Page added on November 24, 2015

Why “Supply & Demand” Doesn’t Work For Oil

The traditional understanding of supply and demand works in some limited cases–will a manufacturer make red dresses or blue dresses? The manufacturer’s choice doesn’t make much difference to the economic system as a whole, except perhaps in the amount of red and blue dye sold, so it is easy to accommodate.

A gradual switch in consumer preferences from beef to chicken is also fairly easy to accommodate within the system, as more chicken producers are added and the number of beef producers is reduced. The transition is generally helped by the fact that it takes fewer resources to produce a pound of chicken meat than a pound of beef, so that the spendable income of consumers tends to go farther. Thus, while supply and demand are not independent in this example, a rising percentage of chicken consumption tends to be helpful in increasing the “quantity demanded,” because chicken is more affordable than beef. The lack of independence between supply and demand is in the “helpful” direction. It would be different if chicken were a lot more expensive to produce than beef. Then the quantity demanded would tend to decrease as the shift was increasingly made, putting a fairly quick end to the transition to the higher-priced substitute.

A gradual switch to higher-cost energy products, in a sense, works in the opposite direction to a switch from beef to chicken. Instead of taking fewer resources, it takes more resources, because we extracted the cheapest-to-extract energy products first. It takes more and more humans working in these industries to produce a given number of barrels of oil equivalent, or Btus of energy. The workers are becoming less efficient, but not because of any fault of their own. It is really the processes that are being used that are becoming less efficient–deeper wells, locations in the Arctic and other inhospitable climates, use of new procedures like hydraulic fracturing, use of chemicals for extraction that wouldn’t have been used in the past. The workers may be becoming more efficient at drilling one foot of pipe used for extraction; the problem is that so many more feet need to be drilled for extraction to take place. In addition, so many other steps need to take place that the overall process is becoming less efficient. The return on any kind of investment (human labor, US dollars of investment, steel invested, energy invested) is falling.

For a time, these increasing inefficiencies can be hidden from the system, and the prices of commodities can rise. At some point, however, the price rise becomes too great, and the system can no longer accommodate it. This is the situation we have been running into, most severely since mid-2014 for oil, but also for other commodities, dating back to 2011.

The higher cost of producing oil and other energy products affects the economy more than a shift from chicken to beef.

The economy is in a sense more dependent on energy products than it is on our decision whether to eat chicken or beef. If the cost of producing oil rises, and that higher cost is carried through to prices, it affects the prices of many things. It affects the cost of food production because oil is used in the production and transport of food. The higher cost of oil also affects nearly all transported goods, since oil is our primary transportation fuel.

Some of the impacts of higher oil prices are clearly adverse for the economy.

If higher oil costs are passed on to consumers as higher prices, these higher prices make goods less affordable for consumers. As a result, they cut back on purchases, often leading to layoffs in discretionary sectors, and recession.

The higher cost of oil products (or of other energy products) also tends to reduce profits for businesses, unless they can find workarounds to keep costs down. Otherwise, businesses find themselves in a situation where customers cut back on purchasing their products. As we will discuss in a later section, this tends to lead to reduced wages.

Some of the impacts of higher oil prices are somewhat positive.

Rising oil prices clearly encourage rising oil production. With this, more jobs are added, both in the United States and elsewhere. More debt is added to extract this oil, and more equipment is purchased, thus stimulating industries that support oil production. The value of oil leases and oil properties tends to rise.

As noted previously, the cost of food supply depends on oil prices. The cost of producing metals also depends on oil prices, because oil is used in extracting metal ores. As the prices of metals and foods rise, these industries are stimulated as well. Values of mines rise, as do values of agricultural land. More debt is taken out, and more workers are hired. More equipment is purchased for producing these products, adding yet more stimulation to the economy.

The higher price of oil also favorably affects the many countries that extract oil. Part of this effect comes from the wages that the workers receive, and the impact these wages have, as they cycle through the economy. For example, workers will often want new homes, and the purchase of these new homes will add jobs as well. Part of the effect comes through taxes on oil production. Oil production tends to be very highly taxed, especially in parts of the world where oil extraction can be performed cheaply. This tax money can be put to work in public works programs, providing better schools and hospitals, and more jobs for citizens.

It is inevitable that the price of oil must stop rising at some point because of the adverse impact on spendable income of consumers.

The adverse impact of higher oil prices on the spendable income of consumers comes in many ways. Perhaps one of the biggest impacts, but the least obvious, is the “push” the higher cost of oil gives to moving manufacturing to locations with lower costs (cheaper fuel, such as coal, and lower wages), because without such a change, higher oil prices tend to lead to lower profits for many makers of goods and services, as mentioned previously.

The competition with lower-wage areas tends to reduce wages in the US and parts of Europe. This push is especially great for jobs that are easily transferred to other countries, such as jobs in manufacturing, “call-centers,” and computer tech support.

Another way businesses can maintain their profit levels, despite higher oil costs, is through greater automation. This automation reduces the number of jobs directly. Automation may use some oil, but because the cost of human labor is so high, it still reduces costs overall.

All of these effects lead to fewer jobs and lower wages, especially in the traditionally higher-wage countries. In a sense, what we are seeing is lower productivity of human labor feeding back as lower wages, if we think of the distribution of wages as being a worldwide wage distribution, including workers in places such as China and India.

Normally, greater productivity feeds back as higher wages, and higher wages help stimulate higher economic growth. Lower wages unfortunately seem to feed back in the reverse direction–less demand for goods that use energy in their production, such as new homes and cars. Ultimately, this seems to lead to economic contraction, and lower commodity prices. This is especially the case in the countries with the most wage loss.

The drop in oil prices doesn’t do very much to stop oil production.

Oil exporting countries typically have relatively low costs of production, but very high taxes. These taxes are necessary, because governments of oil exporters tend to be very dependent on oil companies for tax revenue. If the price of oil drops, the most adverse impact may be on tax revenue. As long as the price is high enough that it leads to the collection of some tax revenue, production will take place–in fact, production may even be increased. The government desperately needs the tax revenue.

Even oil companies in oil-importing countries have a need for revenue to pay back debt and to continue to pay their trained workers. Thus, these companies will continue to extract oil to the best of their ability. They will aim for the “sweet spots”–places that have better than average prospects for production. In some cases, companies will have derivative contracts that assure them of a high oil price for several months after the price drops, so there is no need to reduce production very quickly.

The drop in oil prices, and of commodity prices in general, makes debt harder to repay and discourages adding new debt.

We earlier noted that a rise in the price of commodities tends to make asset prices rise, making it easier to take out more debt, and thus stimulates the economy. A drop in the price of oil or other commodities does the opposite: it reduces asset prices, such as the price of the property containing the oil, or the farmland now producing less-expensive food. The amount of outstanding debt does not decline. Because of this mismatch, companies quickly find themselves with debt problems, especially if they need to take out additional loans for production to continue.

Another part of the problem is that on the way up, rising prices of oil and other commodities helped lift inflation rates, making debt easier to repay. On the way down, we get exactly the opposite effect–falling oil and other commodity prices lead to falling inflation rates, making debt more difficult to repay. Commodity prices in general have been falling since early 2011, leading to the situation where interest rates are now negative in some European countries.

The costs of producing commodities continue to rise, as a result of diminishing returns, so this fall in prices is clearly a problem. Low prices make future production unprofitable; it also leads to an increasing number of debt defaults. There are many examples of companies in financial difficulty; Chesapeake Energy is an example in the oil and gas industry.

* * *

Where oil supply and demand goes from here

The traditional view of the impact of low oil prices seems to be, “It is just another cycle.” Or, “The cure for low prices is low prices.”

I am doubtful that either of these views is right. Falling prices have been a problem for a wide range of commodities since 2011 (Figure 2, above). The Wall Street Journal reported that as early as 2013, when oil prices were still above $100 per barrel, none of the world’s “super major” oil companies covered its dividends with cash flow. Thus, if prices are to be sufficiently high that oil companies don’t need to keep going deeper into debt, a price of well over $100 per barrel is needed. We would need an oil price close to triple its current level. This would be a major challenge, especially if prices of other commodities also need to rise because production costs are higher than current prices.

We are familiar with illnesses: sometimes people bounce back; sometimes they don’t. Instead of expecting oil prices to bounce back, we should think of the current cycle as being different from past cycles because it relates to diminishing returns–in other words, the rising cost of production, because we extracted the cheapest-to-extract oil first. Trying to substitute oil that is high in cost to produce, for oil that is low in cost to produce, seems to bring on a fatal illness for the economy.

Because of the differing underlying cause compared to prior low-price cycles, we should expect oil prices to fall, perhaps to $20 per barrel or below, without much of a price recovery. We are now encountering the feared “Peak Oil,” because much of the cheap oil has already been extracted. Peak Oil doesn’t behave the way most people expected, though. The economy is a networked system, with high oil prices adversely affecting both wages and economic growth. Because of this, the symptoms of Peak Oil are the opposite of what most people have imagined: they are falling demand and prices below the cost of production.

If low prices don’t rise sufficiently, they can cut off oil production quite quickly–more quickly than high prices. The strategy of selling assets at depressed prices to new operators will have limited success, because much higher prices are needed to allow new operators to be successful.

Perhaps the most serious near-term problem from continued low prices is the likelihood of rising debt defaults. These debt defaults can be expected to have a very adverse impact on banks, pension plans, and insurance companies. Governments would likely have little ability to bail out these organizations because of the widespread nature of the problem and also because of their own high debt levels. As a result, the losses incurred by financial institutions seem likely be passed on to businesses and individual citizens, in one way or another.

Gail Tverberg via Our Finite World

35 Comments on "Why “Supply & Demand” Doesn’t Work For Oil"

shortonoil on Tue, 24th Nov 2015 7:44 am

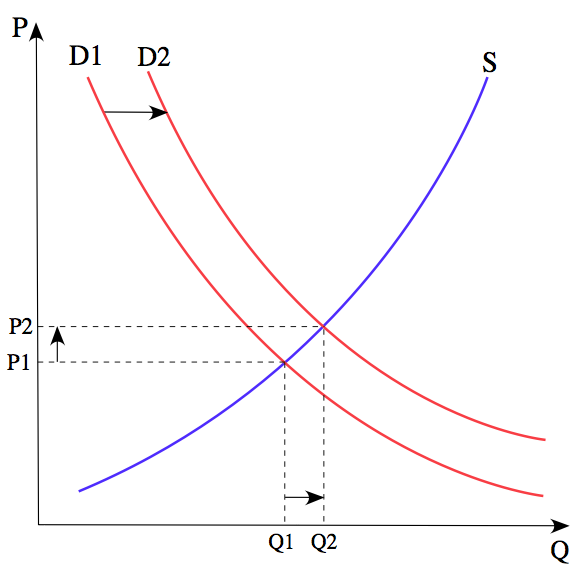

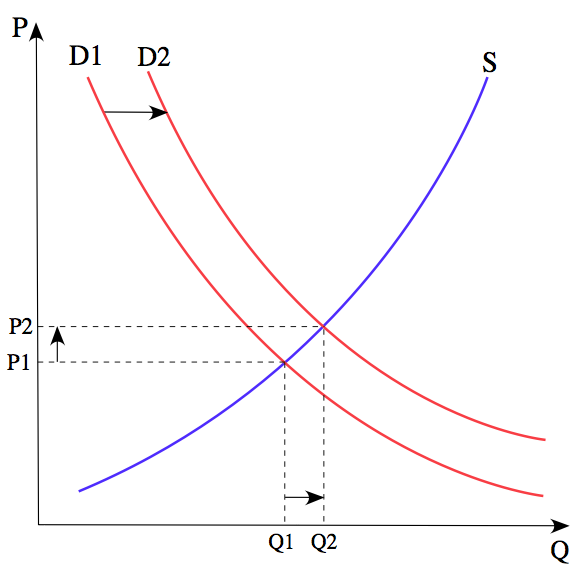

We have been posting this issue Here, at Gail’s site, other sites, and in communication with our clients for the last two years. The Demand curve has followed the Supply curve for the last century. That does not demonstrate a conventional Supply/ Demand relationship. Supply/ Demand are dictated by petroleum’s Deliverable Energy, not its volumetric quantities. The fact that petroleum is used because it is an energy source makes that inimitably apparent. To appreciate the long term Supply/ Demand relationship of petroleum an energy, economy feed back loop must be taken into consideration.

http://www.thehillsgroup.org/

makati1 on Tue, 24th Nov 2015 7:48 am

We all understand debt. Few of us are without it in the 1st world. Those who already understand it don’t need to read this wordy article. Those who do not understand it never will, either out of inability or denial.

To quote the previous village idiot: “Go out and shop!” But that is the problem … too much debt. Cards maxed out. Home equity under water. Jobs evaporating. Savings losing ground in a zero interest world. Etc. We are screwed.

Pops on Tue, 24th Nov 2015 8:13 am

Conventional oil has not grown in 10 years so likely it’s close to peak.

But Gail says:

“Because of the differing underlying cause compared to prior low-price cycles, we should expect oil prices to fall, perhaps to $20 per barrel or below, without much of a price recovery. “

$20/bbl sustained price will get you maybe 20mmb/d of oil supply.

If you actually believe that, I mean really believe it, you’d serve yourself well by digging a hole right now and crawling in because a quick 80% drop in oil production means the walls are coming down.

Don’t bother replying to this post telling us all how sure you are that is exactly what is going to happen because it will mean you are just playing Doom. If you were sure, you wouldn’t be here, you’d be busy.

The current low oil price is due to overcapacity and oversupply resulting from scarcity in the oughts. It was mostly caused by growing imports to China (and the decline of the N. Sea). Ditto all other commodities with capacity overbuilt using free US dollars. Did anyone actually think China’s plan for building ghost cities would sustain 15% growth forever? That after the US and EU finished offshoring factories to the 3rd world using the trillions of US Stimulus-Bucks that the frenzy would continue?

The average expansion period lasts 5 years – we’re going on year 8.

Eventually this surplus will clear and the price rise. Then sometime later, post-peak, supply will start to fall on depletion and the price will rise just beyond what people can pay. They will then use a little less – to a little better effect, until the price falls just enough to be affordable. The process will repeat as declining production continues.

That is PO in a nutshell folks and it is scary enough if you consider the ramifications. There really is no reason to contort a short term —typical— boom/bust scenario into the newest iteration of “We’re Dead!”.

unless you are selling “papers” and speaking engagements

Jeff on Tue, 24th Nov 2015 9:09 am

Shortonoil;

The website that you pointed toward: [http://www.thehillsgroup.org/] is making a ridiculous argument with bogus graphs… Sure, it gets harder & harder to find oil, no one will argue with that (unless you happen to be drilling in Kurdistan), but the estimated ultimate recovery in terms of energy from a successful oil well dwarfs the amount of energy required to construct the well & deliver that crude/energy to market… Even when you include the energy expended in the drilling of all the dry-holes as well, Energy Recovered dwarfs Energy Expended by many orders of magnitude…

Anonymous on Tue, 24th Nov 2015 9:30 am

Eventually, eventually, but probably within a decade, we’ll see a continual slide in living standards to being comparable with Mexico, and then Central America as transportation fuels grow increasingly expensive, energy scarcity grows, and our economic system collapses under the sheer weight of fuel costs.

The only real silver lining is that as the world grows poorer, China and Russia become more and more distant as threats and unable to effectively endanger us due to the huge cost of moving people long distances across the world. The only real potential enemy the “United States” will have will be the Cubans and the Mexicans; and we’re just letting more and more of their nationals into this country when they will likely become an enemy in a peak oil scenario.

The people in charge of our security have zero foresight and i’m convinced are mentally impaired.

rockman on Tue, 24th Nov 2015 9:43 am

“If the cost of producing oil rises, and that higher cost is carried through to prices, it affects the prices of many things.” Complete and very easily proven bullsh*t. Not one bbl of oil being sold today based on what it cost to develop that production. The Rockman and the rest of the oil patch certainly do wish it were true. Not one of the companies buying Rockman’s oil cares what it cost him to drill his wells or if it will make him a profit. In fact the buyers have no idea how much the Rockman has invested in his wells.

Seriously: has anyone noticed how much oil prices have fallen in the last 10 months? Did the price of oil come down because it has gotten that much cheaper to drill? LOL.

It obviously isn’t the rising cost of developing oil that impacts economies: it’s the rising cost of oil that does that. Think about it for a minute: when oil hit $100/bbl the great majority of global oil production at that time was coming from wells that were drilled when oil averaged less than $35/bbl (inflation adjusted). Thus oil prices didn’t increase to record level because it cost so much to develop most of our oil. Oil prices rose because of demand. Until demand could no longer afford to continue to buy the same amount of oil. Which is why the KSA et al had to continually lower their selling price to encourage enough demand so they could max their revenue stream.

At least I think most have come to the understand that the oil price/production dynamics really aren’t that difficult to understand

shortonoil on Tue, 24th Nov 2015 9:50 am

“Shortonoil;

The website that you pointed toward: [http://www.thehillsgroup.org/] is making a ridiculous argument with bogus graphs… Sure, it gets harder & harder to find oil, no one will argue with that (unless you happen to be drilling in Kurdistan), but the estimated” ….. etc.

Raw crude is essentially useless until it is processed, and distributed. The energy to accomplish those processes is very large, and of course must be included in the Total Production Energy (Etp). To act as an energy source petroleum must be able to supply enough energy to power its own production; extraction, processing, and distribution. Once it can no longer do that it essentially become useless; it becomes black goo in a barrel.

Apparently you started off with a preconceived notion, and then extrapolated that to the site. That kind of approach is not likely to add much to your general awareness of the situation!

Davy on Tue, 24th Nov 2015 9:59 am

Pops, I hear you on discouting doomerism but I would caution you against diminishing it all together. There are far too many issues that can derail globalism. Peak oil issues are only part of it. Once globalism is derailed we are in deep trouble because of likely cascading interconnected failures.

You make a good point for sobriety of doom. I am a dedicated doomer and will continue to preach it. I try to be fair, balance, and sober about it but I am getting more concerned instead of less concerned. If the trend were toward a comfort level for a softer landing I would modify my message.

As things stand now I think we will enter a critical period soon. How we as a global people negotiate that initial crisis will set the tone for the future. None of us can predict how that will turn out.

Pops on Tue, 24th Nov 2015 10:20 am

Davey, I didn’t say everything would be fine. I said that not only does supply and demand work for oil, contrary to Gail’s thesis, but it works overly well.

A slight 1mbd oversupply has dropped the price 50%.

Just as the mere suggestion of undersupply (actually just reduction in spare capacity) increased the price 600% in the aughts.

Have we forgotten that?

A true undersupply due to peak and decline will likewise affect price dramatically.

Kenz300 on Tue, 24th Nov 2015 11:33 am

Fossil fools are the past…… alternative energy sources are the future…..

Renewables to Overtake Coal as World’s Largest Power Source, Says IEA

https://ecowatch.com/2015/11/10/renewables-to-overtake-coal/

Jeff on Tue, 24th Nov 2015 11:38 am

You are wrong… assuming that a refinery derived 100% of it’s energy needs from using the same crude oil that that it refines… They would only use a very small percentage of the incoming stream…

All & all these energy requirements are negligible when compared to the energy reserves unlocked from oil per unit volume…

rockman on Tue, 24th Nov 2015 11:44 am

“A slight 1mbd oversupply has dropped the price 50%.” Or as I would phrase it: the oversupply of tens of millions of bbls of $90+ oil has caused dropped the price 50%. And the 50% price decreased has spurred an increase is demand which is why the world is consuming more oil today then every before in history.

GregT on Tue, 24th Nov 2015 11:58 am

“A slight 1mbd oversupply has dropped the price 50%.”

A 1.1% increase in the oil supply would easily be soaked up by a 1.13% increase in global population growth, and an economy expanding at a rate of 3.3%, would it not? If higher oil prices are not responsible for the global economic downturn, austerity, QE, ZIRP, and mountains of un-repayable debt, then what is?

There is more to this story than supply and demand, or the amount of barrels of oil available. It is the cost of that oil, and the energy available to our economies that matter. Oil is not like any other commodity. Oil is the energy source that fuels our economies, and modern industrial society.

rockman on Tue, 24th Nov 2015 12:21 pm

“A 1.1% increase in the oil supply would easily be soaked up by a 1.13% increase in global population growth, and an economy expanding at a rate of 3.3%, would it not?”. No, not necessarily if that 1.13% increased global population can’t afford to buy that increase in oil supply. In fact if 10% of the current oil buyers couldn’t afford the price of oil at that time not all the oil on the market would be bought. Of course if the oil price is reduced sufficiently those potential new buyers could soak up that increase in production. In fact if prices are reduced enough so many new consumers could afford to buy even more oil, such as the record volume of oil purchase we see today.

Again the same statement will be repeated again and again because it’s an undeniable fact: there is a greater demand for oil today than ever before in history. Which is why the world is consuming more oil than ever before in history because there are a lot more consumers who can afford $45/bbl oil then there were before who could afford $90/bbl oil.

Pops on Tue, 24th Nov 2015 12:34 pm

Did anyone say that oil at $100 was not a problem? Don’t think it was me.

But supply caught up with demand and the price fell.

The energy available to run the economy?

LOL

Pretty sure that didn’t fall by half last november.

marmico on Tue, 24th Nov 2015 12:46 pm

All & all these energy requirements are negligible when compared to the energy reserves unlocked from oil per unit volume…

That’s overstating the case. The U.S. consumes ~100 quads of primary energy, of which ~6 quads is consumed by petroleum refineries.

http://www.eia.gov/consumption/manufacturing/data/2010/pdf/Table1_1.pdf

The U.S. consumes ~35 quads of petroleum. But the main thrust of your argument stands, very little oil is used as a refining feedstock.

GregT on Tue, 24th Nov 2015 1:24 pm

“No, not necessarily if that 1.13% increased global population can’t afford to buy that increase in oil supply. In fact if 10% of the current oil buyers couldn’t afford the price of oil at that time not all the oil on the market would be bought.”

Thanks Rockman, exactly my point. A 1.1% surplus in oil production was not the reason for a 50% price drop. It is the price of that oil that matters, and the energy available to our economies.

Now if oil were to pull back to ~$25/bbl and we didn’t have the hangover to deal with from the global economic downturn, austerity, QE, ZIRP, and mountains of un-repayable debt due to oil prices above$100/bbl, the world’s economies could continue on as they have. Unfortunately there isn’t enough ~$25/bbl oil left in the world to allow us to continue to do so. While growth is still occurring, it isn’t the growth required to service an economic system that was built on an ever expanding supply of cheap, affordable oil. Those days are over.

GregT on Tue, 24th Nov 2015 1:32 pm

“Pretty sure that didn’t fall by half last november.”

Pretty sure that’s not what I wrote Pops.

Pops on Tue, 24th Nov 2015 3:07 pm

“A 1.1% surplus in oil production was not the reason for a 50% price drop.”

Then what was?

Demand was not falling. It grew by 1.2mbd in both ’13 & ’14

“the energy available to our economies.” Consumption grew by 1.8mbd in 2015, a 5 year high, the energy available is working fine.

Rather than repeat myself in a comment box that disappears in a couple of days, you can take a look at the last couple of pages here:

http://peakoil.com/forums/the-etp-model-q-a-t70563-360.html#p1279690

GregT on Tue, 24th Nov 2015 5:34 pm

“Then what was?”

$100+bbl/oil. It wasn’t affordable at that price, but that same oil is being bought up at $45/bbl. Some of it at a loss. Much of that extra production that came online after ’08 is now no longer worth producing.

“Consumption grew by 1.8mbd in 2015, a 5 year high, the energy available is working fine.”

The energy available is not working fine Pops. We still have not recovered from the global financial crisis of ’08. Canadian GDP growth was announced yesterday to be at/or close to 1.2% for 2015. That is depressionary. US official GDP growth is expected to be around 3.1%. Even with every financial tool in the book thrown at the US economy, it still cannot recover. Real US growth in GDP is closer to 2%, probably less.

Supply and demand is not a useful metric to describe oil. Oil is the underlying commodity that fuels the entire economy, our financial systems, and even growth itself. The ideology of the modern school of economics was born on the assumption of infinite exponential growth in the supply of cheap energy. That model has been broken and cannot be fixed. We need a new model, a new monetary system, and a new ideology.

shortonoil on Tue, 24th Nov 2015 5:43 pm

“You are wrong… assuming that a refinery derived 100% of it’s energy needs from using the same crude oil that that it refines… They would only use a very small percentage of the incoming stream… “

The specific heat of petroleum is about 0.51 BTU/lb*°R. A barrel of oil weights 302 lbs (API 37.5), and the average refinery runs 650 to 850 °F. It would take over 1 million BTU just to heat up a barrel to a refinable temperature out of its total energy content of 5.88 m BTU/b. Take a physics course, and try again later.

makati1 on Tue, 24th Nov 2015 8:47 pm

All this back and forth and it still balances on the ability to buy at whatever price. THAT is the weak card in the house of cards. The one shivering and beginning to turn to dust.

If the world financial system goes, all else will go with it, never to return to the current globalization we ‘enjoy’ today. And with our intricately interconnected, just-in-time delivery system, many other things we take for granted in the 1st world will evaporate with it, never to return.

Boat on Tue, 24th Nov 2015 10:42 pm

GregT,

If higher oil prices are not responsible for the global economic downturn, austerity, QE, ZIRP, and mountains of un-repayable debt, then what is?

Overspending through the decades by most of the world.

You can add lack of regulations in the markets for the last big crash.

Your argument is weak anyways. When oil was cheap there were billions in poverty. When oil is high there are billions in poverty. There are billions who don’t use fuel. This is why the per capita doesn’t mean anything and your reliance on oil being the biggest factor is wrong.

If oil goes high again it’s replacement will just happen faster assuming climate change makes that impossible.

Another problem you have is this consumption thing. It does not turn on a dime. The difference between a couple percent of oil and nat gas world wide is huge. If the world could supply $5 a barrel for a year there still wouldn’t be huge growth. It takes years for companies to add plants, hire and train people and find a place in the market. And then people won’t just go buy stuff. Not till the stuff they have wears out. Just because gasoline is low doesn’t mean I drive any more

GregT on Tue, 24th Nov 2015 11:24 pm

“Overspending through the decades by most of the world.”

Again Boat, you display your complete lack of understanding as to how our monetary systems work.

“You can add lack of regulations in the markets for the last big crash.”

So you believe that the rise in oil prices from ~$20/bbl to $147/bbl was a result of a lack of regulations in the markets? That somehow when the TBTF banks packaged up mortgage backed securities as AAA, when they were really junk, caused the prices of oil to increase some 700%?

Geez Boat, you are so nonsensical that I’m having a problem even responding to your above post. As usual, most everything that you say is exactly the opposite of reality, and you continue to contradict yourself. OMFG.

Boat on Tue, 24th Nov 2015 11:42 pm

The price of oil went up when George Walker Bush invaded Iraq. Iraq immediately slowed production Libya was soon to follow. Nigeria followed that.

There wasn’t a shortage of oil in the ground, just oil that was taken out of the market took awhile to be replaced. Why is that so hard for you to see. Now the middle east oil that is cheaper to produce is replacing the fracked oil. When Iran returns to full production more fracked oil will go away. Supply and demand, idiot, that you discount. lol You and short keep dreaming up shyt and we will see in the years ahead.

Joe D on Tue, 24th Nov 2015 11:49 pm

“Take a physics course, and try again later.” Isn’t that the truth!

I for one, appreciate your wealth of knowledge. But than again, I have had many physics courses.

Thanks for all your work on the subject shortonoil.

Boat on Wed, 25th Nov 2015 12:01 am

Turkey shoots down Russian fighter jet. Putin will find the Middle East a less nuanced. Shoot first and fear later.

GregT on Wed, 25th Nov 2015 12:04 am

“The price of oil went up when George Walker Bush invaded Iraq.”

As was pointed out to you before Boat. The price of oil started climbing in 1998. Five years before the US invaded Iraq. Iraqi oil production in 2005 was 2.5M bbl/day, the same level that it was at in 1998, eight years before the peak in oil prices in 2008 of $147/bbl. As usual, you don’t make any fucking sense.

http://www.americansecurityproject.org/wp-content/uploads/2012/10/iraq-oil-graph2.jpg

GregT on Wed, 25th Nov 2015 12:06 am

3 years before. My bad.

GregT on Wed, 25th Nov 2015 12:25 am

Boat mumbled’

“Putin will find the Middle East a less nuanced.”

This would be a very good example of why a minimum of grade five english skills are important. Anybody that has the slightest fucking clue of what it is that you are attempting to communicate, would be guessing. Epic fail.

theedrich on Wed, 25th Nov 2015 5:52 am

In addition to the phantasmagorical complexity of the global energy/economy predicament as discussed above, there are also other factors which bode ill for civilization and the planet. As far as politics is concerned, the presumably human being running the White House has little to no interest in preserving America in anything like its traditional culture. His sole focus is changing the demography of the country to cement one-party rule by the Demonic Party forever. In implementing his plan, he is importing vast numbers of ThirdWorlders in order to overload the nation to the point of collapse, just as collapse is also the goal of his so-called “Affordable Care Act” boondoggle.

Still, since this and the disaster of his foreign policy are well known, there is no need to review them here. What is truly ominous, however, is a threat that neither he nor most of Congress (of either party) is interested in preparing for in any way: civilizational collapse through the destruction of our electrical grid.

Although this subject has been touched on before in PO websites, a new book by retired and well-known reporter Ted Koppel, titled “Lights Out: A Cyberattack, A Nation Unprepared, Surviving the Aftermath” brings the issue into starker focus. Koppel reiterates the three main ways in which such a destruction could occur: (1) a coronal mass ejection (CME); (2) a powerful electromagnetic pulse (EMP) caused by a nuke exploding 200 miles abover the U.S.; and (3) cyberterrorism.

A CME amounts to a kind of series of (i.e., 2 or more) successive shotgun blasts from a solar flare which can wreak massive electrical havoc on any planet up to Mars they hit. Such blasts reach earth’s orbit about a day or so after their initiating flare. As many already know, on 2012 July 23, a fierce CME crossed our orbit nine days after our planet had passed through the CME-orbit intersection. The probability of earth’s being hit by a moderate (“Carrington-class”) CME in the next ten years is calculated at 12%. (Or, 100% within 83 years.) Should we err on the side of caution and prepare for such an impact? Or spend the money on importing more aliens?

An anti-U.S., nuke-caused EMP seems less likely, since America could quickly retalieate against its source, presumably another nation which would not want to be annihilated. The situation is a little like the “Mutual Assured Destruction” (“MAD”) policy during Soviet times, which kept the U.S. and Russia from nuking one another.

Cyberterrorism, however, can be a worry. Koppel’s book is not particularly useful in this area, since he did not consult a single penetration tester or cyber security specialist. His only sources were people who were politically motivated bosses or others not themselves expert in the grimy technological details of the electrical grid. At least he does mention other modes of grid interruption, such as by terrorists taking out big transformers. (In fact, one such takeout did occur a few years ago in California, but the reporting was subdued so as not to disturb the sports-viewing public.) In this connection, we should think about the possibility that ISIL infiltrators may be among the many “refugees” whom Ø is importing from Syria.

Koppel discusses the emergency-preparation measures of the Mormons at tiring length (three chapters), with asides about some hopeful programs in Seattle and El Paso County, Colorado. However, the real merit of his overly long book resides in the fact that he points out the utter lack of concern and preparedness on the part of the Federal government. It is almost as though Ø and his multi-billionaire friends are in fact preparing the nation and the world for Olduvai Gorge. That must be comforting for all the members of the Church of Ø-worship.

Cloud9 on Wed, 25th Nov 2015 6:00 am

One Second After is a good read on EMP. A number of the locals I know are very concerned about this possibility and are taking measures to mitigate it. Our danger lies with the Golden Horde that will invade us from the south and north.

shortonoil on Wed, 25th Nov 2015 7:53 am

“(1) a coronal mass ejection (CME);”

theedrich, somewhere in my mass of saved, and mostly useless paper work is a report by a 19th century solar astronomer, who I believe, was named Holtz (or something close to that?). He reported that in 1859 the earth was hit by a CME that was so powerful that people reported telegraph lines glowing at night. It was even reported that telegraph keys were burned out. Such an EMP event today would wipe out every CMOS circuit on the planet. Our entire civilization would cease to function in about 20 milliseconds. Will it happen again? It seems highly unlikely that it won”t!

tita on Thu, 26th Nov 2015 2:02 am

In the last decade, a great effort in european countries was made to reduce our oil consumption. This is a political move (more taxes on fossil fuels), relayed with medias. More isolated building, triple layer windows, less consuming cars are the norm now. The reason came from the increasing price of oil in the beginning of the 2000’s.

This would not have happened if oil stayed in the $20s. Price dictates demand and supply. The only interest of a producer is to get as much cash possible from selling oil. The only interest of a buyer is to get oil the cheapest as he can get.

What is special in the demand/supply of oil is the slowness of the change. It takes an awful lot of time to bring new production online. We talk of decades for arctic oil. And when investment is made, there is no reason to shut it! Even supercartel like OPEC didn’t really worked. But prices affect investments. The effect of low prices took decades to affect production. But now, it may be shorter as the depletion from shale oil is higher than conventional oil.

Demand also react slowly. We don’t change our heating systems, our cars or our electricity plants every years. Of course, economic downturns have an immediate effect. But actual consumption is higher now. Another financial crisis won’t blow up everything as this article suggest.

theedrich on Thu, 26th Nov 2015 3:37 am

Short, you are talking about the Carrington Event of August-September 1859, which is what I was referring to in my above comment. Although other astronomers and scientists also noted it, it was British astronomer Richard Carrington who saw the initial solar flare, so the resulting EMP was named after him and considered a basic metric for such geomagnetic disturbances. But because such things are unpredictable not only in timing but also in magnitude, it would not be in any way impossible for us to be hit by a CME vastly larger than the Carrington blast. I recall reading in (I believe) Astronomy magazine some years back that some astronomers have conjectured that the reason Mars has so little atmosphere and water (if any at all) left is because it may have been struck by just such a coronal mass ejection long ago. And mind you, Mars is much farther from the sun than we are.

The insouciance of our leaders in this respect can only be regarded as criminal.