by Pops » Sun 13 Jun 2021, 09:33:07

by Pops » Sun 13 Jun 2021, 09:33:07

$this->bbcode_second_pass_quote('AdamB', 'O')nce again, some pretty basic geologic ignorance trips up the economists.

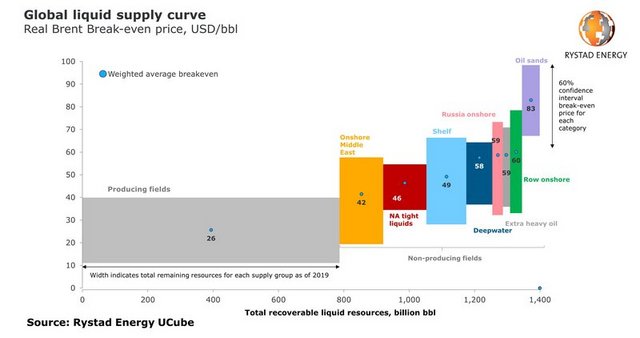

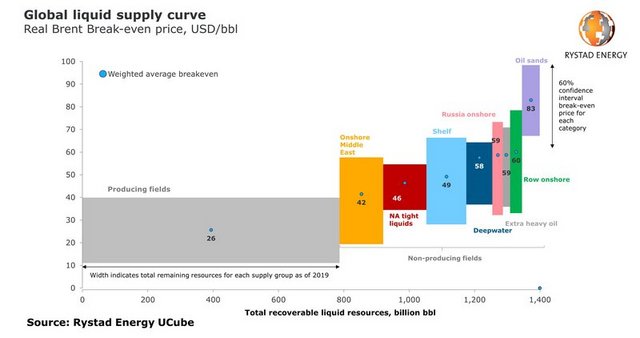

Doesn't take a geologist or an economist to grasp that cost to produce new oil is double the cost of existing production. Even new mid-east oil is no longer cheap, $45 now vs $10 in the recent past and pennies back in the day.

May 2019

May 2019I don't subscribe to EROEI as the be all-end all, mainly because it is so hard to calculate and so easy to fudge the calculations to fit a particular view. In fact, refining is the most energy intensive part of the process and it has gotten MORE efficient, not less, over the last decades.

But what Morgan calls "surplus energy" — which I take to mean energy "too cheap to meter" i.e. the (deflated) $10-15/bbl oil was up until the 1970s— is the point I key in on. History was human and animal muscle up to a couple hundred years ago. The mid-century - half-century that saw the great leaps and great prosperity were fueled, literally, by nearly free energy. Right up to the OPEC repricing.

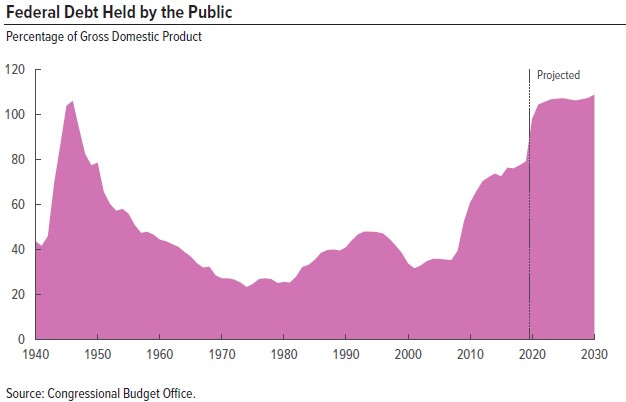

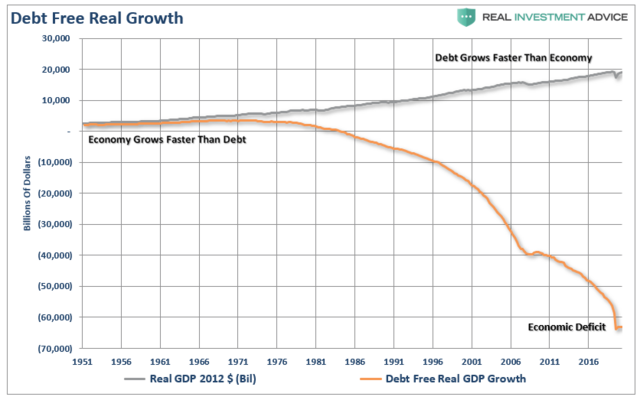

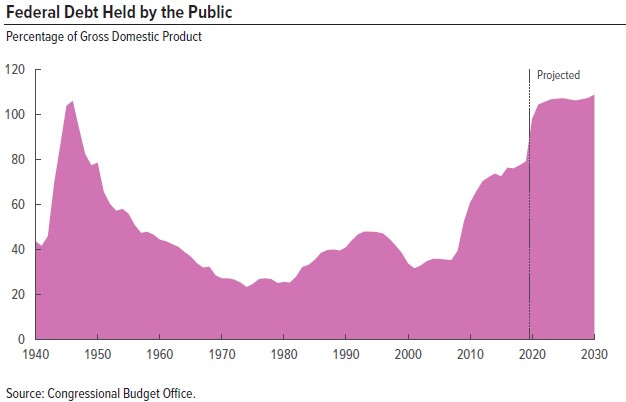

Which time, coincidentally or not, was the same point the US inflationary policy collapsed what was left of the gold standard and the economy went permanently in the red. Debt expansion has exceeded GDP "growth" consistently since. One could even imagine that the $4 of borrowing it now takes to produce $1 of "growth" has actually been masking deflation — GDP decline — since the repricing of oil.

So while one can predict this and that based on whatever bias they enjoy, a few things seem fairly clear to my biases:

1. In real terms oil is more expensive now.

2. It will be more expensive still in the future as cheaper to produce oil is depleted.

3. GDP "growth" is over, has been since the '80s

4. Growing debt masks the de-growth.

5. Renewables may "save" us but they won't save growth.

Plain old ROI is important. LTO at $45 cost is simply not as profitable as conventional at $25 — no matter the selling price and offshore shallow and deep are even worse. And LTO may be a safer bet with and quicker payback, profit is still important, as has been apparent in the bankruptcies and buyouts in LTO the last few years.

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops

- Elite

-

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

-

by Plantagenet » Sun 13 Jun 2021, 12:53:55

by Plantagenet » Sun 13 Jun 2021, 12:53:55

$this->bbcode_second_pass_quote('Pops', '

')Doesn't take a geologist or an economist to grasp that cost to produce new oil is double the cost of existing production. Even new mid-east oil is no longer cheap, $45 now vs $10 in the recent past and pennies back in the day.

Actually, oil is currently at ca. $70 bbl on the market.

But that is good news.

In fact, the higher the price of oil goes the better it is for the planet.

We have to stop using all fossil fuels as soon as possible or the planet is going to become too hot to trot.

It doesn't matter if it costs pennies to produce or $45 bbl to produce.

The oil spigot has got to be turned off.

The good news is that turning off the oil spigot does't have to destroy the economy.

In fact, if we're lucky, economic growth will come from transforming to renewable non-carbon energy.

We have to stop using fossil fuels as soon as possible, EROEI be damned!

We have to stop using fossil fuels as soon as possible, EROEI be damned!Cheers!

Never underestimate the ability of Joe Biden to f#@% things up---Barack Obama

-----------------------------------------------------------

Keep running between the raindrops.

-

Plantagenet

- Expert

-

- Posts: 26765

- Joined: Mon 09 Apr 2007, 03:00:00

- Location: Alaska (its much bigger than Texas).

-

by AdamB » Sun 13 Jun 2021, 13:36:57

by AdamB » Sun 13 Jun 2021, 13:36:57

$this->bbcode_second_pass_quote('Pops', '')$this->bbcode_second_pass_quote('AdamB', 'O')nce again, some pretty basic geologic ignorance trips up the economists.

Doesn't take a geologist or an economist to grasp that cost to produce new oil is double the cost of existing production. Even new mid-east oil is no longer cheap, $45 now vs $10 in the recent past and pennies back in the day.

Of course the nominal price of oil today is far more than yesteryear. The real price of oil, now, is similar to what it was from 1860 through about 1880.

And while neither a geologist nor economist pays attention to the practical aspects of WHY existing production costs more than yet to be found or even yet to be developed resources, it is because existing production is a sunk capital argument, and new production is not. Production being more expensive isn't the variable to keep an eye on. The cost of the marginal barrel, for a given demand is. Right now, my estimate is that this number is somewhere in the range of $25-$30/bbl.

$this->bbcode_second_pass_quote('Pops', '

')So while one can predict this and that based on whatever bias they enjoy, a few things seem fairly clear to my biases:

1. In real terms oil is more expensive now.

2. It will be more expensive still in the future as cheaper to produce oil is depleted.

3. GDP "growth" is over, has been since the '80s

4. Growing debt masks the de-growth.

5. Renewables may "save" us but they won't save growth.

Plain old ROI is important. LTO at $45 cost is simply not as profitable as conventional at $25 — no matter the selling price and offshore shallow and deep are even worse. And LTO may be a safer bet with and quicker payback, profit is still important, as has been apparent in the bankruptcies and buyouts in LTO the last few years.

1. In real terms oil prices today are about the same as they were between 1860-1880.

2. Because of inflation, in nominal terms, tomorrow is a given to be more expensive in most everything.

3. GDP is GDP, and growth stopping has been a staple of peak oil dogma since they began declaring it in the modern era, circa 1990. In some cases, it was claimed that what Helicopter Ben did could NOT make more oil, and therefore could NOT save the world. And here we are 13 years later, and everyone needs to take with a grain of salt any of the proposed mechanisms from those days being rinsed, recycled and repeated.

4. Growing debt is bad, and masks all sorts of things.

5. I don't know what renewables will do, other than I like my solar panels and my EVs and the effect they have on my discretionary budget that means there is "growth" in my discretionary income because of it.

ROI is the world around which oil revolves, not Tim's EROEI claptrap. And LTO is just another cycle in the development, and not even the largest, or most economically or geologically viable.

You won't find me arguing against the entanglement of important commodities (it isn't just about oil) with financial, fiscal and monetary policies of the entities involved. You will find me arguing that hacks who venture into a specialty they don't understand deserve to be relegated to blogging. And anyone who didn't learn from all the past peak oils, real or imagined, doesn't get a pass on being stupid in the same way, again.

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

by AdamB » Sun 13 Jun 2021, 13:40:51

by AdamB » Sun 13 Jun 2021, 13:40:51

$this->bbcode_second_pass_quote('Plantagenet', '

')In fact, the higher the price of oil goes the better it is for the planet.

We have to stop using all fossil fuels as soon as possible or the planet is going to become too hot to trot.

And how high does it need to go to stop global jet setters who pretend they care about the planet, to stop jet setting?

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB

- Volunteer

-

- Posts: 11018

- Joined: Mon 28 Dec 2015, 17:10:26

-

by Plantagenet » Sun 13 Jun 2021, 14:52:44

by Plantagenet » Sun 13 Jun 2021, 14:52:44

$this->bbcode_second_pass_quote('AdamB', '')$this->bbcode_second_pass_quote('Plantagenet', '

')In fact, the higher the price of oil goes the better it is for the planet.

And how high does it need to go to stop global jet setters who pretend they care about the planet, to stop jet setting?

Probably about the same level as stopping phony EV supporters who pretend they care about the planet, to stop their phony bloviating about how EVs are going to save the planet.

Oil prices are going UP.....and thats a GOOD THING because it means we will use less oil

Oil prices are going UP.....and thats a GOOD THING because it means we will use less oilCheers!

Never underestimate the ability of Joe Biden to f#@% things up---Barack Obama

-----------------------------------------------------------

Keep running between the raindrops.

by Pops » Sun 13 Jun 2021, 17:39:17

by Pops » Sun 13 Jun 2021, 17:39:17

$this->bbcode_second_pass_quote('AdamB', 'O')f course the nominal price of oil today is far more than yesteryear. The real price of oil, now, is similar to what it was from 1860 through about 1880.

Not sure of the relevance. As I mentioned the price was low for 90 years aside from the wars, a time of great growth and prosperity.

$this->bbcode_second_pass_quote('', 'A')nd while neither a geologist nor economist pays attention to the practical aspects of WHY existing production costs more than yet to be found or even yet to be developed resources, it is because existing production is a sunk capital argument, and new production is not.

Note, Rystad says new mideast oil is $45/ bbl—cost. So no, the price isn't the same.

$this->bbcode_second_pass_quote('', 'P')roduction being more expensive isn't the variable to keep an eye on. The cost of the marginal barrel, for a given demand is. Right now, my estimate is that this number is somewhere in the range of $25-$30/bbl.

Discounting DUCs, shut-in, storage, politics etc, which I don't watch TBH, actual new production is minimum $45/bbl per Rystad.

The good news I guess is that Rystad thinks the cost of LTO is down to $45 from $80 not long ago. I certainly don't know, guess we'll see how the new owners make out.

$this->bbcode_second_pass_quote('', '1'). In real terms oil prices today are about the same as they were between 1860-1880.

2. Because of inflation, in nominal terms, tomorrow is a given to be more expensive in most everything.

3. GDP is GDP, and growth stopping has been a staple of peak oil dogma since they began declaring it in the modern era, circa 1990. In some cases, it was claimed that what Helicopter Ben did could NOT make more oil, and therefore could NOT save the world. And here we are 13 years later, and everyone needs to take with a grain of salt any of the proposed mechanisms from those days being rinsed, recycled and repeated.

4. Growing debt is bad, and masks all sorts of things.

5. I don't know what renewables will do, other than I like my solar panels and my EVs and the effect they have on my discretionary budget that means there is "growth" in my discretionary income because of it.

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

by Plantagenet » Sun 13 Jun 2021, 19:16:42

by Plantagenet » Sun 13 Jun 2021, 19:16:42

$this->bbcode_second_pass_quote('Pops', '

')In 1880 oil was for lighting. The Model T didn't show up until 1908. Today oil is for pretty much everything.

It isn't 1880 anymore and it isn't 1908 and oil definitely isn't for everything these days.

Most factories and manufacturing processes don't use oil at all----they run on electricity.

Similarly, we are in the process of driving oil out of the transportation sector, with electric trams, train, trolleys and even cars replacing ICE powered vehicle.

The marine transport business is also starting to decarbonize.

Perhaps the most difficult part of the economy to decarbonize will be air transportation, because the energy density of oil is much greater then existing alternatives, and saving weight is extremely important is air travel.

But just about everything else does't need oil these days.

And thats a good thing.

Oil is no longer "for everything" these days, and hopefully soon it will be for just about nothing......

Oil is no longer "for everything" these days, and hopefully soon it will be for just about nothing......Cheers!

Never underestimate the ability of Joe Biden to f#@% things up---Barack Obama

-----------------------------------------------------------

Keep running between the raindrops.

-

Plantagenet

- Expert

-

- Posts: 26765

- Joined: Mon 09 Apr 2007, 03:00:00

- Location: Alaska (its much bigger than Texas).

-

by AdamB » Sun 13 Jun 2021, 20:49:08

by AdamB » Sun 13 Jun 2021, 20:49:08

$this->bbcode_second_pass_quote('Pops', '')$this->bbcode_second_pass_quote('AdamB', 'O')f course the nominal price of oil today is far more than yesteryear. The real price of oil, now, is similar to what it was from 1860 through about 1880.

Not sure of the relevance. As I mentioned the price was low for 90 years aside from the wars, a time of great growth and prosperity.

Didn't notice the 90 time frame, only noticed "in the recent past and pennies back in the day", and "which I take to mean energy "too cheap to meter" i.e. the (deflated) $10-15/bbl oil was up until the 1970s", neither of which specifies the time period AFTER oil was nominally cheap but real dollar expensive.

You are indeed correct that after changes in drilling technology came along and opened up a whole new world of production, there was a stable period demonstrated in the graph you included...and to some extent, it was only because of that stability, and balanced supply/demand, that Hubbert was able to make the bell shaped curve argument that he did.

$this->bbcode_second_pass_quote('Pops', '

')$this->bbcode_second_pass_quote('', 'A')nd while neither a geologist nor economist pays attention to the practical aspects of WHY existing production costs more than yet to be found or even yet to be developed resources, it is because existing production is a sunk capital argument, and new production is not.

Note, Rystad says new mideast oil is $45/ bbl—cost. So no, the price isn't the same.

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

by Pops » Mon 14 Jun 2021, 10:12:52

by Pops » Mon 14 Jun 2021, 10:12:52

$this->bbcode_second_pass_quote('AdamB', 'I')'m still waiting for someone to tell me what the price and chemical properties of this mysterious "conventional" oil is. Interestingly, no one has been able to yet.

You can certainly come up with a more original dig than that. LOL

Back to the surplus energy blog. I thought it was interesting because it draws a straight line from increasingly complex and expensive energy production to falling net GDP and increasing debt. The failing of shorts grand scheme is attempting to divorce it from price (unless the price is moving in the right direction of course) he cut off the route to what actually matters... oil price and its effect on the economy. Martin's argues that increasing oil cost and so price is the cause of diminishing returns, deflation, increased debt etc. is a much fuller view that embraces supply and demand rather than discounting it or even refuting it.

Increasing production costs limits supply at the previous lower price. For supply to expand and meet demand, selling price must rise. Actually that is a lot of what Tyverberg goes on about, "low price will kill supply." And the price must stay low to enable the wasteful uses that are so much a n integral part of the economy.

The OPEC repricing from real $20/bbl to real $40/bbl coincided with the first great gout of peacetime borrowing to combat the "stag" part of stagflation. The conventional peak/fracking repricing — to say $60, has apparently caused the second great bout of barely growing GDP and greatly expanded borrowing.

Note in this picture how borrowing as a % of GDP declined during the '90s as oil price fell back down to $20... then rose again even higher as oil price climbed into the $100s. Correlation isn't causation: yada, yada.

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops

- Elite

-

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

-

by Plantagenet » Mon 14 Jun 2021, 15:50:33

by Plantagenet » Mon 14 Jun 2021, 15:50:33

$this->bbcode_second_pass_quote('Pops', '

')Back to the surplus energy blog. I thought it was interesting because it draws a straight line from increasingly complex and expensive energy production to falling net GDP and increasing debt.

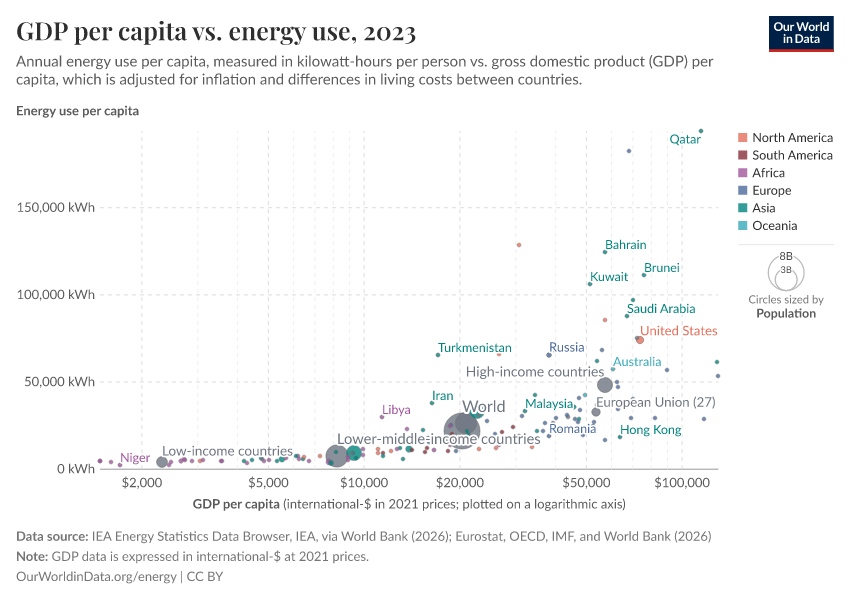

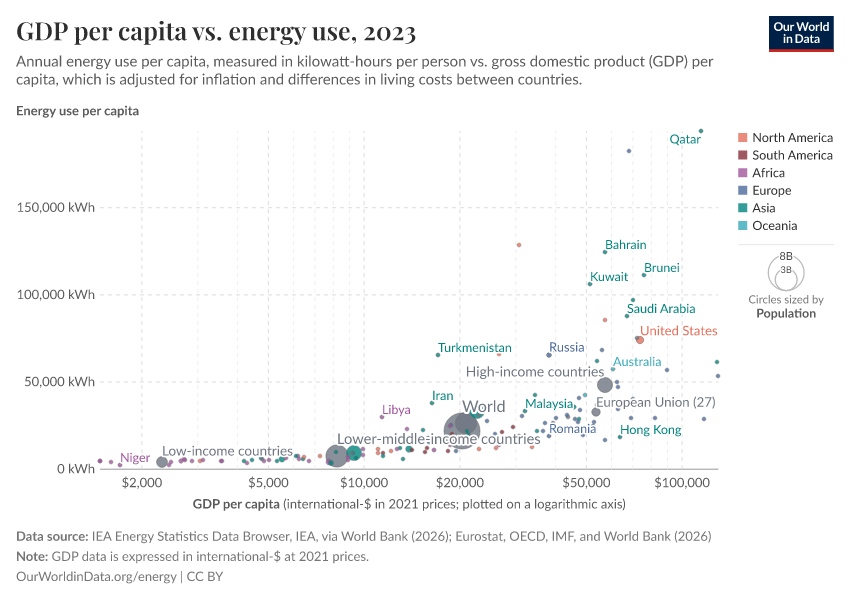

But there is no straight line relationship between GDP and the expense and/or use of energy.

Thats been clear for many many years.

There are wealthy countries who use lots of energy and poor countries who use lots of energy.

This is actually good news because it suggests the US and other countries can lower their energy use without sacrificing GDP.

Cheers!

Never underestimate the ability of Joe Biden to f#@% things up---Barack Obama

-----------------------------------------------------------

Keep running between the raindrops.

-

Plantagenet

- Expert

-

- Posts: 26765

- Joined: Mon 09 Apr 2007, 03:00:00

- Location: Alaska (its much bigger than Texas).

-

by Plantagenet » Tue 15 Jun 2021, 01:22:43

by Plantagenet » Tue 15 Jun 2021, 01:22:43

$this->bbcode_second_pass_quote('mousepad', '')$this->bbcode_second_pass_quote('Plantagenet', '

')This is actually good news because it suggests the US and other countries can lower their energy use without sacrificing GDP.

...you mean by outsourcing energy intensive industries to the 3rd world?

No...thats your idea, I guess.

My idea is to promote greater energy efficiency within the US and other countries by improving and building out mass transit and modernizing the grid, and utilizing renewable energy to the greatest extent possible.

$this->bbcode_second_pass_quote('mousepad', '

')I'm wondering how them "clean" european nations would look like regarding co2 output if they had to count production of everything they import and consume.

Aluminum manufacturing requires an insane amount of energy. None of the biggest smelters is in the EU, ain't that convinient?

https://www.alcircle.com/news/update-to ... wo%20years.

You've just proved my point.

The largest aluminum producer in the world is in China, i.e. they are mainly using COAL to produce aluminum. That is so stupid its hard to believe. Even the Chinese must know that burning coal releases CO2 and is causing climate change.

In contrast, I've visited two major aluminum refining facilities in Europe----one at Ardalstanger in Norway and the second in Iceland....and they both are powered by clean, renewable hydro-power and both facilities are located very close to the hydro plants.

Obviously the folks in the EU are being a lot smarter than the folks in China, because they've figured out how to power aluminum plants without burning coal using free, renewable, and non-polluting hydro power.

The Jfardaal aluminum smelter in easter Iceland uses clean, renewable, non-polluting hydro power, unlike the filthy dirty polluting aluminum plants in China that run on coal.

The Jfardaal aluminum smelter in easter Iceland uses clean, renewable, non-polluting hydro power, unlike the filthy dirty polluting aluminum plants in China that run on coal.Cheers!

by Outcast_Searcher » Wed 16 Jun 2021, 16:29:01

by Outcast_Searcher » Wed 16 Jun 2021, 16:29:01

$this->bbcode_second_pass_quote('Pops', '

')It finally dawned on me that without the borrowing, not only would GDP not have grown but subtracting out the borrowing, it would have been shrinking the last 50 years.

If person A buys a house or a car, it doesn't change the GDP, whether the money is borrowed or not. It's the production of the house or car that is measured in the GDP.

https://www.investopedia.com/ask/answer ... investors/Please don't be like Armageddon. Either wave your arms at something REAL, re economic problems, or at least define them using real world definitions.

Too much debt is a problem re threatening currency stability and economic stability over time, but it's NOT a "GDP problem" just because some people call it one.

Given the track record of the perma-doomer blogs, I wouldn't bet a fast crash doomer's money on their predictions.

-

Outcast_Searcher

- COB

-

- Posts: 10142

- Joined: Sat 27 Jun 2009, 21:26:42

- Location: Central KY

-