Page added on November 25, 2015

A Surprising Look At Oil Consumption

The EIA publishes oil consumption numbers for all major nations. However, they have data for most nations only through 2013. They do have data for some nations through 2014. Nevertheless, a lot can be gleaned from just looking at those consumption numbers. If oil consumption numbers are growing year after year, then there is a good chance that the nation is growing economically. But if oil consumption numbers are continually declining year after year, then it is more than a little silly to say all is well, economically, with that nation. Or that is my opinion anyway.

First, whose oil consumption is increasing year after year, and whose economy is booming? All charts below show consumption as total liquids in thousand barrels per day. Some charts are through 2014, while others are through 2013. Whatever the last year is on the yearly axis is the last year for that data.

Important: All charts are of consumption, not production.

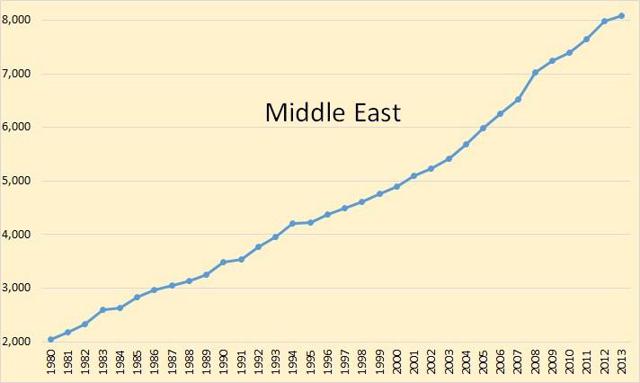

No doubt, the Middle East is booming. The reason being most of them are oil producers, and for most of this chart anyway, the price of oil was increasing. They had lots of income, and their consumption was increasing every year, as were their economies.

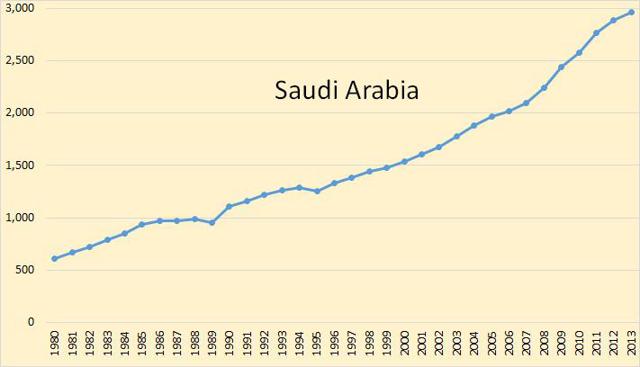

Saudi Arabia, by far the Middle East’s largest consumer, has increased consumption every year since 1995.

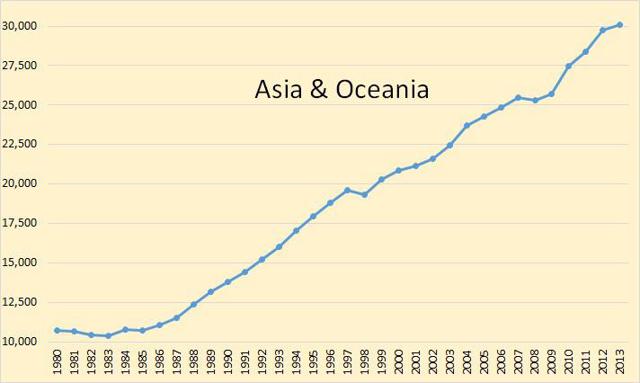

One-third of all total liquids consumption is in Asia and Oceania. The area has experienced tremendous growth in oil consumption.

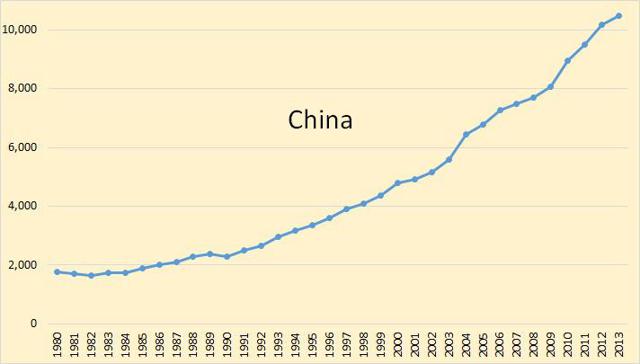

And Asia and Oceania’s largest consumer is China. The country has increased oil consumption 6.5 percent per year since 1985.

Most of the rest of the world has not seen the consumption boom that was experienced by the Middle East and Asia & Oceania.

This chart dates only from 1992, the first year after the break-up of the Soviet Union. Russian consumption declined by almost 2 million barrels per day to 2.5 million barrels per day during the next 6 years. It later recovered, but is still almost 1 million barrels per day below the FSU break-up point.

The combined consumption of the rest of the former Soviet Union nations declined by over 52 percent over the next 8 years, and has not yet recovered.

Most of the rest of the world has seen a serious decline in consumption in the last decade.

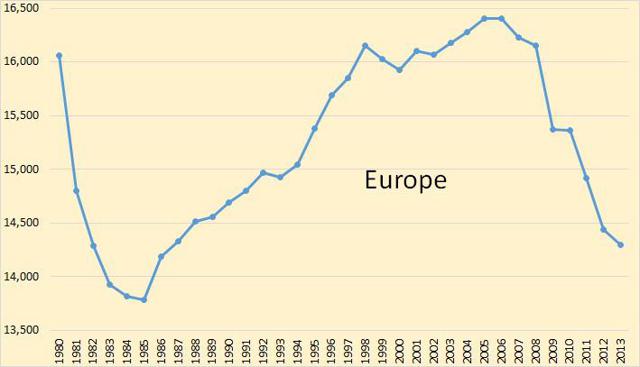

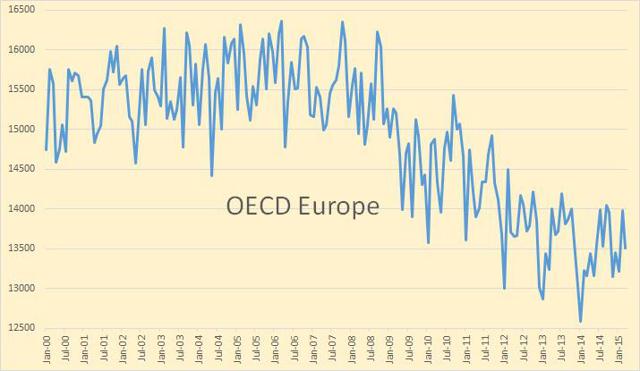

Consumption peaked for Europe in 2005 and 2006. The largest drop was in 2009. For Europe, we only have data through 2013. Europe’s oil consumption is down 13 percent from 2006 to 2013.

Germany is Europe’s largest economy. The country’s oil consumption started to drop in 1999, but has leveled out since 2007. Its oil consumption is down 18 percent since 1998.

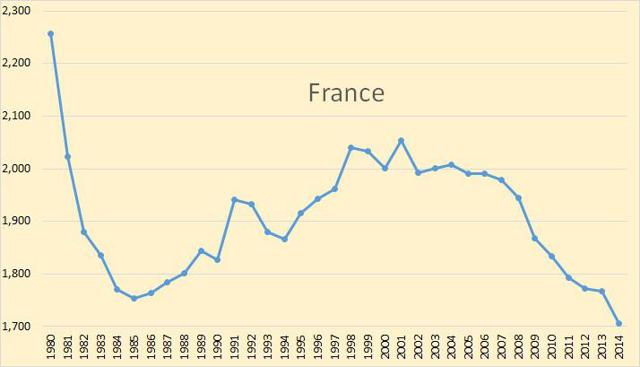

France’s oil consumption has been dropping since 2006, and really took a dive in 2014. Its oil consumption is down 17 percent since 2001.

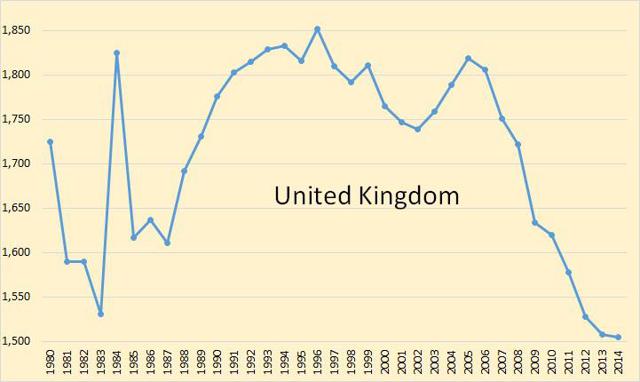

The U.K. peaked in 1996, and then again in 2005. Oil consumption in the U.K. has dropped by just over 17 percent since 2005.

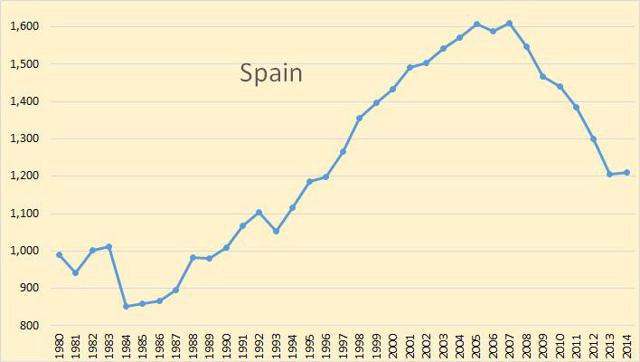

Spain’s oil consumption started dropping in 2007, but leveled out in 2014. The country’s oil consumption is down 25 percent since 2007.

Pity poor Italy. Her oil consumption peaked in 1998, and has dropped 36.4 percent, over one-third, since.

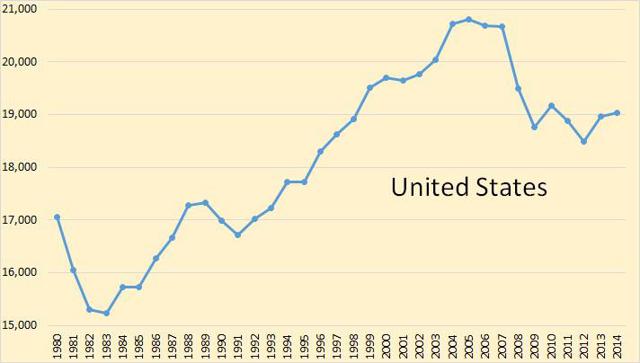

The U.S. held peak oil consumption at around 20,700,000 barrels per day from 2004 through 2007, which dropped in 2008 and 2009, but has leveled out since then. U.S. consumption in 2004 stood at just over 19 million barrels per day, down about 8 percent since the four-year peak period. The recession has not hit the U.S. nearly as hard as it has hit Europe.

Mexico has fared better than Europe as well. Its peak consumption in 2007 was at 2,173,000 barrels per day, and had declined by 9.5 percent by 2014.

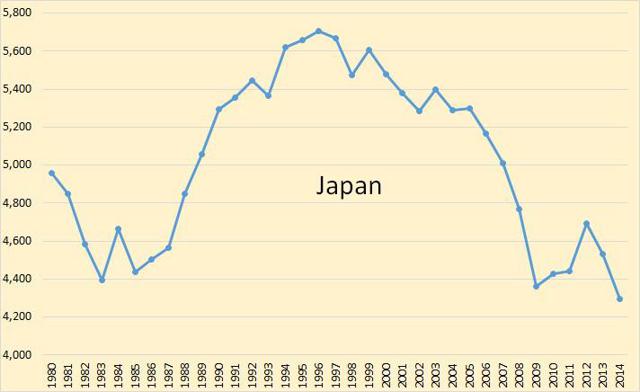

Japan has been in the doldrums for almost two decades. The country’s oil consumption peaked in 1996 at 5,704,000 barrels per day. It recovered slightly in 2012, but dropped again in 2013 and 2014, reaching a low of 4,297,000 barrels per day in 2014. That is a decline of almost 25 percent.

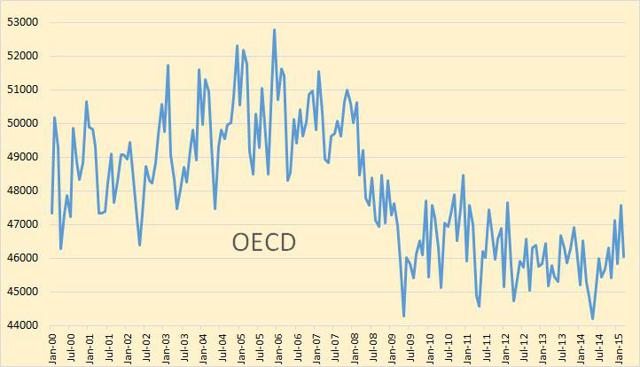

The EIA has OECD monthly oil consumption data through April 2015. As you can see, OECD Europe has not improved much, if any at all, since 2013.

Total OECD oil consumption may had have a slight uptick in the last two years.

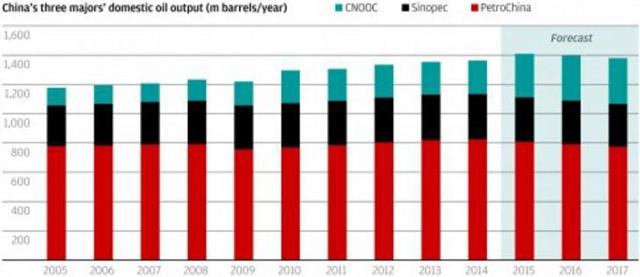

And last but not least, China has peaked, or so says the Japanese financial holding company Nomura. This chart shows China’s oil production, past and predicted.

No turning back for China’s oil production

China’s domestic oil production likely peaked this year and is about to enter a long-term structural decline, according to Nomura. It notes the experience from Alaska’s Prudhoe Bay, which peaked in 1988: “Once the steep stage of the terminal decline output phase begins, there is generally no turning back.” The takeaway is that China could be a buyer on global energy markets next year, importing bigger volumes as it seeks to offset waning domestic production. Nomura says demand from China should help offset new supply from Iran, with prices stabilising at an average US$55 per barrel next year.

My comment: The recent decline in oil prices had at least as much to do with falling consumption as it had to do with rising production. We don’t yet have consumption numbers for 2015 yet, but from the build in inventories, it does not look like consumption has improved significantly.

With China’s economic growth slowing, it looks like world oil consumption will get worse before it gets better. This is one reason I expect oil prices to stay low for quite a while longer.

20 Comments on "A Surprising Look At Oil Consumption"

Lawfish1964 on Wed, 25th Nov 2015 10:24 am

“With China’s economic growth slowing, it looks like world oil consumption will get worse before it gets better. This is one reason I expect oil prices to stay low for quite a while longer.”

Isn’t a decrease in world oil consumption a good thing?

GregT on Wed, 25th Nov 2015 10:53 am

“The recent decline in oil prices had at least as much to do with falling consumption as it had to do with rising production.”

Much of that rising production was a result of high prices. That oil was unaffordable to our economies. Even at todays WTI price of ~$42/bbl, oil is still in the range of historical inflation adjusted recessionary prices. Growth is slowing due to still high prices, and the hangover caused by central banks’ monetary policies in response to $100+/bbl oil. The world is mired in un-repayable debt.

shortonoil on Wed, 25th Nov 2015 10:56 am

What is not being generally recognized is that it requires a growing amount of oil to produce oil. By our calculations that is about 2.5% per year of increased energy, or presently 1.25% per year in increased oil consumed. Consumption will appear to grow, or stay flat until production begins to decline by more than the oil industry is increasing its consumption. Until that occurs there will be continual downward pressure on prices; and once it commences production will begin to fall rapidly. Inventories will continue to increase even as production declines. Oil production is an energy producing process, and must be viewed from that perspective to derive correct determinations.

http://www.thehillsgroup.org/

GregT on Wed, 25th Nov 2015 11:08 am

“Oil production is an energy producing process, and must be viewed from that perspective to derive correct determinations.”

Exactly Short. Oil is the energy source that fuels our economies, our financial systems, and growth itself. To look at oil simply from a supply/demand perspective, is to not look at the big picture. Oil is the lifeblood of modern industrial society. It is not like any other commodity.

Outcast_Searcher on Wed, 25th Nov 2015 11:55 am

Increasingly, conservation and alternative fuels and alternative transport methods are all growing strategies in many first world countries.

Looking at factors like this seems to correlate better with the charts of the slow growth first world countries than of economic growth.

Additionally, just because China’s growth rate is forecast to continue to gradually decrease over time does NOT mean they will use less oil — only that the consumption growth rate may moderate.

Meanwhile, growth powerhouses like India and much of the rest of the third world will continue to see relatively high economic rates, and corresponding growth rates in oil consumption.

Thought experiment — convince the US population that strangling the Middle east oil revenue would be the biggest and long term cheapest, simplest solution to terrorism spawned in the Middle East. Have many millions of people make their next car a Prius instead of a big SUV. Gasoline demand goes way down. The GDP is barely impacted. So much for your predicted correlation between oil consumption and economic growth. (Not that America could ever likely be collectively intelligent enough to do such a thing — say for AGW mitigation or to reduce military expenditures).

marmico on Wed, 25th Nov 2015 12:08 pm

Oil is the energy source that fuels our economies

In 1964 Joe Sixpack (production and non-supervisory worker) earned $2.53 per hour, leaded gasoline cost ~$0.31 per gallon and the average fuel efficiency (AFE) of a light duty vehicle (short wheel base) was ~14 miles per gallon (mpg). Joe could travel ~115 miles per hour of work.

Fifty years later in 2014 Joe earned $20.60 per hour, unleaded gasoline cost ~$3.50 per gallon and the AFE was ~24 mpg. Joe could travel ~140 miles per hour of work.

Gasoline was more affordable per vehicle mile in 2014 than in 1964. In 2015 Joe will be able to travel ~200 miles per hour of work.

If Joe purchased a 2015 model year AFE automobile, he would be able to travel ~300 miles per hour worked.

Looking at the data, you may notice that oil becomes less and less important.

Plantagenet on Wed, 25th Nov 2015 12:15 pm

Yes, oil consumption is dropping in the US and EU. But oil consumption is rising in Asia and other areas of the world. When you look at total global oil consumption, there is no drop. Oil consumption continues to rise at a slow rate. The current oil glut is therefore not caused by a drop in oil consumption, since here hasn’t been a drop. The current oil glut reflects a small but sustained oversupply of oil.

Cheers!

Pops on Wed, 25th Nov 2015 12:26 pm

The interesting part here is the consumers who used the largest amounts per capita reduced consumption most, while those who used smaller amounts increased per capita consumption — even though they likely had lower incomes.

Use less—pay more?

Davy on Wed, 25th Nov 2015 1:08 pm

Outcast said – “Additionally, just because China’s growth rate is forecast to continue to gradually decrease over time does NOT mean they will use less oil — only that the consumption growth rate may moderate.” Who says Outcast? This is the kind of thinking we have been habituated to that represents continuity and trends. There is no reason China consumption may not drop significantly and at any time.

We are near a point of this precipitous decline possibility with converging macro problems. We like to think these changes will be smooth but that is wishful. It will likely become dangerously volatile at some point as chaos and random decay destroy continuity of a fragile global system. You are correct in the status quo but how long will the status quo survive the pressures of decay.

rockman on Wed, 25th Nov 2015 1:42 pm

“We don’t yet have consumption numbers for 2015 yet, but from the build in inventories, it does not look like consumption has improved significantly.” And an equally valid way to make the same statement: thanks to the sharp drop in oil prices global consumption of oil has not plummeted.

Unless, of course, someone really believe the world would be consuming 91+ million bopd if it was still selling for $90+/bbl. So same old pitch: talking about oil consumption without including the price of oil in the conversation doesn’t really add much to the conversation IMHO. BTW according to the EIA 99.5%+ oil the oil imported and produced during the first week of November in the US was consumed. IOW less than 0.5% went into storage.

GregT on Wed, 25th Nov 2015 2:18 pm

“In 2015 Joe will be able to travel ~200 miles per hour of work.”

In 2015 Joe can’t afford to drive an automobile, and still lives in Mom and Dad’s basement at 33 years of age. There is much more oil embedded in almost everything that Joe spends his money on today, compared to back in 1964.

shortonoil on Wed, 25th Nov 2015 3:05 pm

“Who says Outcast?”

http://www.zerohedge.com/news/2015-11-25/why-even-modest-disruption-will-shatter-status-quo

idontknowmyself on Wed, 25th Nov 2015 3:13 pm

Look at Germany oil consumption. It is the lowest since 1980.

Then ask yourself where is the energy to take care of the new immigrants will come from. It is pretty obvious why there is so much chaos in Europe.

This is what is happening in Sweden now from someone living there. News you will never find in main stream median.

Stop looking at the price of oil and volume. Instead look at oil consumption and net energy going into maintaining complexity.

https://www.youtube.com/watch?v=uws9BlnJmjI&index=2&list=PLvLgAyYV3BmUcCJu8KDFzPUteq-NZquSm

https://www.youtube.com/watch?v=uws9BlnJmjI&index=2&list=PLvLgAyYV3BmUcCJu8KDFzPUteq-NZquSm

peakyeast on Wed, 25th Nov 2015 4:23 pm

and now we know from VW that its not because the cars has gotten more fuel efficient 😉

Truth Has A Liberal Bias on Wed, 25th Nov 2015 8:57 pm

In Europe and North America (the West) oil is primarily a transport fuel. Manufacturing facilities are primarily powered by electricity, which is generated by NatGas/nuclear/coal. A lot of steel manufacturing also burns gas at the plant site too as well as running on electricity. Plenty of economic production is taking place without oil, however the movement of those manufactured products is almost entirely oil dependant.

Ralph on Wed, 25th Nov 2015 9:45 pm

VW cars have been getting a lot more fuel efficient. However, in the case of Diesel, this was done by not decreasing (and possibly increasing) the emission of NOx emissions as much as regulations required, by making the engines burn leaner and hotter.

idontknowmyself on Wed, 25th Nov 2015 11:22 pm

I agree with what Truth said about. What really matter is the net energy going into society or complexity to keep alive and functioning.

The fact that we talk a lot about oil seem to indicate that the weakest link of Internationale trade is transportation. No transportation no trade.

Boat on Thu, 26th Nov 2015 12:42 am

Nat gas could replace oil moving trains and ships over 2 years or so. The problem is the cost of infrastructure and the price of the fuels. If a big switch were to occur there would be less oil being used and then another drop in price making oil competitive again. What is the smart way to go in that environment. Those who choose right will get the price advantage for their products.

GregT on Thu, 26th Nov 2015 12:48 am

Natural gas is a fossil fuel Boat, and is a contributor to climate change. There is nothing “smart” about continuing to destroy the environment in exchange for a ‘price advantage’.

As a matter of fact, it doesn’t get more stupid.

Kenz300 on Thu, 26th Nov 2015 5:51 pm

All transportation will be powered by electricity or batteries in the future… Fossil fools are cooking the planet……