Page added on November 29, 2012

Russian oil production to 2020

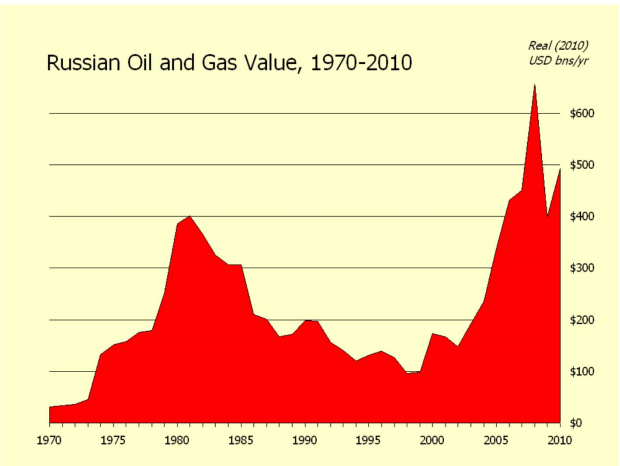

Uncertainty continues whether Russia can maintain its high level of oil production – 10.7 million b/d in 2012 to date on average. A new more benign tax regime which has recently been put in place, and significant industry investments may plausibly enable the Russian Bear to extend its “plateau production” to 2020.

This post below outlines how this impressive achievement has been made possible, given that the decline of existing production is plausibly 6% or more every year for most old giant fields in West Siberia. In other words, the Russian oil industry needs to invest substantially in pushing more oil from existing fields (lowering decline rates) and new field developments, to keep production steady.

For how long production levels can be maintained beyond 2020 is a difficult question, and one which I have left to answer another day. A view of on-going developments and things to come up to 2020 is available below the fold.

This post was informed by a presentation by TNK-BP’s Oleg Mikhailov held at the unconventional gas conference 27-28 November in Aberdeen, with additional information from investor presentations of major Russian oil companies, a few peer-review studies, and a recent study on the Russian Oil & Gas Sector by Wojciek Kononczuk of the Center of Eastern Studies in Warsaw which I recommend reading.

Although TNK-BP recently became a part of Rosneft, making Rosneft the biggest oil company in the world, (see investor presentation) it will be referred here as TNK-BP.

The current state of Russia’s oil production

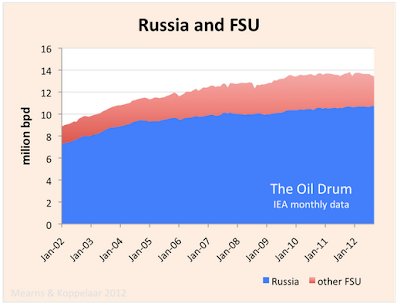

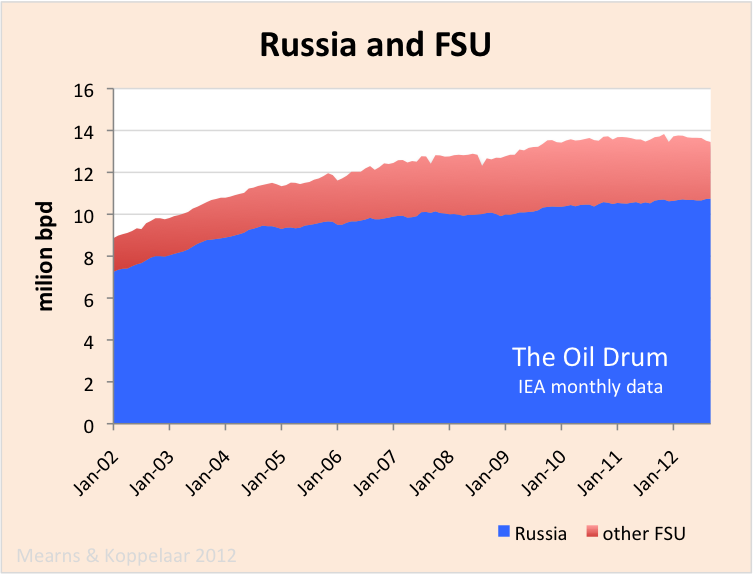

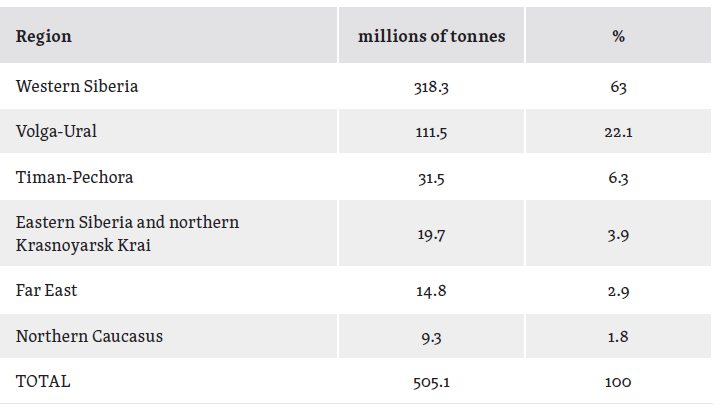

The background to Russian oil production is a story of rapid increase from 3 million in the 1960s to an enduring plateau ±11 mb/d in the 1980s, a rapid drop to 6 mb/d in mid 1990s due to the collapse of the Soviet Union, followed by a revival as investment began flowing again.

Keeping West Siberian declines in check

To ensure continued high flow rates a lot of investment is being made by the industry in venturing into remote oil regions and difficult reservoirs to keep production flowing. In the words of Mikhailov. “We are relying more and more on either tight reservoirs or even venturing into unconventional and shale type plays.” Two key developments, investment in difficult reservoirs and tax regime changes, show that the industry and government are indeed making a substantial effort.

The industry has focused development in mature regions on what is called “challenged reserves” (TNK-BP now Rosneft) or “Hard to Recover reserves“ (Gazprom Neft) which were previously uneconomic. These can be classified into various categories including:

- Low permeability formations with highly irregular reservoir properties

- Under saturated reservoirs in low-permeability reservoir rocks

- High-viscosity oil deposits with gas caps

- Remaining oil reserves in high water cut fields

- Unconventional reservoir rocks

- Thin reservoirs (couple of meters thick)

To recover more oil from these poor quality reservoirs a range of technologies is being deployed combining multiple leg horizontal drilling, multi-stage hydrofracking, and other technologies. TNK-BP alone has about 10 billion of technically recoverable resources in such fields, and is targeting to exploit 4.5 billion of this under its new “challenged reserves” recovery program which focuses on 7 development projects. To give an order of magnitude, TNK-BP was the third biggest oil producer in Russia, and total Russian annual oil production is equal to approx. 3.8 billion barrels.

The combination of these technologies with brute drilling force (many wells with lots of rigs in use) is what allows production in West-Siberia to not decline as rapidly as otherwise would be the case. To make this happen technical expertise is drawn from service companies like Halliburton and Schlumberger by TNK-BP, and joint ventures with players like ExxonMobil and Statoil by other players. “TNK-BP had 130 multi-stage fracking operations versus 15 last year, going forward need to do 1000 well drilling operations or even more per year to access these reserves. Such drilling requires 30%-40% growth in drilling activity. A factor of 5 – 10 for multi stage operations. We need contractors to invest in this equipment. To expedite this we are working with key oilfield service providers Schlumberger, Halliburton and others,” as stated by Mikhailov. For an example of such projects, here is an interesting news item with quantitative bits on the Severo-Khokhryakovskoe field being developed by TNK-BP and Schlumberger.

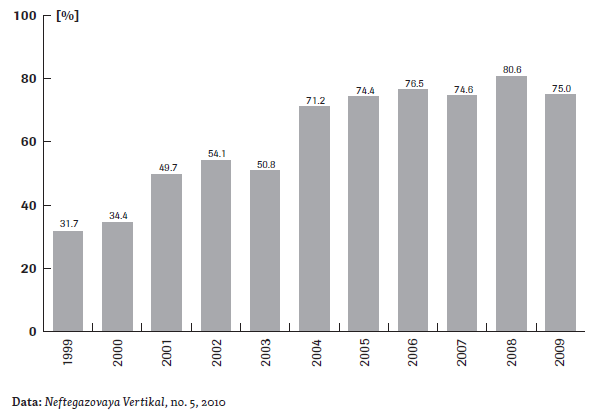

The development of these projects is enhanced by a recent change in the tax regime of Russia. Historically this has been a huge problem because the Russian State obtains the majority of its income from oil & gas wealth which is the biggest driver of the economy. In 2011 50% of state income came from oil & gas.

June 2012, Reuters: “The centrepiece of the package is a sliding scale of tax breaks for investors in tight oil which would grant a discount of 50 to 100 percent on mineral extraction tax depending on the permeability of the rock.”

October 2012, Russia & Industry Report: “Energy Minister Alexander Novak announced that the government had decided to significantly lower customs duties for oil extracted from fields in eastern Siberia. Duties, he said, would be cut almost in half. Moreover, the cabinet of ministers intends to extend the zero percent tax rate already in effect for eastern oil fields. The tax break was supposed to end on January 1, 2017, but has now been extended to January 1, 2022.”

Interestingly, the tax breaks are highly differentiated both by region and reservoir properties. An incomplete listing includes:

- Reservoir thickness used as a differentiation factor on tax incentives.

- Relief provided for formations with permeability under 2 milliDarcy.

- Export duty relief for extra-viscous oil fields (over 10000 cP).

- Availability of tax relief for reservoirs with an oil viscosity over 200cP.

- Highly depleted fields receive a tax cut.

With several large players and loads of activity on-going these development programs will help maintain Russian oil production at today’s levels, by slowing the decline in West-Siberia, and unlocking production in more difficult to access regions.

Moving eastwards, new fields on the horizon

A large share of new production in Russia is expected to come from East-Siberia and the Far East. Exploration and development is on-going in these regions but tackling the key problems, climate and lack of infrastructure, is not an easy task. Because of these issues, exploitation of these resources is so costly that it is is only feasible under a favourable tax regime. In terms of infrastructure the situation is rapidly changing. Several pipeline projects are underway or have been completed:

- In 2010 the Eastern Siberia Pacific Ocean (ESPO) oil pipeline was completed, which connects East to West Siberia from Tayshet to Skovorodino. It is the first in unlocking transport from East Siberia (2700 km, 0.6 million b/d capacity).

- The second phase of the ESPO project is to build a connection to the East coast of Russia for export to Asian markets (1763 km with capacity of 1 million b/d). The oil to the east coast from Skovorodino is currently transported by railway to the Kozmino terminal. The construction is partially financed by China who has loaned Transeft 10 billion USD. This second phase will also expand the capacity of the East to West Siberia link to 1.6 million b/d.

- A pipeline is under construction from Krasnoyarsk Krai with the first stage to be completeted in 2013 (910 km, 0.5 million b/d capacity increasing to 1 million b/d by 2016).

- A pipeline is under construction from Tikhoretsk Tuapse-2 to the Tuapse refinery (247 km, 250,000 b/d capacities).

- Discovery of the 1.1 billion barrels Sevastyanovo field in East Siberia by Rosneft in 2010.

- In June Japan Oil, Gas and Metals National Corp. (JOGMEC) and Russia’s Gazprom Neft signed an agreement for studying exploration potential in the Ignyalinksy licensing block 1000 km northeast of Irkutsk (80 km from the second phase of the EPSO pipeline to Asia).(Link)

- The Vankor oil field development on the border of West to East Siberia. The field was brought on-stream and is expected to reach 600,000 b/d of production in 2014. (Link)

- The Verkhnechonsk giant field, discovered in 1978 “near” to the Chinese border (closest human settlement is stated to be 250 miles away), started production in 2008. Its production development has been ramped up more quickly from 26,000 b/d in 2009 to 90,000 in 2010 and an expected 150,000 b/d in 2014. It’s a tough development requiring horizontal drilling, fresh water due to too high salt content, and temperatures can go as low as -70 degrees Fahrenheit (-56 degrees Celsius).(link 1, link 2, link 3, Link 4)

- The Talakan field which started production in 2008, which produced 100,000 b/d in set to rise in the longer run to 150,000 b/d. This includes the north part of the field whose production ramp-up started late 2011. (more info)

Conclusions for future production

The total of new developments are such that, as long as investment keeps flowing, production can be maintained at 10-11 million b/d. Total possible production from “challenged reserves” unlocked by the tax regime changes in the next 5-10 years is by some estimates of the order 2 million b/d, sufficient to compensate for declines in other fields. How long production levels can be maintained beyond 2020 is a difficult question to answer. This depends largely on whether new exploration will result in sufficient discoveries such as Sevastyanovo, and whether investment is there to develop these fields in the medium to long term.

4 Comments on "Russian oil production to 2020"

actioncjackson on Thu, 29th Nov 2012 7:30 pm

Yet another reinforcement of oil at $110, despite the recession in “advanced” countries.

James on Fri, 30th Nov 2012 3:22 am

Well at least Russia’s oil outlook is more believable than the U.S. becoming a net exporter of oil and surpassing Saudi Arabia. Actually, the U.S. thinks Canada’s tar sands belong to them, and not Canada.

BillT on Fri, 30th Nov 2012 4:35 am

Canada? What Canada? The North American Union will make it so. It exists in most every way except flag and currency. Do you think the empire will allow oil to be denied when the crunch is killing the Us? I don’t.

Sudhir Jatar on Fri, 30th Nov 2012 10:29 am

The point to note here is that Russia can just about maintain the current production level by developing unconventional oil.

Unconventional oil has its fall out in adverse effect on environment and excessive use of water. Add this to the Russian problems of harsher climate and escalating costs.

Obviously, Russian conventional oil has already peaked.