Page added on January 16, 2020

Oil Update

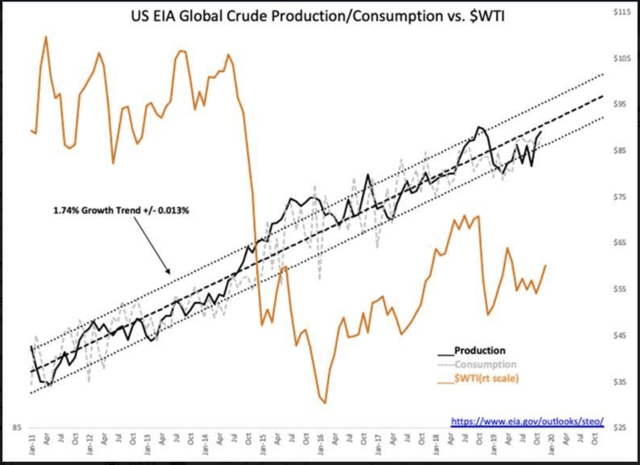

The facts remain that Production/Consumption has seen consistent growth since 2011 with only minor variation of 1.74% +/-0.013%.

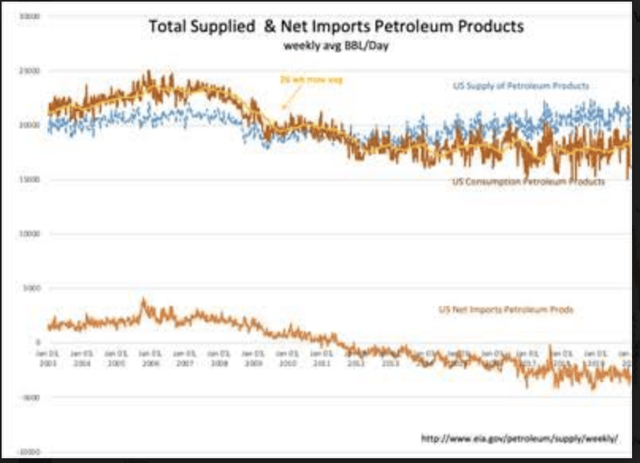

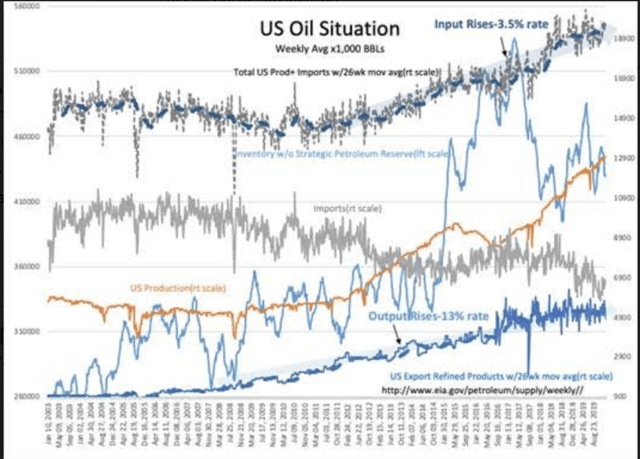

The data presented shows the US developing a Refined Product Export business since 2003 which has grown ~13% annually.

The history from 2003 includes the speculative “Peak Oil” 2010-2014 period representing WTI over $100/BBL only to plunge below $30/BBL on strength in the US (US Dollar) resulting in many believing excess production now represented an “Oil Glut.”

- New Record US Crude Production 13mill BBL/Day

- US Crude Inv declines 2.5mill BBL-now ~27mil BBL below 5yr mov avg

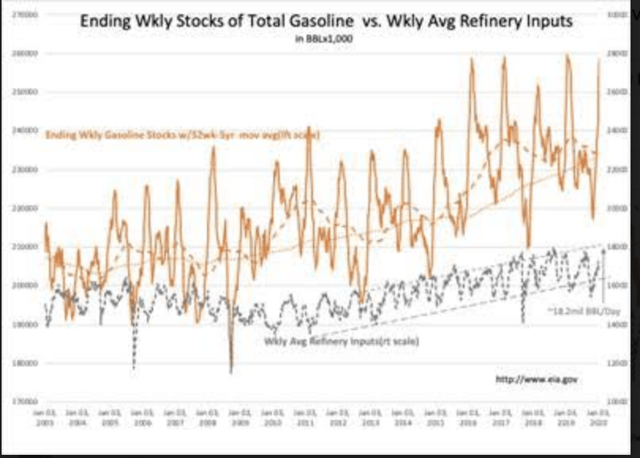

- Refinery Inputs rise less than 0.1mill BBL/Day and remain low relative to historical trend

- Gasoline Inv rise to recently established Spring peaks while exports still positive declined 1mill BBL/Day the past week

The multi-year trends are higher US Crude Production, lower Crude Imports with the US being a Net Exporter of Crude Oil at the end of 2019. The US has been a Net Exporter of Refined Products since 2011, a trend which continues. The excess inventories of 2014-2016 can be attributed to investor speculation that the world was running out of oil, “Peak Oil.” The facts remain that Production/Consumption has seen consistent growth since 2011 with only minor variation of 1.74% +/-0.013%.

The data presented shows the US developing a Refined Product Export business since 2003 which has grown ~13% annually. The US became a net exporter in Refined Products in 2011. Technological advances spurred US Crude Production which made the US a Net Exporter at the end of 2019. The history from 2003 includes the speculative “Peak Oil” 2010-2014 period representing WTI over $100/BBL only to plunge below $30/BBL on strength in the US (US Dollar) resulting in many believing excess production now represented an “Oil Glut.”

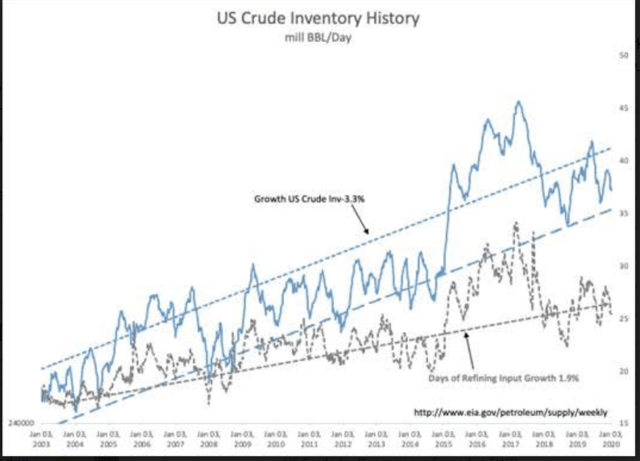

Looking separately at US Inventory and Days of Refinery Inputs as the US has evolved into a global supplier provides interesting details. US Crude Inventories have grown 3.3% annually since 2003. Refined Products Exports have grown ~13%. Efficiencies and substitutes in the US have resulted in US consumption being virtually flat. Coupled with improved reliability of transportation and a surge in domestic production, inventories have not needed to grow at the same pace. Days of Inventory for Refining Input have grown far less at 1.9% annually. The spread between the US Crude Inventory trend lines drawn represent 3.6 Days of Refinery Input.

US E&P companies have been able to lower total production costs below $30/BOE (a few have lowered costs below $25/BBL). Technological advances since fracking began to show promise have been nothing short of incredible.

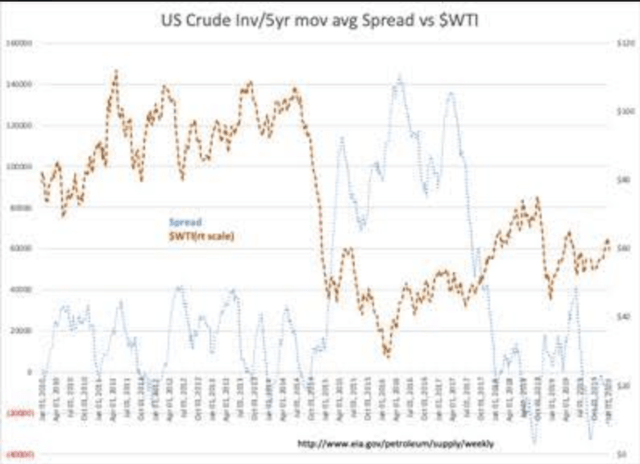

Throughout this period, WTI has swung wildly from fears of “Peak Oil” to fears currently of having too much oil, “Oil Glut.” Traders have priced oil based on expectations of Supply/Demand when the history shows little variation in the Global Production/Consumption trend. The one feature which stands out has been US Crude Inventories relative to their 5yr mov avg. Higher inventories than the 5yr benchmark has a recent history of talk of excess supply, slower economic growth and lower prices. Just as we hear today.

When US Crude Inventories fall below the 5yr benchmark, the talk has been inadequate supply and higher than expected economic growth followed by higher prices. The 2010-2014 period saw traders respond whenever inventories fell 10mil-12mil BBL below the 5yr mov avg. Today, US Crude Inv are 27mil below the 5yr mov avg. As recently as Sept 2018, inventories fell 33mil BBL below the 5yr and early Oct 2018 saw $75/BBL WTI. Oct 2018 saw a sharp turn lower in market psychology and WTI when the 10yr Treasury rates plunged, the yield curve flattened sharply and the media spread fear of another “1929.” Nothing in our economic indicators backed this thinking then or since.

In my opinion that investor fears are still being worked off as strong economic data continues to be reported. At some point, I expect traders to suddenly realize that growth continues and that one of their historic benchmarks for pricing oil is at levels normally signaling that higher prices are justified.

Always keep in mind that prices are set by expectations spurring market psychology. If traders believe there is ‘not enough of something’ to meet expected demand, they will drive the price higher very quickly. I think this condition exists today with oil.

14 Comments on "Oil Update"

dave thompson on Fri, 17th Jan 2020 4:04 pm

OH boy, the energy transition away from FF is going…… well maybe not so good?

Richard Guenette on Mon, 20th Jan 2020 3:07 pm

Never trust the stock markets- people lose more money rather than make money (in other words, it is a Ponzi scheme).

Richard Guunette ID theft on Mon, 20th Jan 2020 3:09 pm

The stupid troll juanPee is stealing ID’s

Richard Guenette said Never trust the stock markets- people lose more mo…

Richard Guenette said Capitalism is one big scam.

Richard Guenette said Davy, you have no friends on here. And you waste y…

Richard Guenette said Tax the rich- make these useless parasites pay the…

Richard Guenette said Trump is a one-term President.

Richard Guenette said The US allows infrastructure to crumble, people to…

Richard Guenette said I am not American and what disgusts me is when a l…

Anonymouse on Mon, 20th Jan 2020 3:10 pm

Juan, enough is enough, stop the mindless postings. You act like an idiot and that reflects back bad on Mak and I.

More Davy ID Fraud on Mon, 20th Jan 2020 3:12 pm

Richard Guunette ID theft on Mon, 20th Jan 2020 3:09 pm

Anonymouse on Mon, 20th Jan 2020 3:10 pm

More JuanP ID Fraud on Mon, 20th Jan 2020 3:36 pm

Richard Guunette ID theft on Mon, 20th Jan 2020 3:09 pm

Anonymouse on Mon, 20th Jan 2020 3:10 pm

makati1 on Mon, 20th Jan 2020 3:38 pm

Juan. please stop this nonsense. The old timers want you gone. You ruined a good thing.

More Davy ID Fraud on Mon, 20th Jan 2020 4:08 pm

More JuanP ID Fraud on Mon, 20th Jan 2020 3:36 pm

makati1 on Mon, 20th Jan 2020 3:38 pm

More JuanP ID Fraud on Mon, 20th Jan 2020 4:35 pm

More JuanP ID Fraud on Mon, 20th Jan 2020 3:36 pm

makati1 on Mon, 20th Jan 2020 3:38 pm

More Davy ID Fraud on Mon, 20th Jan 2020 4:41 pm

More JuanP ID Fraud on Mon, 20th Jan 2020 4:35 pm

More JuanP ID Fraud on Mon, 20th Jan 2020 4:57 pm

More Davy ID Fraud on Mon, 20th Jan 2020 4:41 pm

More JuanP is a Fraud on Mon, 20th Jan 2020 4:57 pm

JuanP sucks

The Board on Mon, 20th Jan 2020 5:05 pm

Everyone Please.

Stop feeding the Davy troll.

More JuanP is a Fraud on Mon, 20th Jan 2020 5:06 pm

he Board on Mon, 20th Jan 2020 5:05 pm