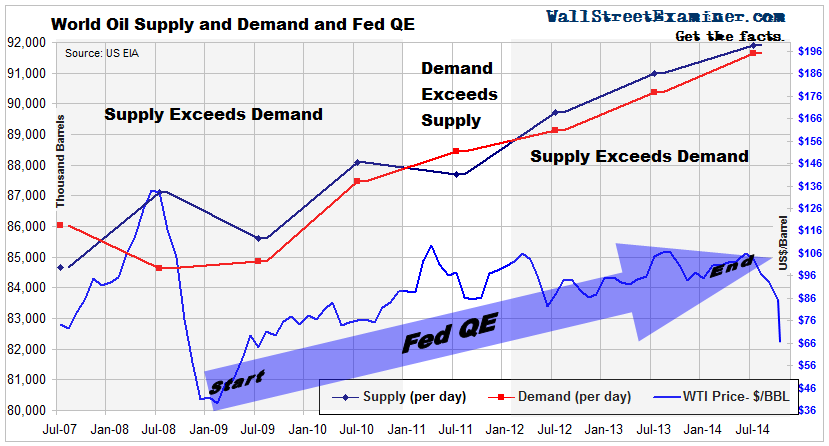

Let’s look at the supply/demand dynamic from another angle. And remember in the background we have to keep in mind the time lags involved. For instance companies were paying big lease prices for Eagle Ford Shale years before production even showed the first signs of an uptick. The same is true for the economies faced with increasing energy costs: they don’t start contracting at the first small increase in costs. As was just said: it’s complex dynamic with lots of complimentary and destructive feedback loops. So given the time lags we probably won’t have a clear TOTAL picture of what’s happening today until the end of 2015.

But let me jumped ahead to the big take away IMHO down below in case this piece is too long to read:

In September 2006 gasoline was $2.62/gal and WTI was $73/bbl. And American consumers were burning 60 million gal/day of gasoline.

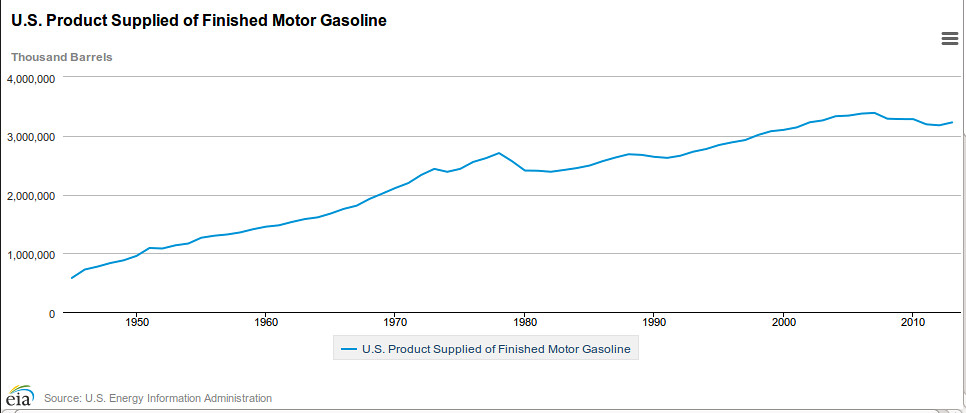

In November 2014 gasoline was $2.80/gal and WTI was $72.36/bbl. And American consumers were burning 21 million gal/day of gasoline. Essentially the same price for gasoline and oil but today we are burning only 1/3 of the gasoline today. Difficult to believe these numbers but they are from the EIA. I’ll dig around and try to confirm from other sources.

So at this point the conversation is somewhat hypothetical. But suppose the drop in oil prices was directly related to the anticipation of the OIL BUYERS, the refiners, that their customer base would be reducing consumption because, for a number of reason, they could not justify maintaining expenditures at the recent price level. If the refiners are forecasting lower future prices for their products they have to reduce what they pay for oil, otherwise they’ll be losing money on every bbl they crack.

Though there have been short term ups and downs the volume of gasoline consumption has steadily declined from the summer of 2006 till today. Though it wasn’t a huge change, we’ve seen a slight increase in consumption in the latest stat but well within the range of normal variations over the last 8 years.

So instead of looking at the gallons consumed it might be more informative to look at $’s spent for gasoline. A simple concept: to what degree has demand/consumption affected the price refiners could charge for motor fuel? Which would also limit what they could pay for oil. Of course the alteration in consumer spending habits won’t change very quickly but compared to the years it took for US oil production to increase significantly the consumer can react much fast when it comes to curtailing spending . Which requires the refines of adjust much faster than drillers and producers…right? In theory that isn’t true especially two cut their production 50%. The crude they’ve already contracted to sell would just be taken from their storage system.

And back to the theoretical premise: if by Dec 2015 we see the same (or perhaps slightly higher) gasoline consumption we might conclude that demand destruction due to high prices and was the prime factor in the decrease in oil prices. IOW it wasn’t due to increased production levels alone: decreased demand would have put downward pressure on oil prices even if we not had the production surge. The oil sellers had no choice in lowering oil prices: if the refiners can’t sell their products at some acceptable profit margin they aren’t going to buy oil. But not just a function of the price. There's a world of difference between refining 200 million bbls of oil with a $15 crack spread and refining 50 million bbls of oil with the same profit margin: refining is a volume game before all else. In 2011 when the price was $3.58/gal we burned $140 million of gasoline per day. And with essentially the same price in 2013 we spent 36% less on gasoline. So one might argue that the US oil production increase kept gasoline prices from rising but at the same time consumption decreased. More US oil production AND decreased demand even at the same price: both have contributed to lower oil prices. So here’s the view in $’s spent on gasoline instead of gallons or miles driven:

2003 – $102 million/day with $1.60/gal

2004 - $111 million/day with $1.90/gal

2005 - $138 million/day with $2.31/gal

2006 – $157 million/day with $2.62/gal

2007 – $164 million/day with $2.84/gal

2008 - $182 million/day with $3.30/gal

2009 - $120 million/day with $2.41/gal

2010 - $127 million/day with$2.84/gal

2011 - $140 million/day with 3.58/gal

2012 - $109 million/day with $3.68/gal

2013 - $89 million/day with $3.58/gal

So from 2003 thru 2008 US consumers increased the amount they spent on gasoline 78% as the price of gasoline increased 106%. And then spending decreased from 2009 thru 2013 by 51% as price increased 49%. So over 5 years prices increase significantly but consumers spend significantly MORE for motor fuel. And then over the next 4 years prices increase significantly and consumers spend significantly LESS for motor fuel.

So what the hell happened in 2008 that caused consumers to decrease what they spent driving? Oh...yeah…a recession. And of course the refiners had to reduce their price for gasoline which also meant they had to reduce how much the paid for oil. But then we had recovery from 2009 to 2011 as the consumers had more to spend on driving…so we were told. And refiners, being the greedy bastards they are, increased the price of their gasoline which also allowed them to pay more for the oil they bought. But what the hell happened in 2012 when consumers started spending a lot less for driving: in just 2 years spending fell 36%.

Obviously we didn’t start heading into another recession: most of the politicians and economists swear things are getting better. For instance we have much higher employment now so there should be more folks driving to work and thus buying more gasoline. It can’t be because more folks are taking more mass transit: those numbers are up a bit but not significant enough to account for the drop. New cars during that period have improved the MPG a bit but the MPG of the total fleet on the road has improved just a fraction of 1%.

Well if you’re a refiner you might spend long hours trying to figure out while consumers are suddenly spending less on you product. But that isn’t your big concern. What troubles you is that income from selling your gasoline DECREASED from $51.1 BILLION per year to $32.5 BILLION per year…a 36% drop in that one product line by the end of 2013. And what does it look like today: from the EIA consumers were buying 42.0 million gal/day in Sept 2011 ($150 million/day) and 20.8 million gal/day Sept 2014 ($72 million/day). We decreased how much we spent on gasoline by more than 50% in just 3 years. And just about 3 months later we’re only spending $57 million/day for gasoline.

Look at the EIA chart:

http://www.eia.gov/dnav/pet/hist/LeafHa ... 600001&f=mMonthly US gasoline sales have been consistently dropping from 62 million gals/day since August 2006. And in August 2006 WTI Cushing was $73/bbl and gasoline was $2.62/gal. And in November 28, 2014 the price was $72.36/bbl and gasoline was $2.80/gal. The price of oil and gasoline are essentially the same today as it was in 2006. And yet demand, how much we are willing to pay at the current price, has decreased from $60 million/day to $21 million/day. IOW we are willing to pay the same price per gallon as we were 8 years ago but can only afford to buy 1/3 as much. Again, I was shocked at these numbers and will try to verify. But all my numbers came from the EIA.

Seems like it’s easy to explain why oil prices are where they are today: the refiners can only pay as much for oil as consumers are willing/able to pay for those refined products. The refiners don’t care what they pay for a bbl of oil: what they care about is how much profit they can make by refining a bbl of oil. And that’s determined solely by what they pay for the oil and what the price they sell their products. And refiners don’t get to decide what they sell gasoline for…the consumers do. Just as the KSA et al don’t decide what price they sell their oil for…the refiners do.

IOW: what’s old is new again.