Fallout from Crude Price Crash Pt. 2

Fallout from Crude Price Crash Pt. 2

What happens when your assets are junk bought with free money? Another multi-billion dollar bankruptcy. They keep coming.

Breitburn Energy Partners Files for Chapter 11 Bankruptcy

$this->bbcode_second_pass_quote('', 'C')iting the “prolonged decline in commodity prices,” Mr. Washburn said Breitburn’s existing debt is unsustainable. In papers filed in the U.S. Bankruptcy Court in New York, Breitburn reported assets of $4.7 billion and debts of $3.4 billion as of March 31.

About $3 billion of Breitburn’s debts are bank and bond debt, topped by $1.25 billion in loans from lenders led by Wells Fargo Bank, NA. Breitburn is carrying $650 million of senior secured second-lien bonds and $1.1 billion in unsecured bonds.

Breitburn Energy Partners Files for Chapter 11 Bankruptcy

$this->bbcode_second_pass_quote('', 'C')iting the “prolonged decline in commodity prices,” Mr. Washburn said Breitburn’s existing debt is unsustainable. In papers filed in the U.S. Bankruptcy Court in New York, Breitburn reported assets of $4.7 billion and debts of $3.4 billion as of March 31.

About $3 billion of Breitburn’s debts are bank and bond debt, topped by $1.25 billion in loans from lenders led by Wells Fargo Bank, NA. Breitburn is carrying $650 million of senior secured second-lien bonds and $1.1 billion in unsecured bonds.

- GoghGoner

- Heavy Crude

- Posts: 1827

- Joined: Thu 10 Apr 2008, 03:00:00

- Location: Stilłwater subdivision

Re: Fallout from Crude price crash

Rock, or anyone else, I wonder if you can confirm this I got it from another site. "What is important is the EROEI FOR oil extraction has dropped from 50:1 to 10:1 for conventional wells and to 5:1 or less for fracked wells (without including environmental costs to polluting groundwater and soil). This translates into oil that is only profitable at $50/bbl and higher while consumers are experiencing demand destruction because they cannot afford oil even at $40/bbl.

"We are mortal beings doomed to die

-

onlooker - Fission

- Posts: 10957

- Joined: Sun 10 Nov 2013, 13:49:04

- Location: NY, USA

Re: Fallout from Crude price crash

$this->bbcode_second_pass_quote('onlooker', 'R')ock, or anyone else, I wonder if you can confirm this I got it from another site. "What is important is the EROEI FOR oil extraction has dropped from 50:1 to 10:1 for conventional wells and to 5:1 or less for fracked wells (without including environmental costs to polluting groundwater and soil). This translates into oil that is only profitable at $50/bbl and higher while consumers are experiencing demand destruction because they cannot afford oil even at $40/bbl.

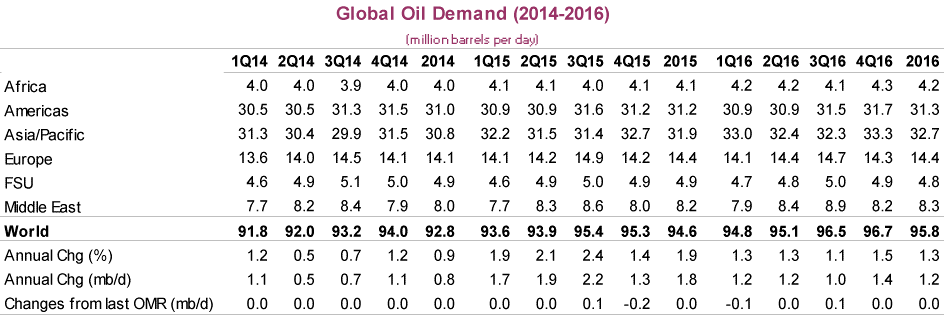

These reports keep throwing out the claim that there is a bunch of demand destruction at current oil prices. As ROCKMAN has pointed out a dozen or so times, every barrel of crude being produced today is being sold today, and as I type this prices are over $47.50/bbl.

If that were not clear enough proof you can also look at world gasoline/diesel/kerosene consumption and see that today is higher than the same date in 2015, 2014 and so on and so forth.

We are consuming more oil today than we were before, where is this demand destruction all these theorists keep claiming is going on everywhere?

$this->bbcode_second_pass_quote('Alfred Tennyson', 'W')e are not now that strength which in old days

Moved earth and heaven, that which we are, we are;

One equal temper of heroic hearts,

Made weak by time and fate, but strong in will

To strive, to seek, to find, and not to yield.

Moved earth and heaven, that which we are, we are;

One equal temper of heroic hearts,

Made weak by time and fate, but strong in will

To strive, to seek, to find, and not to yield.

- Tanada

- Site Admin

- Posts: 17094

- Joined: Thu 28 Apr 2005, 03:00:00

- Location: South West shore Lake Erie, OH, USA

Re: Fallout from Crude price crash

T - I think the best slack you can give those folks is to expand that "demand destruction" phrase. We indeed have witnessed significant demand destruction...for $90/bbl oil. OTOH we've seen a significant increase in demand GROWTH thanks to oil under $40/bbl. And as sure as the sun will rise tomorrow if oil prices continue to increase will see demand destruction from the folks that could afford $40/bbl oil but can't afford $65/bbl oil.

IOW: YOU SAY TOMATO AND I SAY...SHUT THE F*CK UP. LOL.

IOW: YOU SAY TOMATO AND I SAY...SHUT THE F*CK UP. LOL.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: Fallout from Crude price crash

$this->bbcode_second_pass_quote('ROCKMAN', 'T') - I think the best slack you can give those folks is to expand that "demand destruction" phrase. We indeed have witnessed significant demand destruction...for $90/bbl oil. OTOH we've seen a significant increase in demand GROWTH thanks to oil under $40/bbl. And as sure as the sun will rise tomorrow if oil prices continue to increase will see demand destruction from the folks that could afford $40/bbl oil but can't afford $65/bbl oil.

IOW: YOU SAY TOMATO AND I SAY...SHUT THE F*CK UP. LOL.

IOW: YOU SAY TOMATO AND I SAY...SHUT THE F*CK UP. LOL.

My econ 101 class was back in 1974 so I am a bit rusty. As I recall the supply vs. demand curves/ diagram it was not that individuals stopped demanding a product (in college the example was beer,) at any given price point, say $65/bl. It was that they would still buy oil at $65 only less of it then they would buy at $40. Each individual has their own personnel demand curve as does each supplier. It is the aggregate of the curves both supply and demand that ultimately determines today's price.

And then there is elasticity. If the price of gas triples tomorrow your still going to have to drive that huge SUV you bought when gas was $2.00 to work tomorrow and for quite a while before you can trade it in for a smart car or move to within walking distance of your job. So a temporary price spike seems to have little or no effect but consistently higher prices for a couple of years or more will radically change peoples behavior and purchasing decisions which will show up as demand destruction but not on day one.

-

vtsnowedin - Fusion

- Posts: 14897

- Joined: Fri 11 Jul 2008, 03:00:00