Page added on July 28, 2011

Analyzing the Global Oil Supply: 2012 Is the Year for Peak Oil

I first want to make sure that we are on the same page as to what Peak Oil actually means. Here is the definition from Wikipedia which is basically how I understand it:

Peak oil is the point in time when the maximum rate of global petroleum extraction is reached, after which the rate of production enters terminal decline. This concept is based on the observed production rates of individual oil wells, and the combined production rate of a field of related oil wells. The aggregate production rate from an oil field over time usually grows exponentially until the rate peaks and then declines—sometimes rapidly—until the field is depleted. This concept is derived from the Hubbert curve, and has been shown to be applicable to the sum of a nation’s domestic production rate, and is similarly applied to the global rate of petroleum production. Peak oil is often confused with oil depletion; peak oil is the point of maximum production while depletion refers to a period of falling reserves and supply.

So just to be clear. We aren’t running out of oil. The problem is that we are at the point where we just can’t increase the rate at which we extract it. Since 2005 we have more or less been on a plateau when it comes to daily oil production. We are holding at the current level and running awfully hard just to stay there.

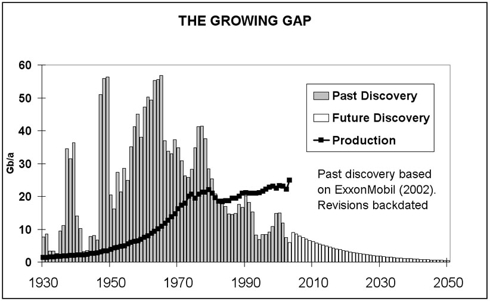

Supply Challenges – All the Easy Stuff Was Found Decades Ago

[Click to enlarge]

When you look at this chart, is it not common sense that as the production from the super-giant fields discovered in the 1960s declines, we simply do not have a sufficient inventory to replace it ?

What makes this more troubling is the fact that the technology we are now using to try and find new oil fields is exponentially superior to what we had at our disposal in the 1960s. And the economic motivation to find more oil has also been vastly increased because of the once unbelievable $100 per barrel price that it sells for.

Demand Growth – The Other Side of the Problem

The daily per barrel consumption statistics are startling. A Chinese person uses about 10% of what an American does on a daily basis. An Indian person uses less than 5%. If China and India’s per capita consumption levels were to increase to just 20% and 10% of America’s respectively world daily oil demand would increase by over 11 million barrels.

The Great Recession of 2008/2009 gave us a bit of a break and postponed the problem. After looking at the most recent information from the IEA, I think 2012 is where the reality of what we are facing is going to really hit home.

Here is the problem. Current daily oil production is 88.3 million barrels per day and the second half of 2012 expected daily oil demand is 92 million barrels per day. Current production is a 3.7 million barrel per day shortfall from where we need to be in 2012. Where can the oil to make up this shortfall reasonably be expected to come from ? 3.7 million barrels per day is 40% of Saudi Arabia’s current total oil production and they are currently banging up against the most oil they have ever produced on a daily basis. Does anyone really think they have another 3.7 million barrels of spare capacity ?

There is no way that the world can supply 92 million barrels a day of oil consumption. The only way to balance supply and demand therefore is on the demand side. And the only way to kill enough demand is with a high price.

3 Comments on "Analyzing the Global Oil Supply: 2012 Is the Year for Peak Oil"

James A. Hellams on Thu, 28th Jul 2011 10:17 pm

According to the figures mentioned in this article, the worldwide demand for oil will rise from 32.2 billion barrels per year to 33.6 billion barrels per year.

The above information should be used to evaluate claims by people, who claim that “huge” oil finds are going to rescue the world from the certainty of the demise of the oil age.

Stephen Lawrence, Cambridge, UK on Fri, 29th Jul 2011 11:40 am

Actually, a high oil price doesn’t kill overall demand – it just moves it around. The high price paid by one set of consumers is passed on as new money to another set. They use this extra money to buy their oil.

When oil demand exceeds supply, the logical conclusion is that the local people living in the country where the oil is extracted end up using more of it.

Roderick Beck on Fri, 29th Jul 2011 2:45 pm

Well, the problem is that the author’s definition of oil is too broad. The author is clearly using ‘all liquids’ measure of oil production, including liquified natural gas. Crude oil production is around 77 million barrels, not 87-88 million barrels a day.