Page added on February 18, 2016

Foiled by Oil

People do use their oil shares to buy houses, cars, planes and college educations. When crude oil prices hit $140 per barrel, pension funds and college endowments rejoiced.

People do use their oil shares to buy houses, cars, planes and college educations. When crude oil prices hit $140 per barrel, pension funds and college endowments rejoiced.

Our 2006 book, The Post-Petroleum Survival Guide and Cookbook was published just as conventional hydrocarbons struck their all-time global production top and began to decline (a picture that emerged only years later). The book challenged readers to consider how they might cope with $20 per gallon gasoline and the absence of public transit alternatives.

It also described the undulating top we now see, where high price destroys demand, which crashes price, which boosts demand, which raises price, and so on. Think of this part as the whoop-de-doos after the roller coaster cranks its way to the top and lets gravity take over.

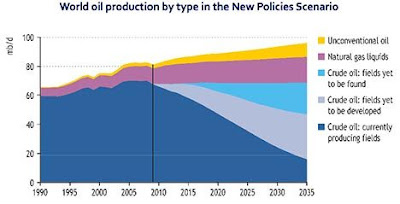

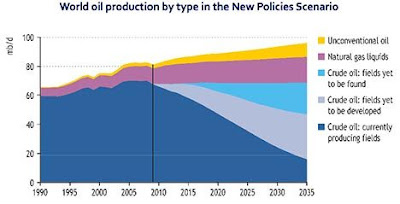

Lately there have been a spate of articles in the financial press beating up on Peak Oil theorists for being so widely wrong in their predictions. They point to charts showing global oil production rising from 86.5 million barrels per day in 2008 to 96 million in 2015. Of course, they are mixing apples and oranges. What peaked, right on schedule in 2006, was conventional liquids.

Lately there have been a spate of articles in the financial press beating up on Peak Oil theorists for being so widely wrong in their predictions. They point to charts showing global oil production rising from 86.5 million barrels per day in 2008 to 96 million in 2015. Of course, they are mixing apples and oranges. What peaked, right on schedule in 2006, was conventional liquids.

After 2006 Big Oil played its hole card, unconventional oil and gas. Those inside the sector had been telling the Peak Oilers about this all along, but it still caught some incautious prophets out on a hoisted petard. “Our community would concede that we underestimated or didn’t quite understand this whole fracking thing,” said Jan Lars Miller of ASPO-USA (Association for Study of Peak Oil). “It exceeded everyone’s expectations.”

Not everyone’s.

What Big Oil did not tell the pundits was that the unconventionals are a Ponzi scheme, too expensive to compete with renewable energy, made up mostly of a great credit bubble and churning real estate plays. Like all such schemes, unconventionals run on a short fuse that is only as long as the credibility of its grifters. As long as the con can keep up an appearance of legitimacy, people still buy houses, cars, planes and college educations riding on cascades of fraud.

On Big Oil’s books, proven reserves of oil are presently estimated at 1,700 billion barrels. Just in the past 18 months, and accelerating after the Paris Agreement, the decline in value has been $70 per barrel. The value of oil shares, therefore, has been reduced by $119,000,000,000,000. That is 119 trillion. It is only a matter of time until the market catches up to that peg. It is already on its way. Maudlin said, “The lost value in crude oil is equivalent to a couple of hundred Googles and Apples going up in smoke.”

On Big Oil’s books, proven reserves of oil are presently estimated at 1,700 billion barrels. Just in the past 18 months, and accelerating after the Paris Agreement, the decline in value has been $70 per barrel. The value of oil shares, therefore, has been reduced by $119,000,000,000,000. That is 119 trillion. It is only a matter of time until the market catches up to that peg. It is already on its way. Maudlin said, “The lost value in crude oil is equivalent to a couple of hundred Googles and Apples going up in smoke.”

But lest we forget, we are not just over the top of Peak Oil, we’re at Peak Everything: coal, natural gas, iron, copper, zinc, nickel, lead, palladium, platinum, silver, and aluminum – all suffered double-digit percentage valuation drops in 2015.

One of our earliest blogs here on this site was published August 14, 2007. It was called “The Mexican Trigger.” We still do not know if what we prophesied then will yet come to pass, but it is worth looking at. We laid it out more completely in September, 2007 for Energy Bulletin:

One of our earliest blogs here on this site was published August 14, 2007. It was called “The Mexican Trigger.” We still do not know if what we prophesied then will yet come to pass, but it is worth looking at. We laid it out more completely in September, 2007 for Energy Bulletin:

In 2004, Pemex was pleased to announce that its oil wealth would continue for many years to come. Pemex’s head of exploration and production, Luis Ramirez, was quoted in the daily newspaper El Universal as saying that Pemex had mapped seven new offshore blocks with large pools of oil and natural gas, likely in the range of 54 billion barrel-equivalents, more even than México’s proven plus probable reserves at that time.

“This will put us on a par with reserves levels of the big players like Iraq, United Arab Emirates, Kuwait or Iran,” Ramirez said. “What’s more, we would be in a position to reach production levels like those of Saudi Arabia, which produces 7.5 million barrels per day, or Russia, which produces 7.4 million.”

Just 3 years later, Pemex’s tune had changed. It had reckoned the cost of unconventionals versus conventionals and fully understood that high prices would be required if it was going to become a big league star. As we described in our post, on July 27, 2007, Raúl Muñoz Leos, Director General of Pemex, warned that México had less than seven years before the country would run out of conventional oil. Not seven years until it peaked. Not seven years for Cantarell, its super field. Seven years, and Méxican production would run dry.

Let’s see. 2007 plus 7 equals 2014. So what happened?

What happened was that Mexico did the same thing as the United States did in 1970. It deployed technological advances, it went unconventional (first offshore, later shale and fracked gas), and it imported to fill the gaps. When Enrique Peña Nieto was elected he quickly moved to privatize the national oil company. Pemex stopped being a public agency and became a “State Production Enterprise.” Thanks to Peña Nieto’s government, Pemex is now authorized to attract foreign investment of $8.5 billion dollars by selling parts of itself to private companies, including the US oil cartel.

Fast forward to 2016.

30 January: With budget cuts, the abandonment of the oil installations on land and in the Campeche Sound, it appears that the Federal Government is determined to liquidate Petroleos Mexicanos (Pemex) and return to where we were before the oil boom, which would create an economic and social catastrophe for the oil states like Campeche….

The government, which previously milked Pemex oil revenues to pay for breathtakingly rapid development of the country, found itself having to now raise taxes from tourism and other sources to keep Pemex afloat. In 2015 it cut what it spent on Pemex by 340 million dollars. Pemex shed 11,735 jobs and did not replace 80% of those retiring. It canceled $10 billion in pensions for those in retirement.

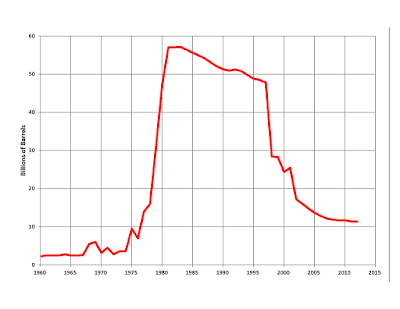

|

| Mexico: Oil Production 1960-2015 |

Editorials in the Mexican press say the crisis was “the most important in the sector since the 1938 constitutional change [nationalizing energy companies].”

What is still not being widely recognized is that the crisis in oil is the main reason for the crisis in the finances of Mexico. The crash of the peso against the dollar — 20% per year since 2013 — is seen as good for tourism. How tourism will fare when the national grid fueled by petroleum cannot provide power to beach resorts is not discussed.

In January, 25 Pemex buildings had no electricity service for a period because the Federal Electricity Commission (CFE) cut off service for nonpayment. Some workers ran to the hardware store and bought portable generators so they could continue monitoring critical functions like pipelines and offshore drill rigs.

The average price Pemex received for oil in 2015 was $49/bbl. It is now below $25. Some analysts estimate that government, in full-blown financial free-fall, may cut investment in Pemex by $3 billion in 2016, which would take production to 2.0 million barrels per day, down from 2.27 million last year and 3.4 million at the peak in 2004.

Low oil prices do not mean oil is not going to peak any more than a snowstorm means that global climate is not warming. In fact they only serve to prove the peak oil theory.

Low oil prices do not mean oil is not going to peak any more than a snowstorm means that global climate is not warming. In fact they only serve to prove the peak oil theory.

Pemex revenues are down 70% in the past 18 months. That is what Peak Oil looks like. Mounting debt for exploration, which must be paid in dollars to US companies, is $11.7 billion, or 63.8% of the present value of Mexico’s declining proven reserves.  Remittances — money earned abroad and sent back to the families – are now one-third larger for the Mexican economy than oil revenues. Will those be used to pay Pemex’s foreign debt service, 65% of which is due in dollars, and 15% in euros, yen and yuan? Or perhaps the government just can switch to legalizing and taxing marijuana?

Remittances — money earned abroad and sent back to the families – are now one-third larger for the Mexican economy than oil revenues. Will those be used to pay Pemex’s foreign debt service, 65% of which is due in dollars, and 15% in euros, yen and yuan? Or perhaps the government just can switch to legalizing and taxing marijuana?

This month Mexican Association of Petroleum Industry (AMIPE) Chairman Erik Legorreta told potential investors:

“Petróleos Mexico is and remains the ideal for Mexican companies and foreign participants in the sector, and this is the time to invest in it, to seize the coming period of rising prices, that are historically cyclical.” He said Pemex was among the most competitive companies in the world .

In January Pemex issued a tranch of 10-year junk bonds valued at 5 billion pesos, roughly 300 million dollars, with promised interest rates of 6.9%, or 491.6 basis points over comparable US Treasuries. Standard & Poor’s rates them BBBB. Those are still for sale. Want some?

And, lest we forget, Mexico was until recently the largest source of crude oil flowing to the United States. Its share was down to just 9% of US imports in 2015 and the flow will change direction in 2016. But then, the US no longer needs to import oil, right?

Shale oil fields, by their nature, are easy to turn on and off. If your oil costs $40 a barrel to produce and you can sell it for only $35, you can cap your wells and wait for higher prices. Canada, which supplies 37% of oil imports to the US, is doing this now.

However, if you borrowed or fleeced gullible investors for the money to drill your wells you need cash to service debt and pay dividends. You will keep pumping even if you only break even or run a loss, as long as you can pay the debt. The alternative is default. Bondholders are the only ones getting quick liquidations from drilling — in bankruptcy court. Oil patch bond prices have collapsed.

Fracked gas is a different story. Once you drill you have to extract. If you are not fast enough, you can wind up with a methane gusher like Porter Ranch (or Deepwater Horizon’s Macando blowout). So you have a monkey on your back. It doesn’t matter what you paid to drill the well, you have to sell at a loss, as North Dakota fracker Hess Oil recently discovered to the tune of negative $875 million (forcing it to sell off all its retail gas stations to Marathon and shares of its stock it had only just purchased at twice the price, in exchange for a couple more quarters of solvency and hope).

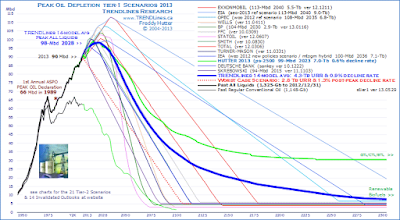

|

| Current Depletion Projections by Industry Analysts |

We suggested here in 2007 that if Pemex went down, it could take the US economy with it. Since then, however, the US economy has weaned itself of dependence on Mexican oil. Instead, it grew its own (and Canada’s) unconventional fuel capacity on a foundation of financial fraud. That became the US’s main economic driver — extending by pretending — and a growth industry it could export.

Fraud is a fragile mistress that likes to be pampered. She does best with the trendy urbane who imagine that to the clever, reward comes without work and that pushing paper between desks, or electrons through the ether, is the same as growing potatoes or pounding nails. She avoids being seen around reality-based communities, preferring to find dark embrace where the fog of deception is thick and judgments are clouded by greed.

As Frederic Bastiat reminded us, “When plunder becomes a way of life for a group of men in a society, over the course of time they create for themselves a legal system that authorizes it and a moral code that glorifies it.”

As Frederic Bastiat reminded us, “When plunder becomes a way of life for a group of men in a society, over the course of time they create for themselves a legal system that authorizes it and a moral code that glorifies it.”

In his documentary, Capitalism: A Love Story, Michael Moore observed that during the Bush Recession when the auto industry laid off much of its workforce and shut down most its lines, it wasn’t because it could not make and sell cars. It was because the Bank of America would no longer loan it money to upgrade its production lines. Mexico is able to extend the illusion of development only as long as someone loans it money. The same is true of the United States.

What if the banks would or could no longer loan money? That day may be nearer than most economists believe, but then, predictions of peaks, or a systemic crash, are a risky proposition.

7 Comments on "Foiled by Oil"

makati1 on Thu, 18th Feb 2016 8:21 pm

We are in the midst of the collapse. Only the sheeple in America are blind to the fact. But, they will soon feel that 2X4 coming at their face.

The Us economy is dead. The Us military is a paper tiger unless they use their nukes and lose it all. Us politics has become a circus and the clowns are winning. Mother Nature is setting up conditions for the fall of Capitalism and maybe, the end of the human species.

Interesting world we get to live in. Pass the popcorn. 88F and sunny here in Manila.

ennui2 on Thu, 18th Feb 2016 9:12 pm

“88F and sunny here in Manila.”

Ground zero of overpopulation, thanks to the catholic church.

makati1 on Thu, 18th Feb 2016 11:55 pm

ennui, nope. It is a country that will be able to weather the collapse better than any in the West. Why? Because most are STILL self-sufficient. Not so in the Us where most depend on the government for their income. You apparently have no idea what the real Us is like. The collapse is happening there faster than anywhere else in the world outside the war countries.

The PS is still growing their economy by a conservative 6+% this year. It has no military/industrial complex to feed. It has no need for nukes or F35s. It has no need for most of the trappings of the West. Indeed, many here don’t even need electric or, GASP!, a phone or bank account. Not necessities where the temps are never near freezing and usually between 70F and 90F. Year round growing seasons, helpful neighbors, etc. What’s not to like?

I suspect that you have to worry about freezing to death for half of the year or rely on huge food imports for the same half, if not most. If it is out of season, it is imported. If it is something not grown in the US, it is imported. (Coffee, chocolate, many fruits, some veggies, etc.) Not to mention the other imports that are necessary for the current American life style, like most electronics, petroleum, many minerals and metals, etc.

And then there is the failing health system in America, the failing economy, the failing military, the failing government, etc. Look in the mirror and open your mind. THEN you will see that it is you who have the most to be worried about when the SHTF.

We have a great weekend coming. 90F daytime. 72F nighttime. Zero precip. Winds variable at about 8 mph. Humidity 62%. This is typical weather here. What’s it like where you live? LOL

GregT on Fri, 19th Feb 2016 12:00 am

“Ground zero of overpopulation, thanks to the catholic church.”

In God We Trust…..

Davy on Fri, 19th Feb 2016 5:53 am

“Why the Chinese Yuan Will Lose 30% of its Value”

http://charleshughsmith.blogspot.com/2016/02/why-chinese-yuan-will-lose-30-of-its.html

“Due to the USD peg, the yuan has appreciated in lockstep with the U.S. dollar against other currencies. On the face of it, the yuan would need to devalue by 35% just to return to its pre-USD-strength level in 2011. This would imply an eventual return to the yuan’s old peg around 8.3–or perhaps as high as 8.7.”

“The dynamic is clear. A splurge of new lending can help to dilute existing bad loans, but only at a cost. This is a game that can’t continue forever, particularly if credit is being foisted on to an already over-leveraged and slowing economy. At some point, the music will stop and there will have to be a reckoning. The longer China postpones that, the harder it will be.”

“One way to paper over impaired loans is to issue a flood of new credit: this dilutes the problem and enables defaulted loans to be “paid down” with new loans that are doomed to default once the ink is dry”

“Now that the tide of capital has reversed, nobody wants yuan: not foreign firms, not FX punters and not the Chinese holding massive quantities of depreciating yuan. This is why “housewives” from China are buying homes in Vancouver B.C. for $3 million. That $3 million could fall to $2 million as the yuan devalues to the old peg around 8.3 to the USD.”

“For years, China bulls insisted China could crush the U.S. simply by selling a chunk of its $4 trillion foreign exchange reserves hoard of U.S. Treasuries. Now that China has dumped over $700 billion of its reserves in a matter of months, this assertion has been revealed as false: the demand for USD is strong enough to absorb all of China’s selling and still push the USD higher.”

Davy on Fri, 19th Feb 2016 6:04 am

“China’s Subprime Crisis Is Here”

http://www.bloomberg.com/gadfly/articles/2016-02-17/china-s-600-billion-subprime-crisis-is-already-here

“Chinese authorities are on the case — discussing reducing the required coverage for bad loans so that banks can keep booking profits and lending. Including “special-mention” loans, which are those showing signs of future repayment risk, the industry’s total troubled advances swelled to 4.2 trillion yuan ($645 billion) as of December, representing 5.46 percent of total lending. That number is already higher than the $600 billion total subprime mortgages in the U.S. as of 2006, just before that asset class toppled the world into the worst financial crisis since 1929.”

“The amount of loans classed as nonperforming at Chinese commercial banks jumped 51 percent from a year earlier to 1.27 trillion yuan by December, the highest level since June 2006, data from the China Banking Regulatory Commission showed on Monday. The ratio of soured debt climbed to 1.67 percent from 1.25 percent, while the industry’s bad-loan coverage ratio, a measure of its ability to absorb potential losses, weakened to 181 percent from more than 200 percent a year earlier.”

PracticalMaina on Fri, 19th Feb 2016 1:21 pm

Makati, don’t forget Cuba is in the west. Although now that they are back in bed with the US I am sure things there will take a step backwards.

I will acknowledge the US has much farther to fall than the Philippines but I don’t see Americans freezing to death in there homes. People were able to survive hundreds of years ago, before even airtight stoves, with colder average temps. Factor in high capacity housing where the occupants provide a significant portion of the heat load. I can see water issues and the shorter growing seasons effecting many in this country.

Davy, there is a big difference between 700 billion and 4 trillion. I think there is a little bit of cooperation going on. I think the US and China could damage each others currency’s and economy’s much more quickly and violently than we are seeing. If things got out of hand the wheels would already be off BAU, right now the lug nuts are still popping off.