Page added on September 1, 2016

U.S. And Russia Emerging As Winners 2 Years Into The Oil War

Summary

Each oil producers’ fortune differs depending on fundamentals.

Demand is still extraordinarily high.

Inventory remains very high, especially in the U.S.

U.S. shale oil and to a lesser extent Russia are emerging as winners.

“However beautiful the strategy, you should occasionally look at the results.” — Winston Churchill

Everyone knows the story. Saudi Arabia decides not to cut supply in mid-2014, resulting in a spectacular price plunge. Thus begins the oil war. Some thought the worst was over by spring 2015: It was not. Another collapse lead oil prices to $25 in early 2016.

Let’s recap the current oil market after two years in the oil war. First, I’ll take a look at current oil supply from China, Iran, Iraq, Nigeria, Russia, Saudi Arabia, the U.S. and Venezuela.

Second, I’ll state the current state of oil demand globally. Finally, I’ll take a quick look at global oil inventories as it is wildly discussed here on Seeking Alpha.

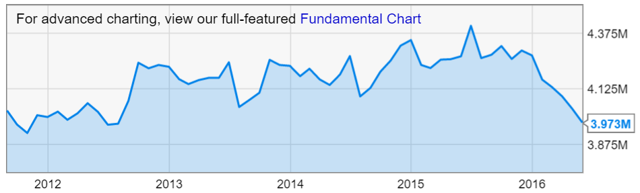

Supply – China

Source: YCharts

Let’s say the obvious, to go down in history books: Chinese peak oil production was 4.4MMbbl/d.

Chinese oil majors are having difficulties maintaining their homeland output. There is simply no new oil reserves discovery to keep up current production.

The current oil price collapse accelerated this phenomenon as it takes a lot more money to squeeze ever less Chinese oil out of the ground. China will import more oil as production declines naturally.

Supply – Iran

Iran’s oil production skyrocketed as soon as sanctions were lifted in early 2016. This was a bit surprising considering the health of the Iranian oil industry after years of underinvestment. This rhetoric was widely used by bulls to diminish the prospect of Iran returning to the global oil market.

Still, it finally appears Iran is having problems producing over 4MMbbl/d as it did before the Western sanctions. As we learned recently from the Iranian energy minister, Iranian oil production stalled in July to 3.85 MMbbl/d, compared to 3.83MMbbl/d in June. The IEA went further by saying Iranian output fell 230Mbbl/d to 3.6MMbbl/d in July.

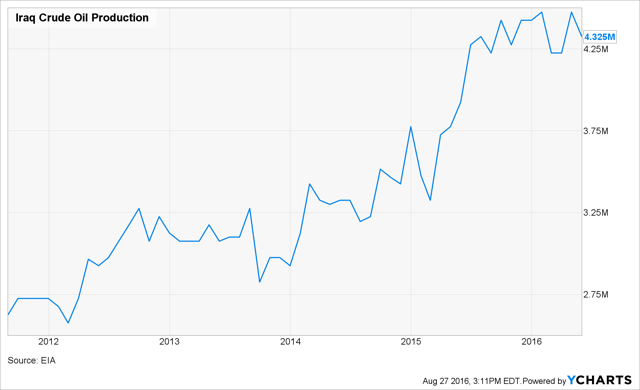

Supply – Iraq

Source: YCharts

Iraq is without a doubt the best success story out there when looking at oil production: Production grew more than 1MMbbl/d since the oil crash.

Companies operating in Iraq get extra cash with each extra barrel they are able to produce. This seems to be a great incentive as Iraqi oil production is on the up swing.

Recently, Iraq asked companies to grow exports by 125Mbbl/d, while resuming oil exports via a Kurdish pipeline through Turkey. Iraq also appears to be willing to grow its oil production and market share further.

However, the political situation is still difficult in Iraq. Indeed, people took the streets last spring to denounce the political stalemate. While the riots are now under control, political problems remain unsolved.

Last but not least, ISIL still controls part of Iraq. Nonetheless, the Iraqi army is making progress with continued support from some Western nations.

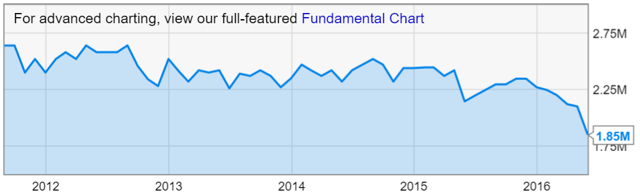

Supply – Nigeria

Source: YCharts

An organization known as the Niger Delta Avengers carried sophisticated attacks on Nigeria’s oil infrastructure. These attacks are currently impacting Nigeria’s oil production by as much as 800Mbbl/d.

While negotiations are underway, it’s unclear when a deal would be signed, if any.

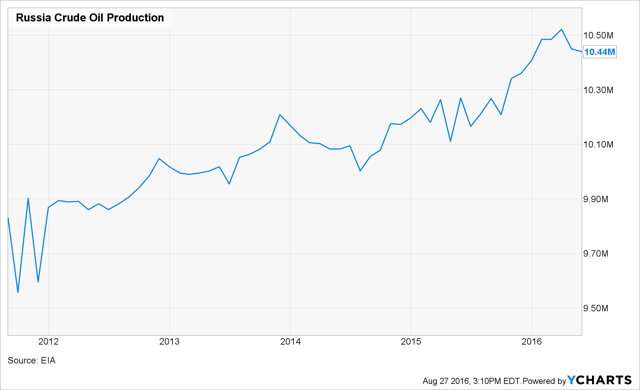

Supply – Russia

Source: YCharts

Russia has been steadily increasing its production to reach a post-Soviet high. The Russian energy ministry is planning modest growth while the EIA believes Russian oil output will have some difficulties growing further.

Goldman Sachs is saying Russian oil production will break its previous record of 11.47MMbbl/d dating back to 1987 no later than in 2018.

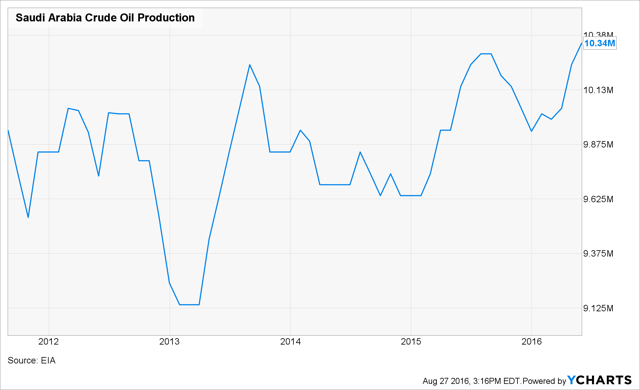

Supply – Saudi Arabia

Source: YCharts

Oil production from Saudi Arabia has been stable when excluding seasonality. Production increases in the summer to make for increased summer power demand.

Saudi Arabia changed its strategy recently as it pledged to prevent doing any shocks to the oil market. At first, the Saudi strategy was simple, as explained in late 2014 by Ali Naimi, then Saudi Arabian Energy Ministry:

[…] our production costs are low – $4/bbl or $5/bbl at most. Whether it goes down to $20/bbl, $40/bbl, $50/bbl, $60/bbl, it is irrelevant.

Saudi Arabia would crush the other high costs producers and increase its market share. We now know other oil producers, especially U.S. shale oil, were much more resilient than Saudi Arabia thought.

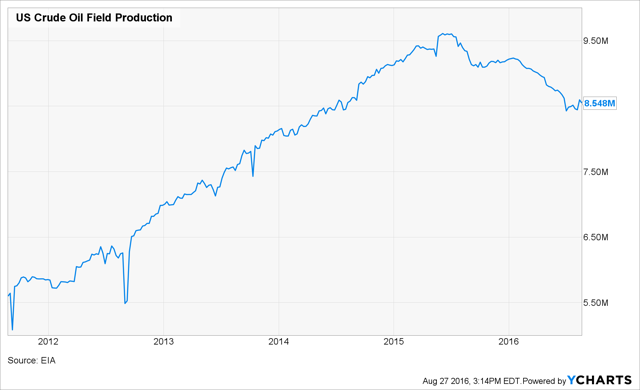

Supply – U.S. (Lower 48)

Source: YCharts

U.S. field oil production declined 1MMbbl/d from its peak in mid-2015.

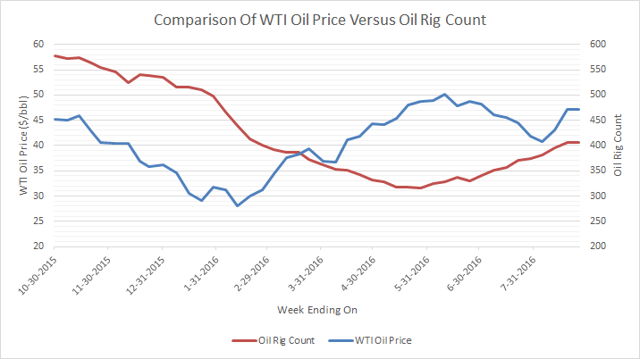

Source: EIA, Baker Hughes, my own work.

From January to early June, onshore field activity remained muted. The shale oil industry gradually released oil rigs from work as oil collapsed.

The rise of oil from $30 to $50 per barrel was enough for shale drillers to increase their rig count to 406 today. The rise is limited to top performing oil fields, namely the Permian basin, which added 62 of the 90 oil rigs added this summer.

The U.S. oil rig count remains well under its peak. However, because of technical improvements, cost cutting and the drilling of premium locations, each new oil well brings more barrels, cost less and its production can be sustained longer.

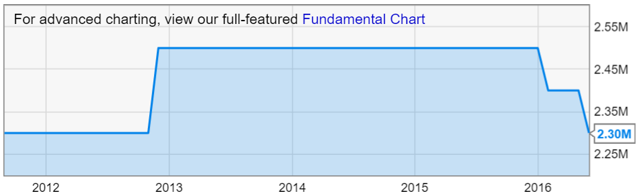

Supply – Venezuela

Source: YCharts

Venezuela is in a state of crisis. A recent report by Columbia University calls Venezuela the biggest threat to the oil market’s stability.

From its inability to pay for light oil imports, to extreme inflation and a failing government, PDVSA can’t sustain its current production. The decline is now well under way. The country will experience its greatest oil production collapse since the PDVSA strike of 2002-2003.

Global demand

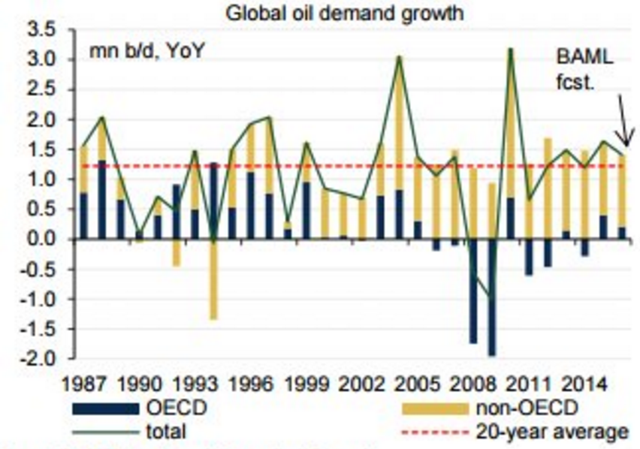

Global oil demand remains high. Oil demand growth should average at least 1.2MMbbl/d to 2020, well over the 20-year average.

Source: Merrill Lynch Commodities Research

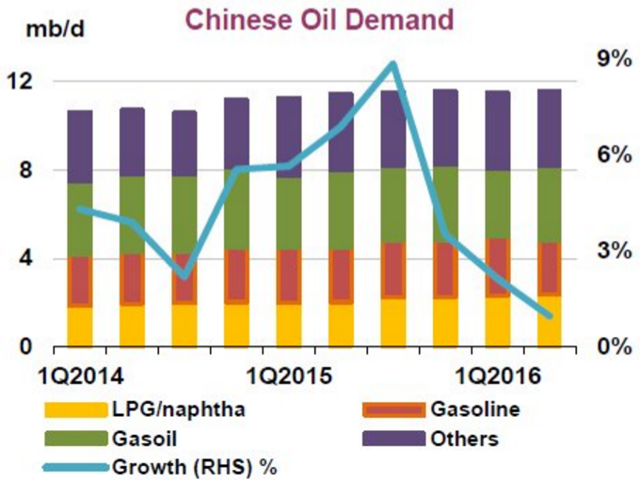

Oil demand growth will be primarily fueled by non-OECD, non-China countries, notable India and the Asia-Pacific region in general. Indeed, China’s high oil demand growth is rapidly coming to an end as its economy slows down.

Source: IEA

Oil inventory

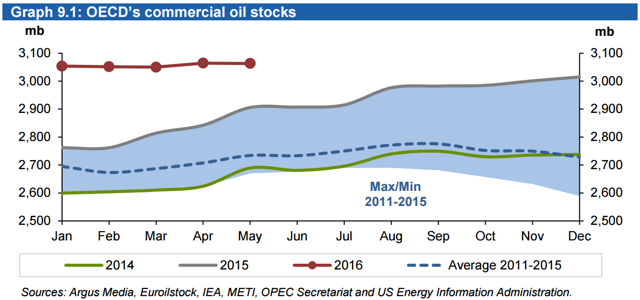

With supply bigger than demand, oil inventories are hemorrhaging since late 2014.

Source: OPEC Monthly Oil Market Report – July 2016

High oil inventories will put a lid on the rise of oil prices globally. The situation in the U.S. is critical: I won’t dig deeper on the subject as it is wildly discussed here on Seeking Alpha.

Besides, we should note that Saudi Arabia and Iran are currently drawing oil from storage to fill exports:

Despite near record production, the kingdom’s oil inventories have declined for six consecutive months, the longest stretch since […] nearly 15 years ago.

The drop in Saudi crude stocks signals the rebalancing has started.

Conclusion

Oil supply and demand is finally coming to balance: it’s only a matter of time. However, as we can learn from above, it’s still unclear when rebalancing will happen: By Christmas? In mid-2017? Will oil linger at $50/bbl for the next 4 years?

Let me offer you my explanation.

You can’t deny the American shale oil industry is under transformation. The hundreds of shale oil bankruptcies will let the stronger players prosper. Shale oil drillers should thank technical improvements and aggressive cost cutting. The current downturn cemented the best of the shale oil operators in the global oil stage.

Some other oil producers are having longer term issues at home, namely China, Nigeria, Saudi Arabia and Venezuela.

Saying Saudi Arabia is having big problems at home wouldn’t be an understatement. I don’t believe its entire oil industry will collapse: survival isn’t at risk for now as currency reserves still amount to $550B. However, the clock is ticking at -$6B per month. The country will definitively come out of the oil war as a poorer nation.

Nigeria is suffering from weak government institutions. Venezuela’s situation is dire. To me, these nations will be the hardest hit.

The Iranian oil production is also very important. Iran being unable to achieve pre-sanction oil production of 4MMbbl/d would be a bullish development.

In summary, those are my focus points:

- Oil production falls from China, Nigeria and Venezuela

- Saudi Arabian oil production in October: Saudi Arabia could cut oil production as it did in 2015 after the summer demand peak. This would be further evidence of a change in strategy.

- Rig activity on the onshore U.S.

To me, two potential winners are emerging two years in the oil war: the U.S and Russia to a lesser extent.

- Russian oil production is increasing, reaffirming Russia as an energy superpower.

- Russia is experiencing financial problems, but definitively not on the scale of Saudi Arabia. Those concerns are diminished in part by a very weak Ruble.

- American oil production is proving to be much more resilient than thought.

- With technical improvements, cost cutting and premium drilling, shale oil has found a niche. Some top American oil producers are planning to grow output for years to come at current prices.

Saudi Arabia couldn’t be on the winning list even though it caused the oil war because it’s facing structural problems:

- The only thing the country knows to produce is oil.

- Social harmony in the Kingdom is assured by the government in the form of a generous welfare state.

The current situation is exacerbating these fundamental weaknesses. The cost to the country’s reserves are already mounting to almost $200B.

The conclusion is somewhat the same I had a year ago: All hardest hit nations are members of OPEC. Now it’s time to rethink the strategy.

seeking alpha

19 Comments on "U.S. And Russia Emerging As Winners 2 Years Into The Oil War"

HARM on Thu, 1st Sep 2016 8:13 pm

“Wiiiining!”

–Charlie Sheen

–>Take THAT, doomers! 😉

onlooker on Thu, 1st Sep 2016 8:21 pm

I present to you the indispensable , exceptional and virtuous nation oops Empire for your amusement

https://www.youtube.com/watch?v=Rfm4unbyHV0

Especially listen from the 6th minute to the 8th

JuanP on Thu, 1st Sep 2016 9:26 pm

So, we have Mbbl/d, MMbbl/d, mnb/d, and mb/d all used in the same article. For those who are new to these, the first and second mean 1,000 and 1,000,000 and are using Roman numerals, the third and fourth mean 1,000,000 and use the Arabic alphabet. Aren’t humans smart? We couldn’t be more stupid if we tried! LOL!

Survivalist on Thu, 1st Sep 2016 10:05 pm

Seeking alpha is always good for a very superficial analysis of the obvious with a little twist of ‘go USA’ for fun. If your kid needs something for show and tell try this article.

peripato on Thu, 1st Sep 2016 10:10 pm

onlooker – I could hardly keep my lunch down, listening to this delusional drivel.

rockman on Thu, 1st Sep 2016 11:17 pm

“U.S. shale oil and to a lesser extent Russia are emerging as winners.” Almost stopped reading after that insanity but skimmed forward anyway.

“The rise is limited to top performing oil fields, namely the Permian basin, which added 62 of the 90 oil rigs added this summer.” In fact the majority of most PB drilling hasn’t been similar to the Eagle Ford or other fractured shale reservoirs. In fact a number of reservoirs aren’t even that tight. Many of the wells were drilled within existing existing producing fields. And would be classified as “acceleration wells”: drilled between existing wells in order to accelerate recovery. Very different the drilling in leases not already and producing and looking for virgin reserves. Higher oil prices make SOME such efforts economical even at today’s prices. BTW not all the PB rigs are drilling for oil.

By comparison (according to the EIA) the rig count in the pure fractured shale Eagle Ford play had continuously declined since late 2014 from 28o to where it has finally stabilized at less the 40. That’s an 85% decline with no increase since prices have recovered to the current level.

And there have no meaningful improvement in shale drill since the rig count collapse. Lower costs have been the result of increased competition amongst the service companies due to decreased activity. That’s the only benefit the remains shale players have gotten from the collapse. Which doesn’t come close to losing 50%+ of their production revenue from their existing wells.

And as far as that 400+ US rig count: 80 of them are drilling for NG…not oil. And according to the EIA the total (including those targeting NG) thevrig count only increased by 30 this summer. But much more important: since the oil production level topped out at 2 mm bopd last January it HAS NOT INCREASED as oil prices improved…it slilped s!ightly.

And Russia “winning”??? Even though it has increased production Russian oil export revenue has declined significantly since 2014. So selling more of its FINITE oil reserves and making a lot less revenue is winning???

Anonymous on Thu, 1st Sep 2016 11:30 pm

LoL!

onlooker on Fri, 2nd Sep 2016 3:57 am

Yes, peripato as an American I bow my head in shame

peakyeast on Fri, 2nd Sep 2016 4:45 am

@onlooker: Sorry I couldnt take the full two minutes – I was puking in disgust before 70 seconds…

Cloggie on Fri, 2nd Sep 2016 5:38 am

@onlooker – watched minute 6-9. Nothing… um… exceptional, nothing surprising. Just repeating in brutal clarity what the intentions of the US deep state are. I would advise Hillary Clinton to have a long discussion with Brzezinski instead of George Soros, Richard Haass, Janet Yellen, Michael Ledeen, Paul Krugman, Abe Foxman and the rest of the warmongering Sanhedrin that wants it all and sells it as compassionate, humble leadership. Furthermore she claims that the US leads an unparalleled alliance. I wouldn’t be so sure that she can keep everything under one roof if I were her. She says: Russia and China have nothing in parallel. B-b-but mrs Clinton, they have each other (covering most of Eurasia), Iran as well as the European right. And perhaps even Turkey and India. And how about these Jihadists: they hate Washington. And are you sure you can keep the Reps electorate on board of the SS NWO?

You won’t. Whitey has enough of globalism and is going to revolt against post-WW2 modernity as it sucks big-time, for them.

Cloggie on Fri, 2nd Sep 2016 5:53 am

Agree with rockman, I cannot see Russia as a winner on the oil front at all. Russia’s economy is cripled due to low oil prices, its main source of income. Neither the US that has to produce against much higher cost. In reality nobody is a winner in a price war, except perhaps Iraq and Iran that finally see their income increase due to recovering production after civil war c.q. lifting of sanctions.

peakyeast on Fri, 2nd Sep 2016 6:01 am

@cloggie: I also found it had similarities to the proverb:

The operation was a success, the patient died.

Davy on Fri, 2nd Sep 2016 8:07 am

“Putin Joins “OPEC Headline” Fray, Pushes For Oil Production Freeze, Iran Exemption”

http://www.zerohedge.com/news/2016-09-02/putin-joins-opec-headline-fray-pushes-oil-production-freeze

“Overnight the debate over the fate of the OPEC oil production freeze got a new and unexpected entrant when Russian president, Vladimir Putin said he’d like OPEC and Russia, producers of half of the world’s oil, to reach a deal to freeze supply and expects the dispute over Iran’s participation can be resolved. As Bloomberg first reported, Putin said that “from the viewpoint of economic sense and logic, then it would be correct to find some sort of compromise,” speaking in an interview in Vladivostok. “I am confident that everyone understands that. We believe that this is the right decision for world energy.”

Exclusive: Vladimir Putin on Russia’s oil, an output deal, Saudi Arabia and Iran https://t.co/ISoE7poKVg pic.twitter.com/9z7vpHNbd2

— Bloomberg (@business) September 2, 2016

“Just as surprisingly, Putin sided with Iran saying that oil producers recognize that the middle-eastern nation, which has mostly restored the output halted during three years of trade restrictions, deserves to complete its return to world markets.”

joe on Fri, 2nd Sep 2016 9:31 am

With the latest push by the elites efforts to convince us that we need an interest rate hike (so they can make money from the 0% interest bonds they bought), we are presented with this good news story. Dont worry, theres balance and balance is good, right?

Sadly they dont tell you that the demand growth from China is predicated on the continuation of LOW interest rates, lest the price of buying increases, and oil is part of the inflation story, which argues for rate hikes.

I for one am not buying it. George Soros can suck it up a while longer. If people have to pay more on debt, oil demand slumps and its bye bye balance. Tight oil slumps, as does easy.

The world changed in 2007, the elites havent learned it yet. From the rise of isis to the botched middle eastern revolutions, the US is politically defunct globally. The dollar is the last leaf covering the Americans modesty. If the elites want to screw it up so they can buy more coke, I say, why not. But this oil story should fool nobody.

rockman on Fri, 2nd Sep 2016 10:23 am

“In reality nobody is a winner in a price war, except perhaps Iraq and Iran that finally see their income increase due to recovering”. Well, yes and no. I’m sure both would be happier selling for $90+/bbl. OTOH had they gotten back into the market sooner the price bust may have developed earlier.

The only real winners (besides the consumers) in such situations are the refineries. Not a hard rule but typically the lower the oil price the better their margins. Plus they are selling 20%+ more then just a few years ago. IOW their profit margin and income are much higher selling $2/gallon gasoline then at $4/gallon.

Plantagenet on Fri, 2nd Sep 2016 10:24 am

Russia’s push for cut in global oil production to stabilize prices will only work if Russia itself cuts oil production. Since that isn’t going to happen, look for the oil glut to continue a bit longer.

Cheers!

PracticalMaina on Fri, 2nd Sep 2016 10:47 am

All we had to do was sacrifice ground water and air quality!!! YAYY!!!

shortonoil on Fri, 2nd Sep 2016 11:04 am

“Oil supply and demand is finally coming to balance:”

When one does not realize that the price of oil is an effect, not a cause, such statements may appear valid. In this case they don’t even “appear” valid. China is likely to complete filling its SPR this year, and when they do it will take 1 mb/d of demand off the market. At $46/ barrel no one is going to reduce production until they have finally gone absolutely, totally broke.

Like the price has to go back up, and it hasn’t for three years, the market must come back into balance, and it hasn’t for three years. A some point these idiots will realize that their ECON 101 models just don’t work anymore – and actually never did. But, “when the only tool is a hammer every problem looks like a nail”; until the building falls down.

So they will just continue to drone on, and on about how every thing will be fine when such, and such has taken place. And, such and such becomes the the newest euphemism for IF, and IF.

Will the US and Russia be the last men standing? It highly possible. After the Middle East explodes, Russia will have all the oil, and the US the most money to spend on it. Europe will be fighting revolutions between Spanish city states and their defunct central governments, and trying to discover who ran off with all the gold. China will have been retaken over by its war lords as its central communist government heads for Tibet to escape the rope that will be hanging from every lamp post.

Of course, last men standing is most likely a bad analogy. Last men on their hands and knees is likely to be a little more accurate.

JGav on Fri, 2nd Sep 2016 8:42 pm

Right on Short,

How anybody could possibly be considered a “winner” in an “oil war,” is beyond my comprehension.