sense in this thread.

Instead we get your usual dose of “this is bullshit” and “but…die-off!”

Well, yeah, but between now and then, we get this.

markisha on Sun, 14th Feb 2016 12:52 am

Short I like your comments.

For the last 15years or so I have been reading about PO. I red declining rate of an oil field is about 3% percent per year, and if the most of the giants have peaked about 2005 ( or before). How is possible that they still produce as much as they produce today?

Any idea from anybody?

markisha on Sun, 14th Feb 2016 6:35 am

New extraction technology OK, but still ?

Are these calculation wrong?

jv153 on Sun, 14th Feb 2016 7:23 am

markisha :

There was a big increase in drilling (active drilling rigs or strip mining in Canada) elsewhere as well as the US. After 2002 or so it has been mainly the US, Russia and Canada that increased oil production followed later by Iraq.

To be sure, the most obvious and clear cut example of an exhausted former major producing oil area (5.8 mb/day) is the North Sea oil fields shared by Denmark, the UK and Norway.

jv153 on Sun, 14th Feb 2016 7:39 am

Incidentally the North Sea is the most active off-shore drilling region, with 170 active rigs. Johan Sverdrup will provide one last kick for the North Sea.

jv153 on Sun, 14th Feb 2016 7:42 am

In fact the Netherlands and Germany also have shares of the North Sea.

PaOil on Sun, 14th Feb 2016 8:33 am

Shale 2.0 is already here…but not because of technological advance. Cost of development in the shale arena is down because the industry is “surviving” in cannibal mode.

Pipe supply stores that haven’t gone out of business are selling steel at cost; and before their deceased competitors went out of business they sold their inventory at below cost to move it. With this meager stock the E&P’s manage to drill a few more wells to satisfy drill commitments and squeeze a little more flush production to generate cash flow.

Frac companies that built their horsepower fleet in the last 5 years are now pumping at half-off pricing. But they’re not discounting because technology made the pumps cheaper; they’re simply stealing parts from their mostly idled fleets (while the pump manufacturers are going idle).

Sand companies have not discovered new technology to bring proppants to market. It’s sand after all. Instead, they have chopped pricing and closed mines to survive. Earnings for sand companies have dropped to zero.

And what about longer legs? Legs have grown longer ever since the start of the shale “revolution.” But don’t ignore that the longer leg still requires more steel, more pumping and more sand.

Eventually the supply stores, pressure pumpers, and sand suppliers have to pay the debt. Cannibal mode won’t continue…because there are only so many bodies to eat. The next move in oil pricing is not down to $5 to $20. This article overlooks readily available information to arrive at a silly projection.

rockman on Sun, 14th Feb 2016 9:36 am

m – The big and old heritage fields still produce for two reasons. First the obvious: they have a huge volume of residual oil reserves…hundreds of billions of bbls. That’s because they contained trillions of bbls originally. Recoveries vary greatly… 10% to 60%+.

Second, they can produce that residual rather cheaply…as little as a few $’s per bbl. But do so much slower then originally. Like producing 1,000 bopd and no water but today producing 1,000 bbls of FLUID per day but with 98% water. IOW 20 bopd and 980 bwpd. But there are many thousands of those wells. Yes: US shale wells came on at many hundreds of bopd. None the less the AVERAGE US oil well TODAY produces less the 20 bopd.

So in the US we have hundreds of thousands of old wells producing millions of bopd very cheaply at a rather slow rate and depleting very slowly. Long after all of those 1,000+ bopd shale wells are plugged and abandoned and after all those Deep Water GOM fields that came on at 200,000 bopd are abandoned there will still be thousands of very old wells making 10 bopd or less.

shortonoil on Sun, 14th Feb 2016 9:58 am

“How is possible that they still produce as much as they produce today?

Any idea from anybody?”

Like with most complex issues there is not one answer to that question; several things came together at the right time to stimulate the production of liquid hydrocarbons that are now over supplying the market:

1) Huge investments in Canadian tar sands production produced a demand for more diluent to allow their products to be sent via pipeline to Eastern, and Southern refining operations. That encouraged the development of US Shale fields which mostly provide a very light oil. Between 2000 and 2013 US condensate production increased from 3% of total production to about 14%. Even though there has never been a shortage of condensate for the world market (Russia, Qatar, and Indonesia have huge high permeability fields) the US Shale fields where in close proximity to their market. The US Shale oil industry appeared because it was in the right place at the right time, and it led the increase in world production that we see today.

2) During the rein of Greenspan, and later other FED heads the FED took on a very loose monetary policy. ZIRP, QE, and other FED run programs pumped $trillions into the economy. With an otherwise slow growth economy that money found a home in various investments. It allowed for the growth of what would have otherwise been non viable projects with its ease of money availability, and low interest rates. Housing was one such investment that blew up in 2008, and Shale was another. Like with housing the FED was financing production that had an insufficient market to support it. It became a speculation game. Housing construction collapsed, and the price went with it. The same thing happened to shale; their never was a market for 3.5 mb/d of LTO. The market was over supplied and prices, just like with housing, collapsed.

3) With the decline in prices, attention of the remaining producers, turned from long term profits to short term cash flow. To survive they increased their production to its maximum level. Most of them today are producing every barrel that they can suck out of the ground. That is only serving to further supply an over supplied market, which is keeping prices below a sustainable level. It’s a negative feed back loop that the industry can not escape from!

4) Because of depletion the value of a barrel of oil to the economy has declined. That sets an upper limit to the price of oil. The price of oil is now range bound between its maximum value to the economy on top, and its lifting cost on the bottom. Since the highest cost producers can no longer make money producing oil, they will try to survive for as long as possible by maximizing their cash flow by maximizing their production. This situation will only worsen as time progresses.

The industry is now caught in a trap; it must oversupply the market to exist even thought that over supply is guaranteed to eventually destroy it.

http://www.thehillsgroup.org/

Kenz300 on Sun, 14th Feb 2016 10:26 am

Half of U.S. Fracking Industry Could Go Bankrupt as Oil Prices Continue to Fall

http://ecowatch.com/2016/01/18/fracking-industry-bankrupt/?utm_source=EcoWatch+List&utm_campaign=bddf330f10-Top_News_1_18_2016&utm_medium=email&utm_term=0_49c7d43dc9-bddf330f10-86023917

lobotx on Sun, 14th Feb 2016 12:29 pm

“Reality” both micro and macro, is getting harder to pin down. I do agree with most of what PaOil says though, and Rockman as (nearly) always.

However, I just spent two days at NAPE in Houston showing an acreage position in the Delaware Basin of New Mexico (a shale area for you non-geos) and was overrun by buyers with cash aplenty. Not at all what we’d expected !

Strange times in the oil patch. I broke in during the 70’s, survived the 80’s, etc. and I have no clue where oil, the global economy, etc. are headed. So happy to have all of the “expertise” here at PO to draw from…. 😉

rockman on Sun, 14th Feb 2016 1:33 pm

Lob – Did you notice the guy rolling around in an electric power chair at NAPE? That was the Rockman. We might have even spoken: the Rockman was one of those cash flush buyers with $250 million in his pocket. LOL.

I saw the same thing: lots of $’s looking for a home. The Rockman’s pyrime target wasn’t just production per se but more likely a JV we could fund to increase reserves by hz drilling, EOR or whatever. Drop me a PM if you like…I may already have one of your brochures in my NAPE bag. I’ve been trying to get the company unfocused on the Gulf Coast for a couple of years. I think they may finally realize they don’t have much choice but to do so now.

Apneaman on Sun, 14th Feb 2016 2:03 pm

Foiled by Oil

“Pemex revenues are down 70% in the past 18 months. That is what Peak Oil looks like.”

“On Big Oil’s books, proven reserves of oil are presently estimated at 1,700 billion barrels. Just in the past 18 months, and accelerating after the Paris Agreement, the decline in value has been $70 per barrel. The value of oil shares, therefore, has been reduced by $119,000,000,000,000. That is 119 trillion. It is only a matter of time until the market catches up to that peg. It is already on its way. Maudlin said, “The lost value in crude oil is equivalent to a couple of hundred Googles and Apples going up in smoke.”

But lest we forget, we are not just over the top of Peak Oil, we’re at Peak Everything: coal, natural gas, iron, copper, zinc, nickel, lead, palladium, platinum, silver, and aluminum – all suffered double-digit percentage valuation drops in 2015.”

http://peaksurfer.blogspot.ca/2016/02/foiled-by-oil.html

coffeeguyzz on Sun, 14th Feb 2016 2:06 pm

PAoil

Glad to see you post here, but I need to take exception to some of your comment.

The above article is somewhat dated as the “Shale 2.0” from Mills came out a few months back. (The focus on massive data accumulation/analysis is on target, but only a part of these fast-moving developments).

BTW, Outcast, nice reference to Rusty Brazeil’s “Domino Effect”. His online site, RBN Energy may be amongst the most informative around.

Trick question to all … why do the horizontal shale wells experience the now familiar steep decline curves?

It is well recognized that 90% +/- of the existing hydrocarbons are NOT recovered, so … why the big dropoff?

Short answer, no one has been able, AFAIK, to definitely claim the specific, physical reasons why output declines so rapidly, although degraded communication with the wellbore is the most likely, prominent cause.

What causes this diminished communication?

A lot factors that usually include ineffective, ongoing propping of the induced fissures.

Coming round full circle, PA, to the sand is, well, sand.

Apparently not.

The recent GH9 well by Consol was drilled in the Utica to 13,400′, the deepest yet. The outfit that provided the ceramic proppant is doing a lot of chest thumping about their newly developed low density ceramic that can effectively access the farthest vertical fissures and still, they all hope, withstand the heat, pressure, chemical degradation that will eventually occur.

Wells such as EOG’s Riverview 102 32H in the Bakken, EQT’s Scotts Run in the Utica, Rice Energy’s pair of Blue Thunder wells in Ohio … producing 15 MMcfd on restricted choke for a year (6 Bcf each) are located 500′ from each other, are all highly instructive as to what is possible.

These wells are not outliers, they are pathfinders.

The processes and resources that enabled the demonstrated, ongoing output from these wells are being emulated everywhere by operators willing and able to keep up with the dizzying rate of change.

shortonoil on Sun, 14th Feb 2016 2:43 pm

Delaware Basin of New Mexico

According to UTexas at Austin the Delaware Basin fields have been worked since the 1920’s. They have been under CO2 enhancement for the last twenty years

http://www.beg.utexas.edu/resprog/delbas/summary.htm

At $28/ barrel their primary interest would mostly be the Carlsbad Caverns.

lobotx on Sun, 14th Feb 2016 3:04 pm

Short, I read all your posts, enjoy them — but don’t go quoting the Bureau’s stuff. Nice people there, but pure academia in my opinion (with Shirley Dutton being a notable exception). The Delaware Basin has a lot of new oil to recover (Bone Springs, Avalon, Wolfcamp), although many of the old fields are in secondary/tertiary recovery. Much new ground left to drill there though. Love your comment about Carlsbad though !

Rockman, I saw you but we didn’t speak. I will be in touch as soon as I figure out how. 🙂

lobotx on Sun, 14th Feb 2016 3:17 pm

Rockman,

I can’t send you a PM as my PM privleges have not been activated. Apparently I’m not active enough – usually a reader, not a poster, though I’ve been a member for years.

Any ideas ? I’d rather not post my email on here as it contains my name (I’m paranoid that way).

markisha on Sun, 14th Feb 2016 4:40 pm

Thank you on your answers