Amid the most enduring global oil glut in decades, two OPEC crude producers whose supplies have been crushed by domestic conflicts are preparing to add hundreds of thousands of barrels to world markets within weeks.

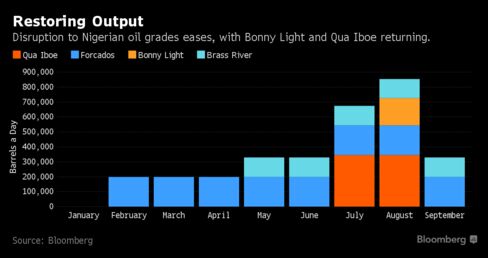

Libya’s state oil company on Wednesday lifted curbs on crude sales from the ports of Ras Lanuf, Es Sider and Zueitina, potentially unlocking 300,000 barrels a day of supply. In Nigeria, Exxon Mobil Corp. was said to be ready to resume shipments of Qua Iboe crude, the country’s biggest export grade, which averaged about 340,000 barrels a day in shipments last year, according to Bloomberg estimates. On top of that, a second Nigerian grade operated by Royal Dutch Shell Plc is scheduled to restart about 200,000 barrels a day of flow within days.

While there are reasons to be cautious about whether the barrels will actually flow as anticipated, a resumption of those supplies — more than 800,000 barrels a day in all — could more than triple the global surplus that has kept prices at less than half their levels in 2014. It would also come just as members of the Organization of Petroleum Exporting Countries and Russia are set to meet in Algiers later this month to discuss a possible output freeze to steady world oil markets.

“If you have some restart of Nigeria and some restart of Libya, then the rebalancing gets pushed even further out,” Olivier Jakob, managing director at Petromatrix GmbH in Zug, Switzerland, said by phone. “It complicates matters a lot before the meeting in Algeria.”

Libya Shipments

With a few exceptions, crude in New York and London has been stuck below $50 a barrel for months. The current global oil oversupply is about 370,000 barrels a day, according to data from the Paris-based International Energy Agency.

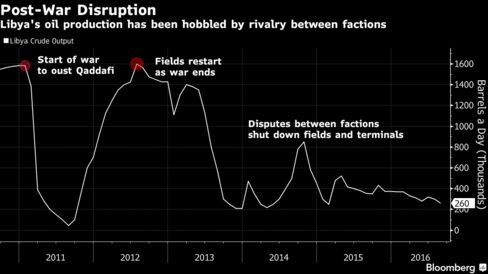

The resumption of shipments from the three Libyan ports would allow Libya to double crude output to 600,000 barrels a day within four weeks, National Oil Corp. Chairman Mustafa Sanalla said Tuesday in a statement on the company’s website.

The exports are possible after a substantial improvement in the security situation there, he said Wednesday in a separate statement. The Tripoli-based NOC lifted a measure called force majeure, which gives the company the right not to meet supply commitments.

Libya has made at least half a dozen failed pledges to restart shipments. What may be different this time is that the NOC has struck a deal with Khalifa Haftar, commander of forces who took control of Es Sider and Ras Lanuf. He also has control of the oil fields and pipelines that feed them.

Qua Iboe

Meanwhile Exxon has filled storage facilities at its Qua Iboe export terminal in Nigeria and is awaiting government clearance to resume shipments, a person familiar with the matter said Wednesday. Exxon declined to provide a timeline for a restart and said that a force majeure, in place since July, still stands.

In Nigeria, militant groups have repeatedly attacked oil infrastructure this year, making any resumption of flow reliant on pipeline and export terminals being secure from further incidents. Qua Iboe has been under force majeure since a “third-party impact” on a pipeline in July, according to Exxon.

“If it’s true, it’s another downward pressure for the markets because that would be a large amount to return to the market,” Thomas Pugh, commodities economist at Capital Economics, said by phone, adding that he doubts the resumptions will materialize given the situations in both countries.

Cloggie on Wed, 14th Sep 2016 6:30 pm

Peak oil, where art thou?

Before the murder of Ghadaffi, a pure act of western hooliganism, Libya pumped 1.6 MBOD.

The potential is still there, the “glut” is here to stay for a little longer, much to the dismay of shortonoil, because reality refuses to bow for his theory.

bahamased on Wed, 14th Sep 2016 6:58 pm

[quote]The potential is still there, the “glut” is here to stay for a little longer, much to the dismay of shortonoil, because reality refuses to bow for his theory.[/quote]

But shortonoil’s theory says that the glut will continue, so I don’t know why he should be “dismayed”

Truth Has A Liberal Bias on Wed, 14th Sep 2016 7:10 pm

“Peak oil, where art thou?”

Global crude plus condensate peaked in November 2015 and has been declining ever since at an annualized rate of 4.2%.

It just so happens that supply and demand are resulting in ‘a glut’, as stunned cunt plant likes to repeat non stop. Peak oil and an oil glut are not mutually exclusive.

This information is not exactly carved in a stone tablet and hidden on the dark side of the moon. For a peak oil website I must say the commenters that frequent the website sure don’t fucking get it! Fuck are yanks ever retarded.

Lucifer on Wed, 14th Sep 2016 10:00 pm

Truth, calm down or Death will visit you earlier than planned.

Most humans live in there own little bubble and don’t have a clue whats coming.

sampson ogiesewu on Wed, 14th Sep 2016 10:15 pm

Crude price is going to leveled out at $35 a barrel with all the glut.Nothing is going to change until U.S production slows and stable out,the change will not be significant either.

Anonymous on Thu, 15th Sep 2016 1:46 am

The world’s producers are intentionally pumping more oil than the world economy actually needs, producing needless excess supply, not a ‘glut’ as plantaidiot keeps calling it. The main reasons for this oversupply are not that complicated, even if the details may be.

The current oversupply situation, is a uS orchestrated attempt to cripple, or at least weaken, Russia, Iran, and Venezuela, mainly. Russia is too powerful for the uS to try to force the world to stop buying Russian FF energy, though it has had some success in Europe though its stooge policitos in the EU. Smaller and weaker Iran, has been subjected to a semi-successful campaign(mostly in the free-world order), to sanction its economy, and physically limit its sales to the world.

But there is still a problem for the plantaglut morons of the world.

Even IF, the uS was not attempting to run Russia and others in the ground via energy market price manipulation, with or without a ‘glut’ (lol), large portions of the global economy are so saddled down the legacy debt and deficits, that there not a lot of room for ‘growth-as-usual’ to resume. Expensive oil, cheap oil, who cares? There is enough money in the ‘west’ to carry on at current, quasi-depressed levels, but that’s about it. No one wants to take on more debt, and debt, is principally how oil-driven ‘growth’, has been, literally fueled by in the past.

Debt levels are so great now, it hardly matters what the cost of barrel of oil is. Even with ZIRP, and sort-of-low prices, no one, in the ‘west’, can afford an economic boom. Maybe the countries under economic attack by the uS and cronies could lead an economic boom, if not for said attacks. But the uS will not likely stop any of its attacks, or oil price manipulations anytime soon.

oracle on Thu, 15th Sep 2016 9:52 am

The oil market is effectively in a fire sale liquidation.

Kenz300 on Sun, 18th Sep 2016 11:46 am

As bankruptcies continue in the oil patch…….

How do Canadian tar sands survive……. deep pockets