Page added on February 13, 2016

Just How Accurate Are The EIA’s Predictions?

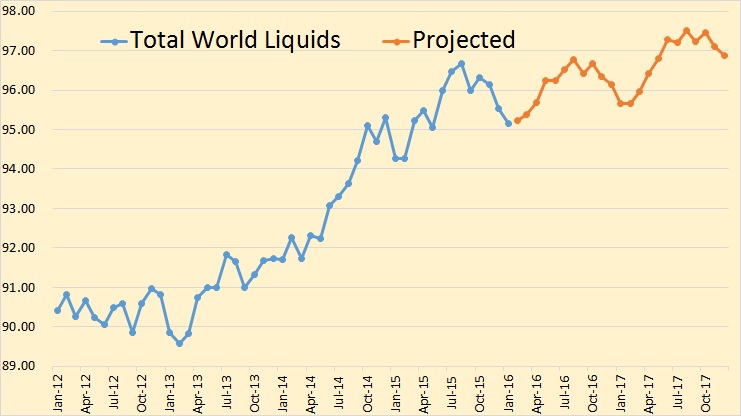

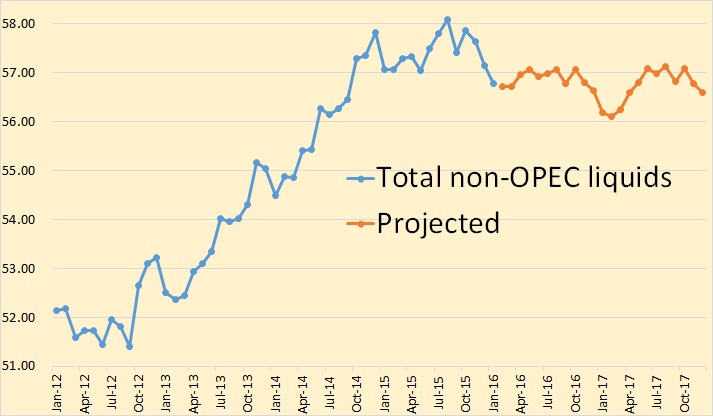

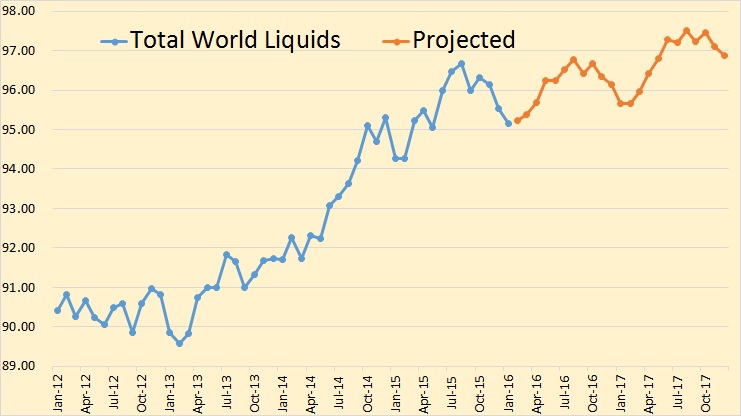

The EIA recently published the February edition of their Short-Term Energy Outlook. If you follow this month to month, and I do, you will notice their prognostications change a little every month. And over several months those small changes can add up to some rather dramatic changes. Nevertheless, below are several charts with their current oil production projections.

The EIA STEO only gives monthly data for total liquids. All C+C data is quarterly and annually. The monthly projected data begins in February 2016. Projections for quarterly and annual data begins January 2016.

The EIA says Non-OPEC total liquids dropped .5 million barrels per day in December and another .36 mbd in January. But then, other than another short drop in the first quarter of 2017, they see things leveling out for the next two years.

For the total world, the EIA expects far better production numbers than just for Non-OPEC. They expect new highs to be reached in 2016 and again in 2017.

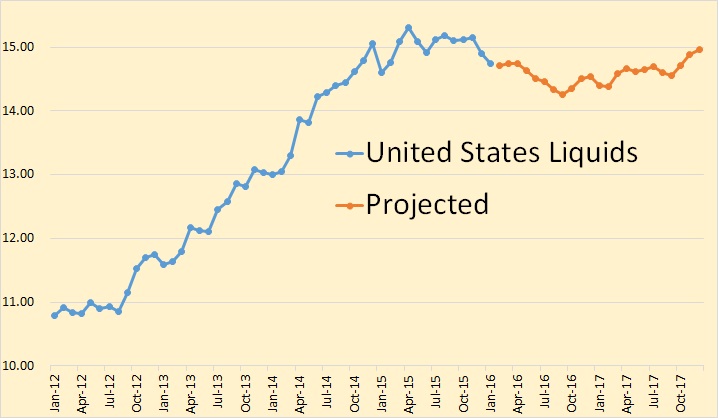

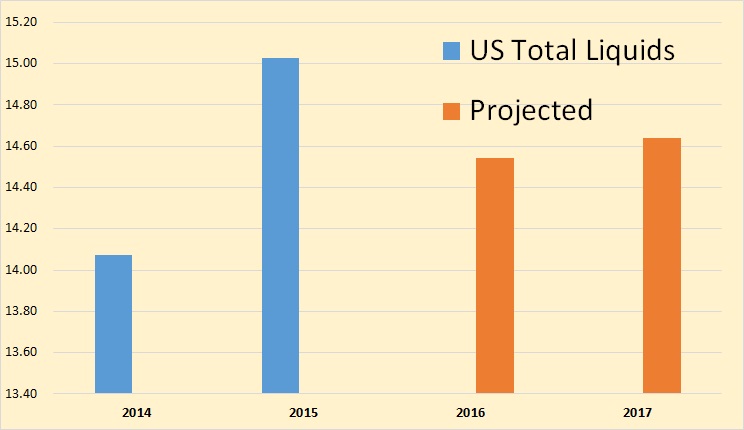

They see US total liquids dropping in 2016 then they begin a slow rise through 2017, but not overtaking the peak in 2015.

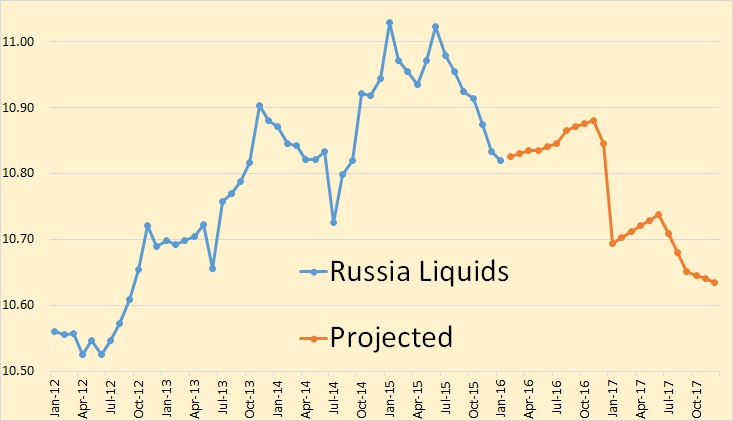

Apparently the EIA thinks Russia has had it. They see a drop in December 2016 then a huge drop in January 2017. I have no idea why. However the scale here makes the decline seem greater than it really is. From January 2015 to December 2017 the decline is only 400,000 barrels per day.

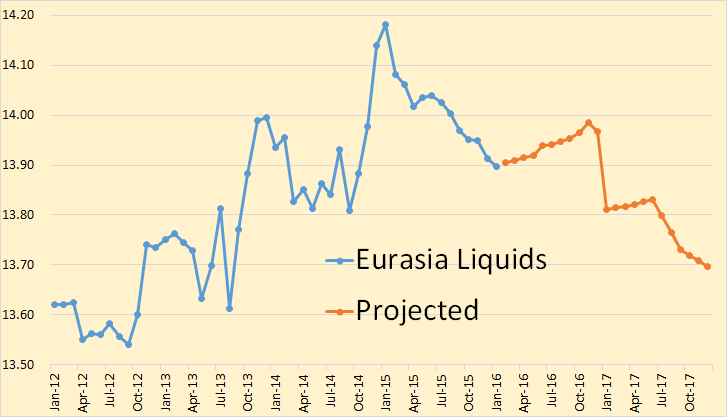

Adding the other FSU nations to the mix, mostly Azerbaijan and Kazakhstan, only exacerbates the decline, making it half a million bpd between January 2015 and December 2017.

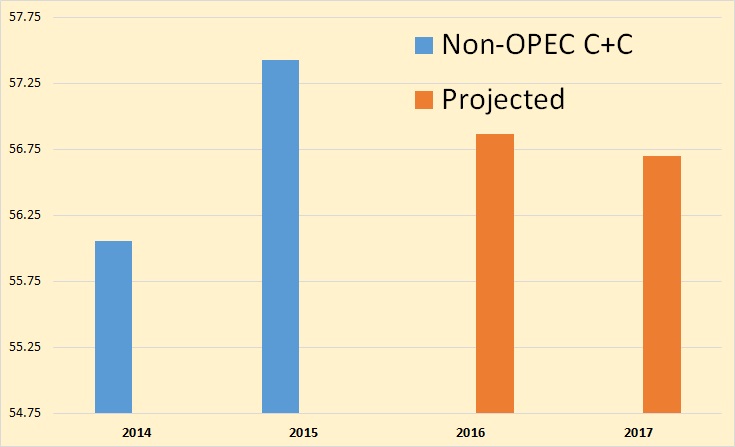

Looking at just Crude + Condensate I think we get a better picture of what the EIA really expects in the next two years. They expect Non-OPEC C+C to drop 580,000 bpd in 2016 and another 170,000 bpd in 2017 for a total of 750,000 bpd over the two years.

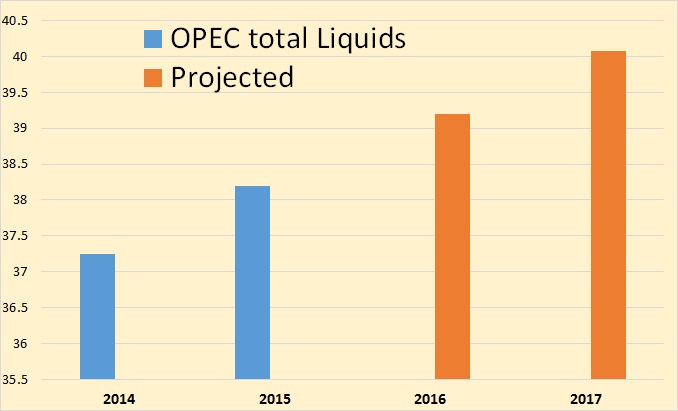

They are expecting far better things out of OPEC however. They have OPEC total liquids up 1,010,000 barrels per day in 2016 and another 870,000 bpd in 2017. They do not project OPEC C+C.

But taking a closer look at their US Projections:

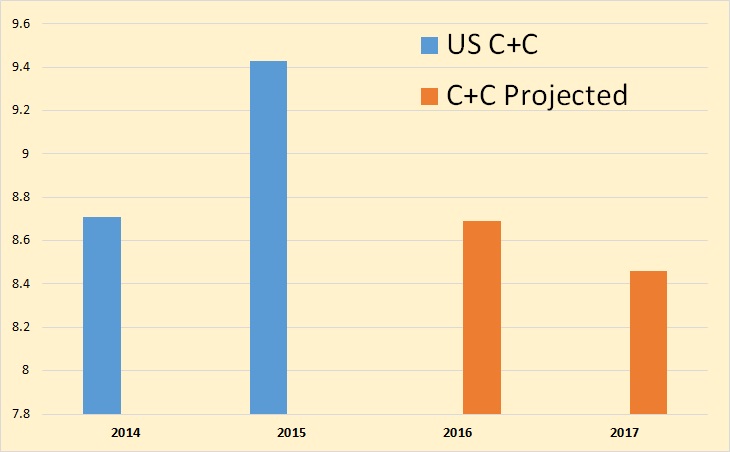

The EIA expects US C+C to drop 740,000 barrels per day in 2016 and another 230,000 bpd in 2017 for a total decline over two years of 970,000 barrels per day.

However they have US total liquids faring much better then just C+C. They have total liquids declining by only 490,000 barrels per day in 2016 and increasing by 100,000 bpd in 2017.

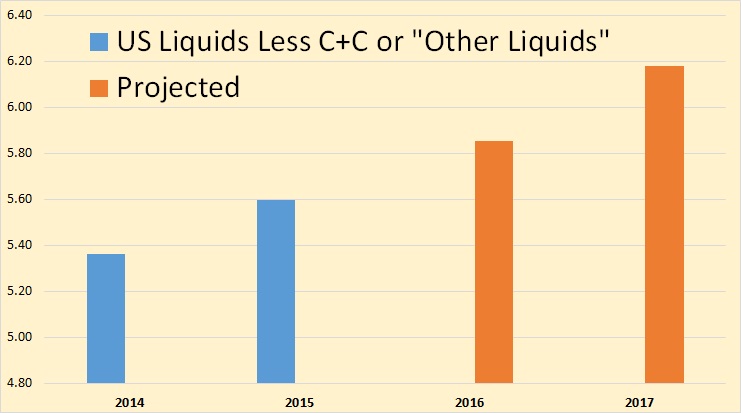

What this means is that US “Other Liquids”, that is NGLs, biofuels and refinery process gain must show a very impressive gains while everything else is going to pot. They show other liquids increasing by 250,000 bpd in 2016 and another 330,000 bpd in 2017.

Most of this increase has to come from NGLs as biofuels are only a minor input and refinery process gain pretty much follows C+C consumption. But…

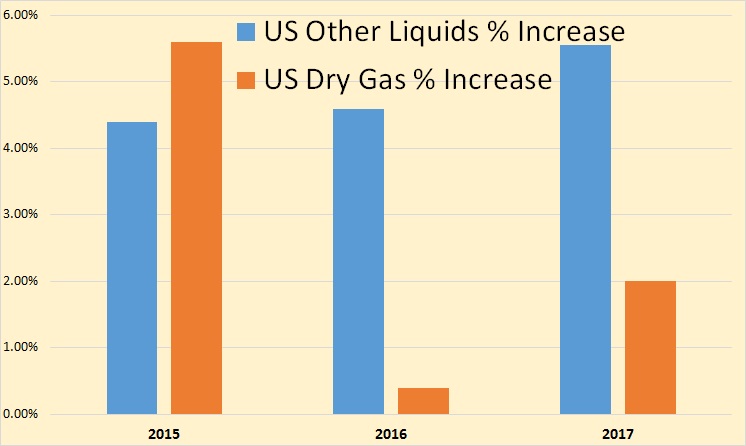

Using their projections for Dry Gas production we find that gas production increased more than other liquids increased in 2015. However they say gas production will increase by only .4 percent in 2016 while other liquids increase by 4.6 percent, and a similar story in 2017 though not quite as dramatic.

Bottom line: I find the EIA’s past production data very accurate. However their projections appear to be pretty lame. This observation is proven out by the fact that those projections are constantly changing. Also, those “Other Liquids” projections seem to make no sense whatsoever. It appears to be mostly a fudge factor.

But the very biggest problem with the EIA’s projections are with OPEC. That is because it is not a projection at all but an estimate of what will be needed to meet world demand. That is they estimate Non-OPEC production, then they estimate world demand, and the difference between the two will be the “Call on OPEC”. That is, they will simply expect OPEC to make up the difference, whatever that difference may be.

Lately however, OPEC seems to be producing a lot more than their call asked them to. That is, they appear to be ignoring their call. And they will likely do likewise when they are expected to produce more to meet demand. They are all currently producing flat out and if there is a call on them to produce more, it will very likely go unanswered. I expect the “Call on OPEC” is a running joke between OPEC nations.

Peak Oil Barrel by Ron Patterson

17 Comments on "Just How Accurate Are The EIA’s Predictions?"

Northwest Resident on Sat, 13th Feb 2016 1:22 pm

“I expect the “Call on OPEC” is a running joke between OPEC nations.”

The type of joke that might be categorized as deathbed, gallows, dark, morbid, perhaps even farcical humor.

In World War II, Hitler depended on imaginary legions toward the end of the war as grim reality set in. Many of his generals knew the real score, but played along with Hitler’s fantasy because they had no other realistic options. The others were just as delusional as Hitler. Nobody who knew the grim truth could tell Hitler or the German people the truth!

And here we are, more or less in the same situation. Epic doom approaching, on track for a near term crushing defeat that end life as we know it, whiffs of dread and certain death in the ill winds blowing our way. But the fearless leaders upon whom we depend certainly aren’t going to tell us the truth, assuming that they even know what the truth is. Instead, they do what Hitler and his merry band of generals did — they engage in fantasy and wishful thinking.

Depending on OPEC to increase production to meet increasing world demand is on par with Hitler counting on those imaginary legions to save his bacon.

So yeah, it has to be a running joke among those who know the truth — a whispered joke with muffled chuckles while they nervously look over their shoulders. I’m laughing too.

Northwest Resident on Sat, 13th Feb 2016 1:37 pm

In any case, I personally don’t believe we will see “increasing world demand” for oil. Increasing world demand only occurs with a growing economy (even more resource consumption). I think economic growth is OVER. My expectation is that we will see continued DECREASING demand for oil on a constantly accelerating downslope to match a rapidly shrinking and eventually collapsing economy.

shortonoil on Sat, 13th Feb 2016 2:05 pm

With a delay, production will follow price. We discuss how the EIA comes up with those numbers here:

http://peakoil.com/forums/u-s-oil-bankruptcies-spike-379-t72300.html

Not withstanding, price is a pretty good indicator of demand; and that is about as bad as it can get!

http://www.thehillsgroup.org/

Nony on Sat, 13th Feb 2016 6:46 pm

Pretty typical Ron post:

-skeptical of any planned increases (despite EIA actually underestimating last few years of increases).

-Blows up the scales too much and makes inaccurate arguments about huge changes because of said blowing.

Northwest Resident on Sat, 13th Feb 2016 8:16 pm

Pretty typical Nony post:

-makes contrary statements without supporting evidence

-Completely ignores financial and economic realities, and accuses individuals with vastly more stature and expertise of presenting facts that dispute his stubborn Cornucopian POV

Apneaman on Sat, 13th Feb 2016 8:21 pm

Smooth

Nony on Sat, 13th Feb 2016 9:22 pm

Point 1 supported by the comments about US NGLs and OPEC total liquids.

Point 2 supported by the interpretation of the Russia chart and the US NGL chart.

[Maybe more, but there is a limit to how much peel you a grape I will do for an IV mechanic.]

Yawn…

Nony on Sat, 13th Feb 2016 9:26 pm

You know if you read the articles, you would see that. But all you do is respond to comments and hoot like a monkey throwing dung at the monkeys from the other tribe. Try unbuckling the brain bucket and using it to read, to parse, to compare, to analyze. The sad thing is I paid more respect to Ron’s work by reading it and criticizing it than you do.

Northwest Resident on Sun, 14th Feb 2016 2:28 am

“The sad thing is I paid more respect to Ron’s work by reading it and criticizing it than you do.”

You did/do?

That’s not how I interpret it.

In both my posts, I addressed what I perceived to be the central point of Ron’s post, that SA can’t be counted on to increase production despite EIA’s projections to the contrary.

I clearly stated my opinions AS opinions, not as the authoritative utterances of some crackpot self-appointed “expert” with a countering “factoid” to defeat every opposing point.

In your post, you dissed Ron in phrase one, uttered bullshit in phrase two, and fabricated manure without substantiation in phrase three.

And you paid more respect to Ron’s work how…?

Davy on Sun, 14th Feb 2016 8:03 am

Neil Howe on oil:

“The Big Picture”

http://www.mauldineconomics.com/outsidethebox/the-big-picture

“BP: What are the odds that oil could rebound to say $50 in 2016 and at least take the heat off U.S. producers? NH: I see very low odds that will happen. As I explained in my Big Picture essay last year (see BP: “January 2015 Report”), the global demand and supply shifts that triggered the recent price decline cannot easily be reversed in a year or two. They will take many years to reverse, which is why we often talk about a long “supercycle” in energy prices. In 2016, the consumer behaviors leading to lower demand will be reinforced by dismal growth in global GDP. On the supply side, most producing nations (I’ll throw in Texas here) have no choice but to max out on output even at basement prices—to pay creditors, quell political unrest, or shore up FX rates and FX reserves.”

shortonoil on Sun, 14th Feb 2016 8:08 am

“My expectation is that we will see continued DECREASING demand for oil on a constantly accelerating downslope to match a rapidly shrinking and eventually collapsing economy.”

It is pretty interesting that the entire petroleum world is now in essence saying, “there is an elephant in the room, but don’t look at it.” At $28/ barrel how long can these producers continue to produce? It is obvious that when they run out of money, they will be running out of oil. Yet in spite of the legions of economist, pundits, blog operators, prognosticators, and general hacks no one is stepping forward with another WAG (wild ass guess) as to when the money well will run dry. These are the same people who for the last forty years have been telling the world that there was X barrels remaining in the ground, that Y barrels per day would be produced in twenty years, and it would cost Z dollars per barrel next year.

The world’s barrel counters, and Econ 101 theorists have gone silent!

ennui2 on Sun, 14th Feb 2016 9:14 am

‘The world’s barrel counters, and Econ 101 theorists have gone silent!’

They’re busy gassing up at <$2 a gallon.

shortonoil on Sun, 14th Feb 2016 10:06 am

“The world’s barrel counters, and Econ 101 theorists have gone silent!’

They’re busy gassing up at <$2 a gallon."

Yes they are while the industry’s revenue stream is falling by $2.3 trillion per year, and they are going broke in the process. Stupid, short sighted little critters aren’t they!

rockman on Sun, 14th Feb 2016 1:57 pm

Davy – Great point. So many underappreciated the huge impact consumer behavior he’s on the entire dynamic. Especially when you consider their impact on the price of oil.

Nony on Mon, 15th Feb 2016 1:38 am

I swallowed so many loads last night that I had to go to the pharmacy and get ‘the morning after pill’. I must have earned a good six bucks. I really know how to put out a fire.

Nony on Mon, 15th Feb 2016 1:47 am

Also got my ass punch fucked so I guess it’s adult diapers for a few days.

Apneaman on Mon, 15th Feb 2016 1:53 am

Nony, like mother like son.