by MD » Sun 09 Nov 2014, 10:24:06

by MD » Sun 09 Nov 2014, 10:24:06

$this->bbcode_second_pass_quote('ROCKMAN', 'M')D - "I'm still convinced of its accuracy though." Fair enough. So you believe the KSA and Russia have undeveloped oil reserves they can drill up for $20/bbl.

Not sayin' that at all, although both can probably continue to keep depletion in check on the $20 stuff for a while yet. I wouldn't bank on it for long though.

The important point, again, are the marginal barrels, or "mill fill". Those barrels that sell for above market price in smaller quantities because they fill out refinery production runs or logistic models.

It's such a convoluted and complex business. At the ground level decisions are often made with factors other than immediate price concerns.

From the overview then, then best that can be done many times is to understand base dynamics.

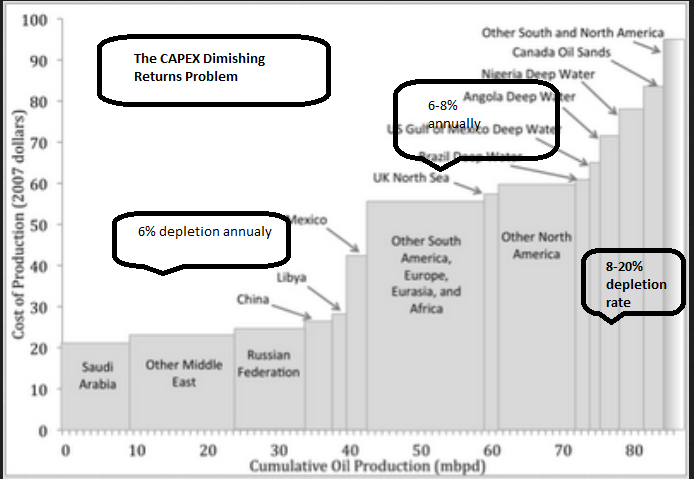

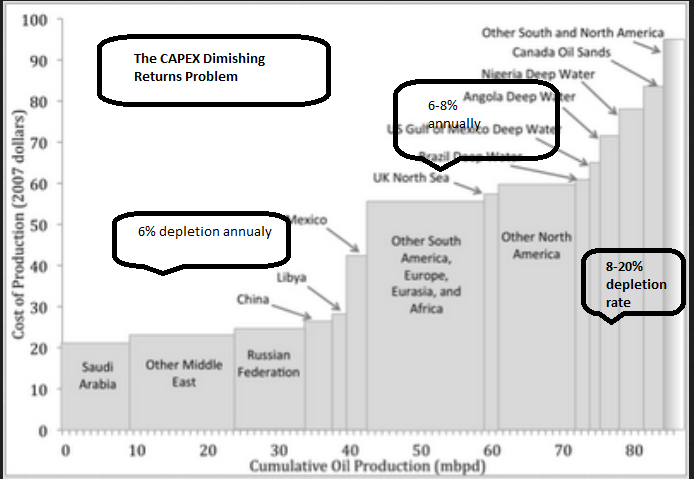

Development and production costs vary across a wide range today from 20-120 bucks a barrel or so. The wedge, however, is moving.

It isn't talked about much, because like this one, the conversations tend to get driven off into the bushes. "But xxx can still do some $50 barrels and yyy has is a completely different resource type and zzz yields a completely different mix of end product." Yep, yep. A report detailing all of those variables would be hundreds of pages long and would require tens of thousands of hours of data review, if you could even get to the data. It's why no one has done it.

Doesn't change the basic "accuracy" of the model though. You want "precision" instead? Good luck with that!

The other graphs offered just up thread are interesting too, but their assertion "price required to produce" is a bit misleading. Here's what people need to get their heads around, and I have heard you say it too, I think:

"The market price does not always determine what is being produced on any given day."Lots of production out there is marginal.

Stop filling dumpsters, as much as you possibly can, and everything will get better.

Just think it through.

It's not hard to do.