(Photo: Oil pump east Eagle Frod, K Aleklett)

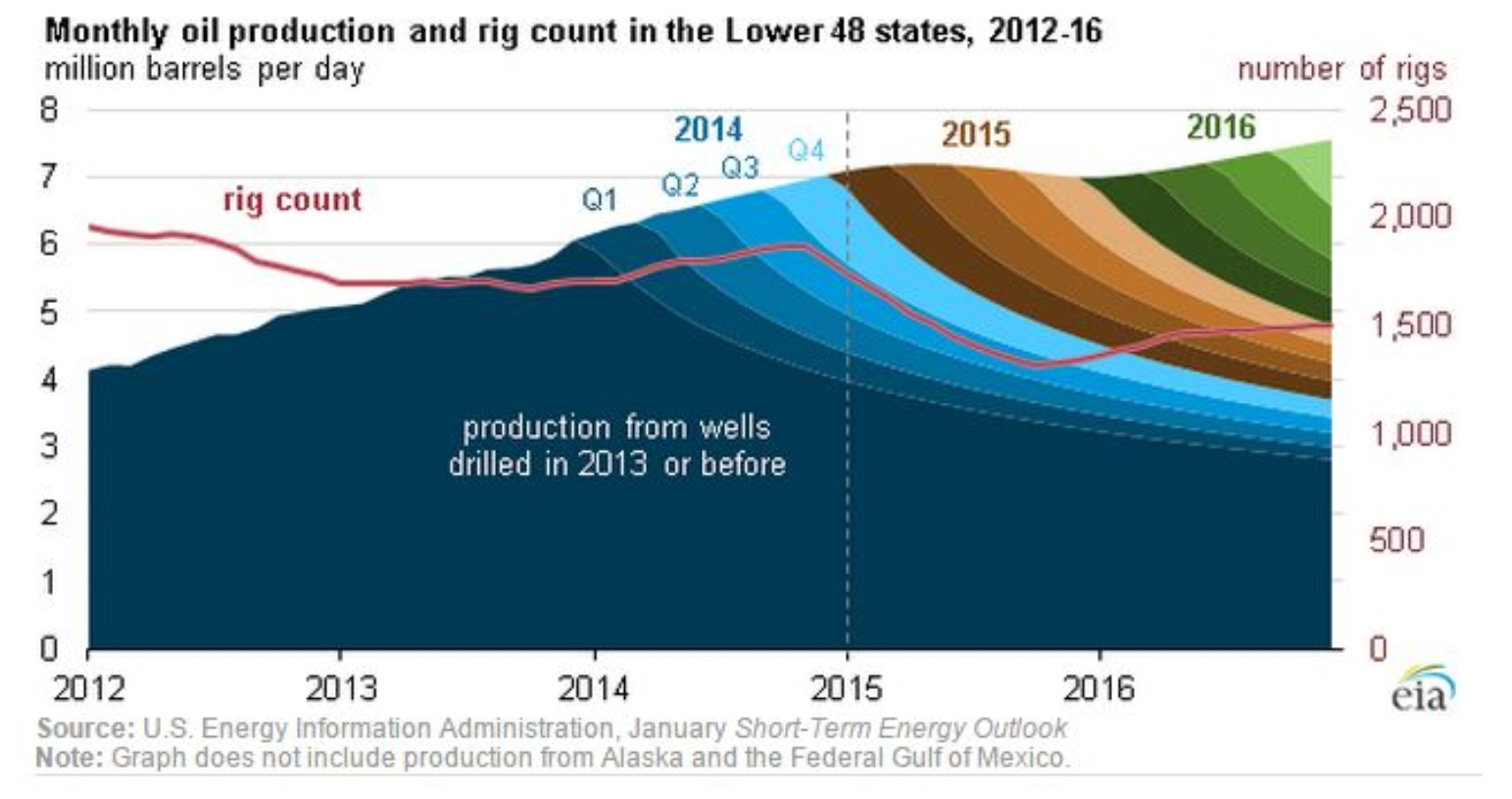

The US Energy Information Administration, EIA, has now made a first forecast of the production of oil from the lower 48 states, the states with fracking. As the decline for individuate wells are very steep the rig count will be a very important factor for the future and the number of new wells each rig will drill per quarter. In the figure you can see that the number of rigs will drop down to 1300 and not came back to the level it had in the 4th quarter of 2014. We have seen peak rig count for shale oil in the US. EIA indicate a peak production in 2015 but hope the production will come back. This is just guesses and the price of oil will determine this. The decline in the existing wells might be so large that we in reality will have peak shale oil in 2015. As you can see in the figure the shale oil has been the driving force for the increase of the global oil production. The decline with 4 million barrels per day for conventional oilfields during 2015 indicate that 2015 will show a peak production. Will this be the final global Peak Oil? Read the EIA article: Lower 48 oil production outlook stable despite expected near-term rig reductions.

Plantagenet on Wed, 28th Jan 2015 6:25 pm

There is little doubt that shale oil production will level off—-it just ins’t profitable to drill at these prices. Its a little less clear to me why this should mark a pen eventual return to higher oil prices will encourage even more fracking of tight shale oil and even higher global oil production.

Plantagenet on Wed, 28th Jan 2015 6:27 pm

There is little doubt that shale oil production will level off—-because of the oil glut it just isn’t profitable to drill at these prices. Its a little less clear to me why this should mark a peak in global oil prices. Oil prices won’t stay low forever, and it is possible an eventual return to higher oil prices will encourage even more fracking of tight shale oil and even higher global oil production.

rockman on Wed, 28th Jan 2015 6:53 pm

“In the figure you can see that the number of rigs will drop down to 1300 and not came back to the level it had in the 4th quarter of 2014.” Based upon my recent conversations with the service companies expectations that the rig count won’t drop below 1300 is a tad optimistic. The rig count the last time (1Q 2005)oil prices were at the current level was about 1100.

And that might not tell the entire story. Of those 1100 rigs only about 11% were horizontal wells. The other 89% were drilling conventional reservoirs for the most part. And that picture is even more bleak when you understand that more the 80% of those 1100 rigs were drilling for NG and not oil. IOW at the $50/bbl level there was very little conventional oil potential. And that has not changed. Currently about 70% of the active rigs are drilling horizontal holes. Not that it will necessarily be linear but if the number of rigs drilling horizontal wells returns to the 2004 level the total count will be well under 1000. And based upon activity in 1Q 2005 the vast majority of those rigs might be drilling for NG.

And there’s a good reason to be pessimistic about the number of rigs drilling for NG in the future: when 80% of those 1100 rigs were drilling for NG in 2005 it was selling for $7+/mcf. Today the price is less than half that level. The last time both oil and NG prices were at such low levels the rig count was closer to 850.

Bet hell will freeze over before you see those stats in the MSM. LOL

Brent on Wed, 28th Jan 2015 7:01 pm

Planet it is just as likely that we will not have higher not because of more drilling if oil goes up, but people will be leaving the oil economy because they cannot afford the prices.

MSN Fanboy on Wed, 28th Jan 2015 7:04 pm

Plant has thrown the gauntlet down lol

But he is technically right.

Pity oil prices can also technically meet consumer affordability

GregT on Wed, 28th Jan 2015 8:22 pm

“but people will be leaving the oil economy because they cannot afford the prices.”

Thanks Brent for stating what should be obvious.

At least one person here maintains that we are in ‘an oil glut’ as opposed to people not being able to afford high oil prices.

A misleading stance at best, but trollish is probably more appropriate in this case.

Perk Earl on Wed, 28th Jan 2015 8:26 pm

“Oil prices won’t stay low forever, and it is possible an eventual return to higher oil prices will encourage even more fracking of tight shale oil and even higher global oil production.”

That’s true if there’s no such thing as depletion of a finite resources like oil, reducing EROEI, reducing consumer affordability, while increasing cost of exploration, Capex.

Plantagenet on Wed, 28th Jan 2015 9:47 pm

@GregT

Of course we are in an oil glut. Of course oil and gasoline prices are much lower then they were just two months ago.

If you still can’t gasoline at $1.99 gallon then you need to get a better job and a swap that gas guzzler you drive for something like a Prius or even a 80 mpg motorcycle.

Cheers!

Plantagenet on Wed, 28th Jan 2015 9:48 pm

@GregT

Of course we are in an oil glut. Of course oil and gasoline prices are much lower then they were just two months ago.

If you still can’t afford gasoline now that its dropped to $1.99 gallon then you need to get a better job and a swap that gas guzzler you drive for something like a Prius or even a 80 mpg motorcycle.

Cheers!

GregT on Wed, 28th Jan 2015 10:11 pm

Plant,

The cost of gasoline doesn’t concern me, the company pays for my vehicle and my gas. Also, Canada like most other nations, abandoned the British avoirdupois system of measurements back in the 90s. The only countries left using gallons are Liberia, Belize, Colombia, The Dominican Republic, Ecuador, El Salvador, Guatemala, Haiti, Honduras, Nicaragua, Peru, some Island States, and the US.

Low prices do not imply a glut Plant, but you already understand that.

Blah, blah, blah, blah ‘oil glut’.

thingy on Thu, 29th Jan 2015 12:26 am

Plantagenet, this shale boom was driven by junk bonds, so these investors are currently losing their shirts. So OK oil will be back up inside 18montsh, will investors run into junk bonds on the same scale?

Plantagenet on Thu, 29th Jan 2015 1:06 am

@gregT

Your claim that the drop in oil prices and the current low oil prices “do not imply a glut” is silly. But your brain seems to too full of “blah blah blah” to figure that out.

Cheers!

Plantagenet on Thu, 29th Jan 2015 1:08 am

@thingy

I have no idea if investors will fund more fracking after the current oil glut ends. It all depends on how long the glut lasts and how low the price of oil goes.

Still, every prior oil glut has been followed by an oil shortage and a recovery in oil prices. I don’t see why this one should be any different.

Cheers!

Bandits on Thu, 29th Jan 2015 1:49 am

I think its about time our local “oil glut” aficionado proves the oil glut hypothesis and demonstrates what occurred and what is occurring to form and sustain the “oil glut”. Keeping in mind oil production data prior to June last year (when the oil price fall commenced)up to the present.

If it can’t be shown satisfactorily he should shut his flapping mouth……Saying the oil is stored in tankers floating offshore Gibraltar won’t cut it.

Davy on Thu, 29th Jan 2015 7:10 am

Planter we know there is an oil glut son, it is the why that is important. You can’t get your dog like brain a chance to go to that next level. A dog like brain is obsessed with bones. That is as far as a dog like brain goes. Dog like brains can be very intelligent so don’t think I am putting you down on the level of intelligence.

It is obvious this a different kind of oil glut so get the friggen econ 101 out of your head Planter. We have an oil glut in a bumpy descent paradigm shift with limits of growth and diminishing returns. We have central bank repression and systematic debt injections at a huge level. We have economic distortions by bubble driven economic policies.

Oil reacted to this Ponzi situation with the distortion of mal-investment and excessive speculation. This is beyond normal fundamental economics of free market price discovery we knew in the past. Our free markets were always corrupt and manipulated but the degree and duration have changed. It is now a Wild West blow out with no traditional rule of law except wealth transfer and cannibalization in the name of growth for the plutocrats. Give it up Planter and accept this is not your daddy’s oil glut. It is systematic and economic with a supply component caused by mal-investment that should have never happened in a normal environment of price discovery

indigoboy on Thu, 29th Jan 2015 7:47 am

On the face of it, it seems logical that ‘shuttered’ wells will be re-opened as the oil price rises, but, whilst the drillers may be gung-ho and willing to take down the steel shutters and start drilling again, will the finance to re-start drilling, be there.? Will ‘the money people’, be willing to put up the new investment to take down the shutters, when an oil drop to $50, has burned their fingers badly (and could very well do so again, and again,… and again! )?

I wouldn’t risk my money in that volatile ‘game’. Would you?

That’s why I suspect the oil price is now in a kind of ‘Goldilocks Price Range’. And that price range (presently about $115 ~ $50 ) will narrow and converge over time, because the high risk (expensive), wells will fall from favour (read -investment), at each price ‘whiplash’ up and down over the coming few years.

And at each price ‘whiplash up and down’, it will shake out those that can’t afford to buy fuel at the ‘up’, and those that can’t afford to drill at the ‘down’, ‘homing-in’ on a mid price point, where global economic growth is not sustainable (at that price), and drilling *new* wells is not financially feasible.

So, enjoy that cheap motoring while it lasts, before your car becomes a chicken coop on bricks!

marmico on Thu, 29th Jan 2015 9:19 am

Saying the oil is stored in tankers floating offshore Gibraltar won’t cut it.

Does U.S. crude oil commercial inventory cut to the chase? First time ever, that commercial inventory stock exceeds 400 million barrels.

shortonoil on Thu, 29th Jan 2015 9:47 am

Of the 4598 wells in the Bakken, through 05/12 that we reviewed, the average cost of drilling was $53/barrel. Oil has now fallen to $45.50/ barrel. The petroleum industry has lost $trillions in stranded assets over the last eight months. After this you won’t be able to get investors close to shale again with a pitch fork. But the hype goes on, and on, and on ……….

The real problem is that as the price goes down, production will go down. The process of delivering petroleum products to the end consumer now consumes more than half of the oil produced. That ratio grows daily. The largest portion of demand is now from the producer, but their demand is ever declining as their production declines. Price, and demand are attempting to balance were no balance is possible. In this scenario demand can never catch up with production. There will always be more oil on the market than the market can absorb at that price. What many are now calling a “glut” in the market is actually a systemic crisis were demand can no longer balance with supply.

This determination flows directly from of the Etp model. 2012 was the energy half way point for petroleum production. It was the point were it required one half of the energy content of a unit of petroleum to produce it, and its products. Petroleum will never again be able to supply more energy to the economy than it consumes during its production process.

Peak Oil is often described as the point where production reaches its absolute maximum rate. A better description would be the point where production can no longer be increased. That point was reached in 2012; but because of Central Bank Monetary policy that allowed energy to be channeled from other sources that would have otherwise not been unaffordable, some production increase continued for another two years. That appeared as massive debt formation by the industry.

We are rapidly approaching the end of the oil age; the point where the industry can no longer continue to supply petroleum for a price that the consumer can afford to pay. With bumps, and some jumps price will continue its long term descent. Production will follow it downward.

http://www.thehillsgroup.org/depletion2_022.htm

The price of petroleum is now at a level were more than a third of world production is taking place at a per unit lose. That, of course, is not a sustainable situation. As industry infrastructure depreciates out, and cash flows go negative production will fall precariously. At this point much of the industry is operating on the embedded energy of its assets. That can not continue for long. At what point this translates into a world wide financial crisis that can not be controlled can not be determined with precision. The inevitability of this occurring can, however, no longer be in doubt.

http://www.thehillsgroup.org/

marmico on Thu, 29th Jan 2015 9:55 am

The price of petroleum is now at a level were more than a third of world production is taking place at a per unit lose

Bull. OPEC and Russia produce 50%+ of global production at a marginal cost of less than $45 WTI.

shortonoil on Thu, 29th Jan 2015 10:14 am

Bull. OPEC and Russia produce 50%+ of global production at a marginal cost of less than $45 WTI.

WTI as of 11:06 AM 01/29/15 $43.86. There goes your grant, and esoteric thought process. By the way, where do you conjure up these numbers you come by? Someone told me you lost your Ouija board. Are you back to dried chicken bones, spells, and rattles?

Davy on Thu, 29th Jan 2015 10:15 am

Cat piss Marm, you forget your POD of social and budget requirements of these countries. Their oil companies are an extension of their government as just another source a revenue. They are in the same boat of being unprofitable at these prices. Social coasts to maintain a country that maintains the oil infrastructure are similar to the relationship of oil companies and their investment environment. There is no free lunch or decouple like the corns preach with their traditional Econ 101.

GregT on Thu, 29th Jan 2015 10:40 am

“We are rapidly approaching the end of the oil age; the point where the industry can no longer continue to supply petroleum for a price that the consumer can afford to pay.”

And this right here is the bottom line. If we had 500 trillion barrels of oil available, but nobody could afford to pay for it, it may as well be sawdust. It is not the volume that matters, it is the price that the consumer can afford to pay, and the number of consumers that can afford to pay for it.

marmico on Thu, 29th Jan 2015 11:01 am

Wow, you follow the oil price second by second. Great, each second your ETP model becomes more busted.

When are you going to respond to Pops?

A blast from your 3100+ past peakoil.com posts:

Non-OPEC production is falling at 3% per year and accelerating by 1% per year. If total world production follows the same pattern, which it probably will, once PO starts, probably this year, world production will fall by 55% in ten years. At that rate in fifteen years the only place you will find a car will be in the Smithsonian. If it still exists?

Giggles all around with your July 6, 2005 masterpiece.

marmico on Thu, 29th Jan 2015 11:17 am

but nobody could afford to pay for it

U.S. households spent $375 billion+ per year for gasoline for 3.75 years. What’s with this affordability crap! One day in July 2014, they just gave up. ROTFLMFAO

GregT on Thu, 29th Jan 2015 11:32 am

“U.S. households spent $375 billion+ per year for gasoline for 3.75 years. What’s with this affordability crap!”

During that same time period, US federal debt ALONE, climbed 3.1 trillion dollars. That is only affordable as long as confidence in the USD continues. Nothing more than a facade. We are living beyond our means.

marmico on Thu, 29th Jan 2015 11:48 am

Ah, the ole debt canard. If my prayers for civilization to collapse because of peak oil don’t come to fruition, I pray that it collapses because of federal government debt.

Well bozo, Canadians spent proportionally the same amount of money on gasoline but Canada federal government debt didn’t rise as much proportionally. Stick that in your cray and move from Surrey to Boulder. Maybe Mork will set you free and you can see the light. 🙂

gamilon on Thu, 29th Jan 2015 11:52 am

Hi Short – do you have source for: “The process of delivering petroleum products to the end consumer now consumes more than half of the oil produced.” Thanks.

Davy on Thu, 29th Jan 2015 12:02 pm

Its obvious Marm likes free lunches.

GregT on Thu, 29th Jan 2015 12:09 pm

“Well bozo, Canadians spent proportionally the same amount of money on gasoline but Canada federal government debt didn’t rise as much proportionally.”

We pay much higher taxes in Canada Marmico, one reason why Canada has weathered the Global Financial Crisis better than most other countries. Your ignorance of debt is not surprising. One of the two biggest reasons that the chicken bone throwers have created such a massive global mess, the other obviously being ignorance of physical limits to growth. Keep living in your make believe world, in the end it will be you and yours, that you will hurt the most.

marmico on Thu, 29th Jan 2015 12:20 pm

Oh Davy-boy, you are slowly turning out to be an effing moron like the quart shy. I thought that I bitch slapped you enough at the wood shed. 🙂

There is a difference between a stock and a flow.

In the 3.75 years under discussion federal debt (stock) increased by $3.1 trillion but the economic flow was (back of the envelope) $16.5 trillion x 3.75 years which equals $63 trillion. So the increase in the stock accounted for at the maxima (and it didn’t) $3.1 trillion divided by $63 trillion or 5% of the flow.

GregT on Thu, 29th Jan 2015 12:25 pm

You would be better served listening to your econ101 gods in Davos, than to continue to live in your sheltered non-reality dream world Marmico. Even the world’s great e-CON-omists are now very concerned.

shortonoil on Thu, 29th Jan 2015 12:35 pm

Hi Short – do you have source for: “The process of delivering petroleum products to the end consumer now consumes more than half of the oil produced.” Thanks.

http://www.thehillsgroup.org/

It is called the Etp model. It is an equation of state derived from a Second Law Statement: “The entropy rate balance equation for control volumes”. Through the calculation of entropy formation in the petroleum production system it allows for a determination of the energy required to produce petroleum, and it products. Etp stands for Total Production Energy.

The model is verified through a number of methods. Which includes an almost perfect correlation to the historic price of petroleum. That curve can be seen here:

http://www.thehillsgroup.org/depletion2_007.htm

The model was used to predict “this” almost a year ago:

http://www.thehillsgroup.org/depletion2_022.htm

GregT on Thu, 29th Jan 2015 12:41 pm

But at the last bone throwing, Marmico’s wishbone landed upside down. That trumps all of your stupid mathematics and physics Short.

Davy on Thu, 29th Jan 2015 1:10 pm

Owee Marm, quit it that mean.

Marm, please tell me the global aggregate outstanding debt has any relationship whatsoever to the physical and the productive potential of the current physical. Please tell me there are not limits ahead and if you acknowledge limits how do you propose overcoming them?

Your answers to our questions and answers here are the same Econ 101 that got us to this point. You always have slick links and numbers but they have little resemblance to reality. They are part of a broken system you are so invested in you can’t think any other way.

Your type are the type that jump out of buildings when things fall apart. Marm, for your sake and your family moderate your extremism for a broken system at least acknowledge the immense danger ahead. Your corn porn don’t fly here son.

indigoboy on Thu, 29th Jan 2015 1:48 pm

In the final analysis, I guess we’re left wondering why,… if Shale Oil is such good stuff, why wasn’t it accessed decades ago? Maybe because it is the *expensive* stuff,… the dregs,… the bottom of the barrel fossil fuel scrapings ?

The undisputable fact is that the *cheap* stuff is now almost all extracted and burned, and our 250 year fossil fuel ‘industrial party’ cannot now survive as it has, on the more*expensive* stuff. ?

People can play childish games with figures and statistics all they like, but it’s downhill from here, and we’re going to have to adapt to a much lesser lifestyle.

shortonoil on Thu, 29th Jan 2015 3:42 pm

But at the last bone throwing, Marmico’s wishbone landed upside down. That trumps all of your stupid mathematics and physics Short.

OMG, its a triple witch twitch. The Dark Lord is zeroing in on me!!!!

shortonoil on Thu, 29th Jan 2015 3:54 pm

The undisputable fact is that the *cheap* stuff is now almost all extracted and burned, and our 250 year fossil fuel ‘industrial party’ cannot now survive as it has, on the more*expensive* stuff. ?

http://www.zerohedge.com/news/2015-01-29/either-oil-soars-back-88-or-energy-stocks-have-tumble-over-40

If the petroleum industry loses the lines of credit it needs to maintain production the future of post industrial civilization doesn’t look good! The problem is that oil can’t go to $88, at least not for more than for a very short period, or the economy would completely collapse:

http://www.thehillsgroup.org/depletion2_022.htm

This is what they call damned if you do, damned if you don’t.

Westexasfanclub on Fri, 30th Jan 2015 4:19 am

Fascinating. To put it simple: Money is a form of energy. If you have money, it’s accumulated energy derived from your work. If your money is borrowed, it’s the advanced energy of future work.

That’s why fracking is producing oil but no energy. The advanced energy of future labour makes fracking possible, but adding money as energy to the equation, especially if interest rates go up – and they will go up – the gained amount of energy, when all is said and done, could in fact be zero.

shortonoil on Fri, 30th Jan 2015 6:12 pm

Fascinating. To put it simple: Money is a form of energy. If you have money, it’s accumulated energy derived from your work.

What you are calling money is actually currency. Money is goods and services; currency is the representational form of money. Currency is an IOU for the future delivery of goods and services, which includes energy. So, money can be equated to energy. The EIA, and World Bank have given us the numbers to do it:

http://www.thehillsgroup.org/depletion2_008.htm

Here in lies the problem with hydrocarbon production that does not deliver energy. It is produced via a debt conduit; a debt of energy that did not exist to begin with. Therefore, it can never be repaid. The system now has 5.6 quad BTU that must be found to bring it back into balance. That energy was stolen from the future via debt formation. Now that the future has arrived – it is no were to be found; and there is no way to file bankruptcy against it.