Oilfinder, Help! (oil discoveries fall to 20 yr low)

Oilfinder, Help! (oil discoveries fall to 20 yr low)

$this->bbcode_second_pass_quote('', 'N')ew finds of oil and gas are likely to have been about 16bn barrels of oil equivalent in 2014, IHS estimates, making it the fourth consecutive year of falling volumes. That is the longest sustained decline since 1950.

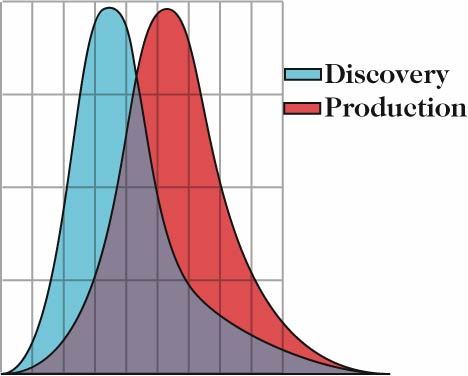

Because new oilfields generally take many years to develop, recent discoveries make no immediate difference to the crude market, but give an indication of supply potential in the 2020s.

Peter Jackson of IHS said: “The number of discoveries and the size of the discoveries has been declining at quite an alarming rate . . . you look at supply in 2020-25, it might make the outlook more challenging.”

So far there has not been a single new “giant” field — one with reserves of more than 500m barrels of oil equivalent — reported to have been found last year, although subsequent revisions may change that.

The figures for declining discoveries are particularly striking because exploration activity in 2014 showed little impact from the sharp fall in oil prices in the second half of the year. The last time oil and gas discoveries were around 2014’s level was in the mid-1990s, when exploration activity was hit by a period of weak prices.

Last year, the number of exploration and appraisal wells drilled worldwide was only 1 per cent lower than in 2013. This year, exploration budgets are being cut back across the industry and the number of wells drilled is likely to fall further.

Depending on later revisions, 2014 may turn out to have been the worst year for finding oil and gas since 1952.

Because new oilfields generally take many years to develop, recent discoveries make no immediate difference to the crude market, but give an indication of supply potential in the 2020s.

Peter Jackson of IHS said: “The number of discoveries and the size of the discoveries has been declining at quite an alarming rate . . . you look at supply in 2020-25, it might make the outlook more challenging.”

So far there has not been a single new “giant” field — one with reserves of more than 500m barrels of oil equivalent — reported to have been found last year, although subsequent revisions may change that.

The figures for declining discoveries are particularly striking because exploration activity in 2014 showed little impact from the sharp fall in oil prices in the second half of the year. The last time oil and gas discoveries were around 2014’s level was in the mid-1990s, when exploration activity was hit by a period of weak prices.

Last year, the number of exploration and appraisal wells drilled worldwide was only 1 per cent lower than in 2013. This year, exploration budgets are being cut back across the industry and the number of wells drilled is likely to fall further.

Depending on later revisions, 2014 may turn out to have been the worst year for finding oil and gas since 1952.

Financial Times via PO.com Front page

That's IHS: you know, Yergin and Co.

To paraphrase Campbell:

"Ya can't pump it if ya can't find it."

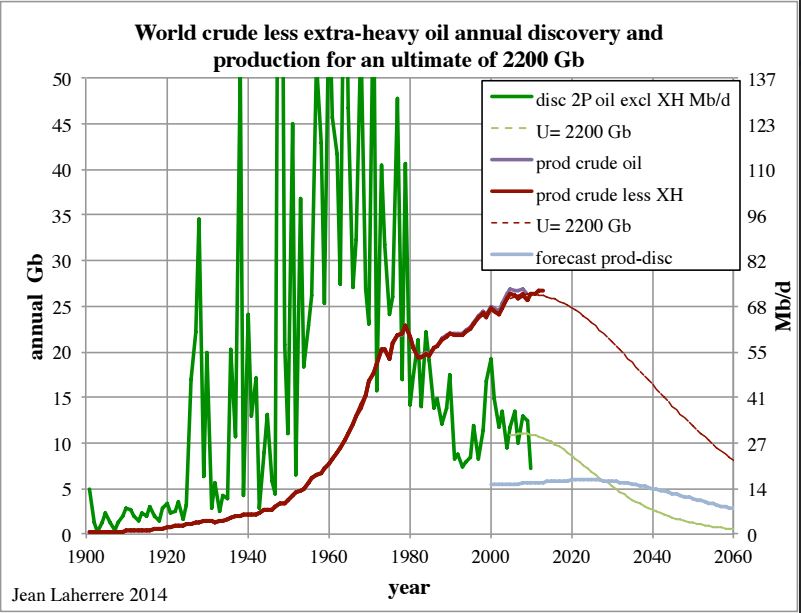

The first "Thought Plot" I drew for PO.com:

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: Oilfinder, Help!

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: Oilfinder, Help!

My guess is he's desperately looking for new reserves to replace the reduction of billions of bbls of proved oil reserves that can no longer be classified as COMMERCIALLY producible thanks to the decrease in oil price. As they say: what the Oil Price God giveth the OPG can taketh away even faster. LOL.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: Oilfinder, Help!

Not sure, IHS says discoveries have fallen for 4 years in a row. Obviously those years didn't have a problem with price considering it was the highest ever.

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: Oilfinder, Help!

Quite shocking considering the source! Peter used the word "Alarming", OMG, we are definitely on the tail end now.

- GoghGoner

- Heavy Crude

- Posts: 1827

- Joined: Thu 10 Apr 2008, 03:00:00

- Location: Stilłwater subdivision

Re: Oilfinder, Help!

Pops – Just to be sure folks get the point I just made: according to the EIA the PROVED RESERVEs of the US increased from 20.6 billion bbls in 2009 to 36.5 billion bbls in 2014. They also peg the average oil price for 2009 at $62/bbl and $103/bbl by mid-2014. And down to $47/bbl by Jan 2015.

And the EIA definition of “proved reserves”: Proved energy reserves: Analysis of geologic and engineering data demonstrating with reasonable certainty such reserves are recoverable UNDER EXISTING economic and operating condition.

IOW the 20.6 billion bbls in 2009 was based upon $62/bbl oil and the 36.5 billion bbls in 2014 is based upon an average price of $88.20/bbl. We’ll have to wait to see what the EIA ends up with as an average 2015 oil price. But IF it’s anywhere close to $62/bbl as it was in 2009 we should expect a reduction in the EIA estimate of proven US oil reserves in the many billions of bbl. Note that the previous peak in US proved oil reserves was in 1981 at 31.3 billion bbls (they only chart that metric since 1980). So for 34 years they show a fairly consistent decrease in US proved oil reserves…until prices shot up after 2010.

Obviously the big increase has come from the shales. And none of those INPLACE reserves have decreased. But there are fewer INPLACE bbls in the shales today then there was in 2009 because we’ve produced a lot of it since then. So the amount of unproduced shale reserves is less than in 2009 and current prices are less than they were in 2009. Which means that if the EIA ultimately uses $62/bbl to estimate COMMERCIALLY recoverable US oil reserves it will likely be close to 21 billion bbls. IOW thanks to lower oil prices the current estimate of proven US oil reserves has decreased about 40%...or about 15 billion bbls.

Of course if prices again reach the $100/bbl level many of those lost bbls will reappear. But until that time they no longer exist. Not according to the Rockman…according to the EIA.

And the EIA definition of “proved reserves”: Proved energy reserves: Analysis of geologic and engineering data demonstrating with reasonable certainty such reserves are recoverable UNDER EXISTING economic and operating condition.

IOW the 20.6 billion bbls in 2009 was based upon $62/bbl oil and the 36.5 billion bbls in 2014 is based upon an average price of $88.20/bbl. We’ll have to wait to see what the EIA ends up with as an average 2015 oil price. But IF it’s anywhere close to $62/bbl as it was in 2009 we should expect a reduction in the EIA estimate of proven US oil reserves in the many billions of bbl. Note that the previous peak in US proved oil reserves was in 1981 at 31.3 billion bbls (they only chart that metric since 1980). So for 34 years they show a fairly consistent decrease in US proved oil reserves…until prices shot up after 2010.

Obviously the big increase has come from the shales. And none of those INPLACE reserves have decreased. But there are fewer INPLACE bbls in the shales today then there was in 2009 because we’ve produced a lot of it since then. So the amount of unproduced shale reserves is less than in 2009 and current prices are less than they were in 2009. Which means that if the EIA ultimately uses $62/bbl to estimate COMMERCIALLY recoverable US oil reserves it will likely be close to 21 billion bbls. IOW thanks to lower oil prices the current estimate of proven US oil reserves has decreased about 40%...or about 15 billion bbls.

Of course if prices again reach the $100/bbl level many of those lost bbls will reappear. But until that time they no longer exist. Not according to the Rockman…according to the EIA.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: Oilfinder, Help!

And there's me thinking Copius Abundance would step in!

Live, Love, Learn, Leave Legacy.....oh and have a Laugh while you're doing it!

-

Quinny - Intermediate Crude

- Posts: 3337

- Joined: Thu 03 Jul 2008, 03:00:00

-

Keith_McClary - Light Sweet Crude

- Posts: 7344

- Joined: Wed 21 Jul 2004, 03:00:00

- Location: Suburban tar sands

Re: Oilfinder, Help!

Keith - Not the same at all. EIA will be forced to reduce the estimate of the amount of PROVED PRODUCING oil reserve with the lower oil price. the Mega project number is based upon the additon of new reserves, a much smaller number the estimate of all existing proved reserves. And based on reports of s number of new field developments due to lower oil prices I assume we'll see a delay in the start up of some new discoveries.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: Oilfinder, Help!

Not much of a surprise, given the probability that actual global crude oil production (45 and lower API gravity) has been flat to down since 2005, as annual Brent crude oil prices doubled from $55 in 2005 to the $110 range for 2011 to 2013. Of course, as other noted, it's surprising that the Yerginistas would admit it.

Copy of previous post:

Peak (Crude Oil) in Rear View Mirror?

OPEC dry gas production increased from 41 BCF/day in 2005 to 62 BCF/day in 2012 (EIA, complete 2013 data not yet available), an increase of 21 BCF/day.

Comparing OPEC (crude only) and EIA data bases (C+C) implies that OPEC condensate production increased from 1.2 mbpd in 2005 to 2.3 mbpd in 2012, an increase of 1.1 mbpd.

This was be an observed increase of 52,000 barrels of condensate (BC) per BCF/day increase in gas production, for OPEC.

The EIA shows that global dry gas production increased from 270 BCF/day in 2005 to 325 BCF/day in 2012, an increase of 55 BCF/day.

If we use the OPEC condensate to gas ratio as a guide, this implies that global condensate production rose by about 3 mbpd from 2005 to 2012. The EIA shows that global C+C rose by 2 mbpd from 2005 to 2012, which of course would imply a decline in actual global crude oil production (45 and lower API gravity crude oil).

Note that the high volume of US condensate would fall in the non-OPEC data set, so in reality the non-OPEC BC to BCF/day ratio is probably higher than the OPEC data set.

In any case, the foregoing analysis is additional support for the premise that actual global crude oil production (45 and lower API gravity crude oil) probably peaked in 2005, while global natural gas production and associated liquids, condensate and NGL, have (so far) continued to increase.

Copy of previous post:

Peak (Crude Oil) in Rear View Mirror?

OPEC dry gas production increased from 41 BCF/day in 2005 to 62 BCF/day in 2012 (EIA, complete 2013 data not yet available), an increase of 21 BCF/day.

Comparing OPEC (crude only) and EIA data bases (C+C) implies that OPEC condensate production increased from 1.2 mbpd in 2005 to 2.3 mbpd in 2012, an increase of 1.1 mbpd.

This was be an observed increase of 52,000 barrels of condensate (BC) per BCF/day increase in gas production, for OPEC.

The EIA shows that global dry gas production increased from 270 BCF/day in 2005 to 325 BCF/day in 2012, an increase of 55 BCF/day.

If we use the OPEC condensate to gas ratio as a guide, this implies that global condensate production rose by about 3 mbpd from 2005 to 2012. The EIA shows that global C+C rose by 2 mbpd from 2005 to 2012, which of course would imply a decline in actual global crude oil production (45 and lower API gravity crude oil).

Note that the high volume of US condensate would fall in the non-OPEC data set, so in reality the non-OPEC BC to BCF/day ratio is probably higher than the OPEC data set.

In any case, the foregoing analysis is additional support for the premise that actual global crude oil production (45 and lower API gravity crude oil) probably peaked in 2005, while global natural gas production and associated liquids, condensate and NGL, have (so far) continued to increase.

Last edited by westexas on Tue 17 Feb 2015, 10:36:47, edited 1 time in total.

- westexas

- Expert

- Posts: 248

- Joined: Tue 04 Jun 2013, 06:59:53

Re: Oilfinder, Help!

$this->bbcode_second_pass_quote('ROCKMAN', 'K')eith - Not the same at all. EIA will be forced to reduce the estimate of the amount of PROVED PRODUCING oil reserve with the lower oil price. the Mega project number is based upon the additon of new reserves, a much smaller number the estimate of all existing proved reserves. And based on reports of s number of new field developments due to lower oil prices I assume we'll see a delay in the start up of some new discoveries.

Again, this is IHS looking at discoveries, no mention of EIA reserves data. But here is what they (IHS) said last year about 2013, which wasn't a low price year:

$this->bbcode_second_pass_quote('', 'F')irst of all, since 2008, every year since then, we've seen a declining number of fields that have been found. In addition, since 2010, we've also seen declining volumes that have been found. 2013, it turns out, was among the lowest volumes found on record since the early days of oil and gas exploration. We found about 13 billion barrels of oil equivalent that year. In addition, 2013 was the first year since the very earliest days of oil and gas exploration that we didn't find at least one billion barrel oil field.

And here is anotherfrom the CO school of mines about the same report (the http is messed up)

$this->bbcode_second_pass_quote('', 'G')lobal conventional oil and gas discovery volumes have decreased since 2010 and 2013 marked the lowest volume of annual oil discoveries since 1952. At year end, 2014 discovery volumes were 24% lower than 2013. Only 3.4 billion barrels of oil were discovered by year end 2014 and the average size of discoveries decreased by 16%. Since 2009 the number of discoveries of any size has decreased by almost 50%.

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac