Venezuela’s Oil Minister Eulogio Del Pino faces an uphill battle persuading Russia and Saudi Arabia to cooperate in cutting oil production amid a supply glut that has pushed prices down more than 30 percent in the past year, according to analysts Robin Mills and Edward Bell.

Concern that U.S. shale producers would benefit from any increase in oil prices following a potential cut is one factor that will keep Saudi Arabia and Russia from agreeing to a reduction in output, according to Mills, chief executive officer of Dubai-based oil consultant Qamar Energy, and Bell, commodities analyst at lender Emirates NBD PJSC. Del Pino will meet Russian Energy Minister Alexander Novak in Moscow Monday before traveling to Qatar, Iran and Saudi Arabia, the world’s largest oil exporter.

“There’s a minimal chance the Venezuelans will get them to agree to anything,” Mills said by phone on Sunday. “I don’t think the conditions are there for an agreement.”

Possible meeting

Venezuela approached Russia about a possible meeting between the Organization of Petroleum Exporting Countries and producers such as Russia that are outside the group, Novak said in an interview with Bloomberg Television on Thursday. Venezuela’s President Nicolas Maduro said on Union Radio Sunday that “OPEC and non-OPEC countries are close to an agreement,” without specifying what kind of agreement.

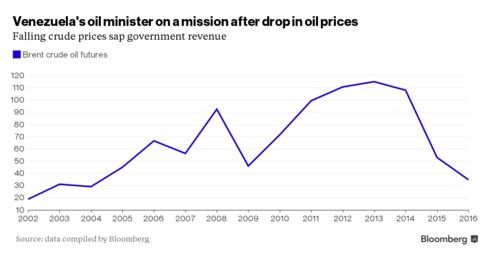

Venezuela has repeatedly called for OPEC members to meet as slumping oil prices sap government revenue. Brent crude has dropped from $115 a barrel in June 2014 to less than $30 this month. OPEC with its de facto leader Saudi Arabia supply about 40 percent of the world’s oil. The group pumped in January at the highest level since 1996, when Bloomberg began compiling data, as it reactivated Indonesia’s membership.

“The Saudis may want to take some oil off the market,” Mills said. “They can talk to the Russians, they can talk to the Venezuelans, they can talk to the Nigerians, but they can’t talk to shale.”

OPEC meetings

Members of OPEC hold twice-yearly meetings to discuss market conditions, whereas the U.S. shale industry involves thousands of private firms working alongside the world’s largest oil companies. That makes it impossible for the U.S. to agree on production cuts, Mills and Bell said. Any decrease in output that results in higher oil prices would benefit the U.S., they said.

OPEC decided last month to abandon its previous 30 million-barrel-a-day production target. The group is seeking to maintain market share by pushing higher-cost producers out of the market, Mills said.

Any effort to coordinate cuts is complicated by Saudi Arabia’s goal of defending sales and Russia’s inability to rein in production in winter months, when output cuts can damage fields. Bell sees signs that demand will rise this year and provide support for prices.

“A fundamentals-driven re-balancing is going to have an effect, and markets will start to recover by the end of the year,” Bell said by phone from Dubai. “The message from this region is ‘it’s going to be a difficult process, but we’re going to ride it out.’ ”

Davy on Sun, 31st Jan 2016 1:55 pm

Dollar shortages in Nigeria with government in panic mode. Is Nigeria another Venezuela?

http://www.zerohedge.com/news/2016-01-31/time-panic-nigeria-begs-world-bank-massive-loan-dollar-reserves-dry

Rick Bronson on Sun, 31st Jan 2016 6:38 pm

Venezuela is the World #1 in Oil reserves as their bitumen rich oil sands is now considered as Oil.

Sadly the #1 player is struggling with the low oil prices.

They have to come up with some new model of pricing of their extra heavy crude to move it in the market.

shortonoil on Mon, 1st Feb 2016 10:18 am

“Venezuela Tries to Convince Oil Nations to Cut Production”

This is pushing on a string! If oil prices rise, additional production will come back on line before the prices get posted. The end of the oil age comes about when oil producers can no longer make money producing oil. That is about right now. As we have been saying for the last two years the highest cost producers will be phased out first. Venezuela is a high cost producer, and they have the weakest central bank to print money. There is likely to be a several more Venezuelas over the next year.

JuanP on Mon, 1st Feb 2016 12:45 pm

Venezuela is very likely to become South America’s first failed nation, just like Ukraine is Europe’s. Both will be the first of many more to come as little by little, all at a time, or in some other way modern human civilization ends its days across the globe.

Resource depletion and environmental degradation will deal us a one two punch that will knock most of us down.

JuanP on Mon, 1st Feb 2016 12:54 pm

I don’t see any significant production cuts agreements in the future. I think what is most likely to happen is that all the world’s oil producers will pump as much as they have to, which in most cases is all they possibly can. The income will be used to pay the bills and remain in business for as long as possible. The market will play out and production and demand will rebalance in time.

We are probably living in a post peak all liquid fuels era. This is the beginning of the end. Expect much craziness!

onlooker on Mon, 1st Feb 2016 1:49 pm

Not to mention failed states already in Africa and Middle East.

shortonoil on Mon, 1st Feb 2016 3:37 pm

“Not to mention failed states already in Africa and Middle East.”

Not to mention Central, and South America. The Ivory Coast in Africa is one that few pay any attention to, but it is very close to just disappearing off the map back to the darkest heart of Africa. There are a number of countries around the globe that are very close to just going off line; just disappearing from the face of the earth. The chances are very good that you won’t even hear about it after it happens. I was talking to someone in Ghana the other day. Even though their cell phone system is still working, it takes six weeks to just get a new phone. Things are starting to break down, shut down every where.

Once the satellite and GPS systems can no longer be maintained the world goes dark.