In its annual World Oil Outlook report released on Oct. 9, 2023, the Organization of the Petroleum Exporting Countries (OPEC) projects global oil demand to reach 110.2 million b/d in 2028, up 10.6 million b/d compared with 2022. Non-OECD oil demand is anticipated to make up 10.1 million b/d of this increase, reaching 63.7 million b/d in 2028. OECD demand is expected to see a modest uptick of 500,000 b/d.

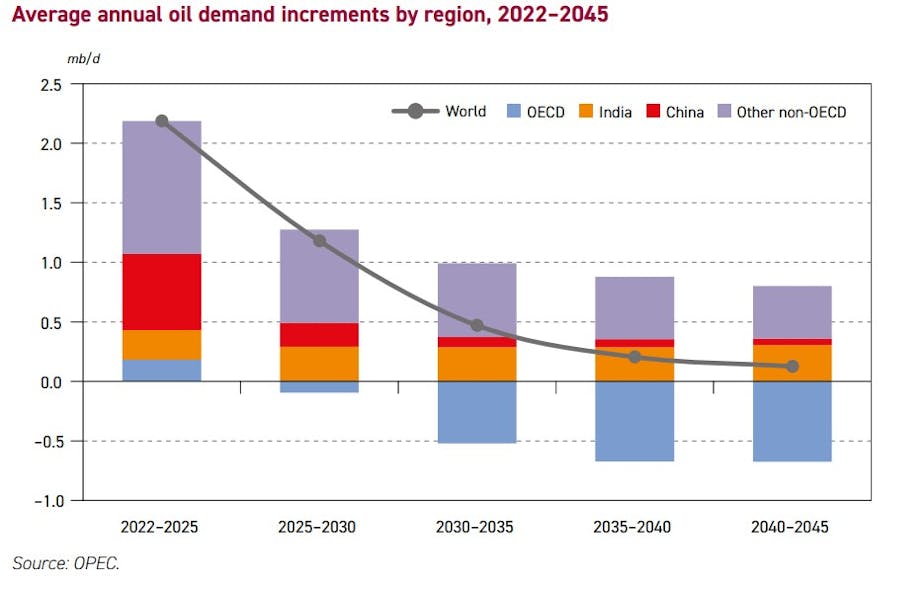

In the long-term, global oil demand is expected to increase by more than 16 million b/d between 2022 and 2045, rising from 99.6 million b/d in 2022 to 116 million b/d. During this forecast period, non-OECD oil demand is projected to surge nearly 26 million b/d, while OECD oil demand is poised to contract by approximately 9.3 million b/d.

According to OPEC’s predictions, the most substantial boosts in non-OECD oil demand are set to come from India, Other Asia, China, Africa, and the Middle East. Specifically, India is projected to add 6.6 million b/d to oil demand between 2022 and 2045. Other Asia’s oil demand is set to increase by 4.6 million b/d, China’s by 4 million b/d, Africa’s by 3.8 million b/d, and the Middle East’s by 3.6 million b/d.

The largest incremental demand during the forecast period from 2022 to 2045 is projected for the road transportation, petrochemical, and aviation sectors. Oil demand in these sectors is set to increase by 4.6 million b/d, 4.3 million b/d and 4.1 million b/d, respectively. With respect to refined products, major long-term demand growth is expected for jet-kerosene (4 million b/d) followed by ethane-LPG (3.6 million b/d), diesel-gas oil (3.1 million b/d), naphtha (2.5 million b/d), and gasoline (2.5 million b/d), according to OPEC.

OPEC’s predictions regarding oil demand stand in contrast to recent forecasts from the International Energy Agency (IEA), which suggest that oil demand will peak by 2030.

Energy mix

According to OPEC’s forecast, global primary energy demand is set to increase from around 291 million boe/d in 2022 to close to 359 million boe/d in 2045, an increase of 68.3 million boe/d, or 23% over the outlook period. Growth is expected to slow gradually from the relatively high short-term rates to more modest long-term increments, in line with moderating population and economic growth. Energy demand growth will be driven by the non-OECD region, which is set to increase by 69 million boe/d over the outlook period. Around 28% of non-OECD growth is expected to come from India alone. At the same time, energy demand in OECD countries is set to marginally decline.

Demand for all primary fuels except coal is set to increase in the long-term, with coal use dropping due to energy policy and climate commitments. The strongest growth is expected for renewables (notably wind and solar), which will increase by 34.3 million boe/d, based on strong policy support in many regions. The share of renewables in the energy mix is set to rise from around 2.7% in 2022 to 11.7% in 2045. Oil will remain the fuel with the largest share by 2045 at 29.5%. Natural gas demand is set to increase by 20 million boe/d over the outlook period, reaching 87 million boe/d in 2045. The share of fossil fuels in the energy mix will drop from above 80% in 2022 to about 69% in 2045, due to the decline of coal. In the same period, the combined share of oil and gas in the energy mix will still represent 54% in 2045, according to the Outlook.

Liquids supply

In this Outlook, OPEC expects non-OPEC liquids supply to grow from 65.8 million b/d in 2022 to 72.7 million b/d in 2028, a growth of nearly 7 million b/d. About 3.4 million b/d of this growth is attributed to the US, with other notable contributors being Brazil, Guyana, Canada, Qatar, and Norway.

US liquids supply, however, is expected to reach its peak around the end of the current decade, leading to an overall decline in non-OPEC production starting in the early 2030s, eventually reaching 69.9 million b/d by 2045. Guyana, Canada, Argentina, Brazil, and Kazakhstan are some of the few non-OPEC producers set to expand beyond the medium-term, but non-crude liquids including biofuels and other unconventional will also keep increasing.

OPEC liquids will rise steadily in the medium-term from 34.2 million b/d in 2022 to 37.7million b/d in 2028, and further to 46.1 million b/d by 2045. OPEC’s share of global liquids supply will therefore increase from 34% in 2022 to 40% in 2045. After US liquids supply, and thus non-OPEC liquids, peak in the early 2030s, OPEC liquids will continue to grow.

Investment requirements for the overall oil sector between 2022 and 2045 are estimated at a cumulative $14 trillion (in 2023 US dollars), averaging around $610 billion per year. Of this, $11.1 trillion is expected to be required in the upstream sector, or an average of $480 billion per year. Downstream and midstream requirements are estimated at $1.7 and $1.2 trillion, respectively.

Jovany on Tue, 10th Oct 2023 3:35 am

This is a quality article that I just read, there is a lot of useful new information shared. Thank you very much. jacksmith

Ted Wilson on Tue, 10th Oct 2023 12:55 pm

As more people keep buying vehicles and americans move to trucks, oil consumption will keep increasing. no idea at what point it will hurt worlds growth.

But electric vehicle sales are increasing at steady pace.

Echtedokumente.at on Mon, 25th Dec 2023 8:27 am

Kaufen Sie einen registrierten und legalen deutschen Führerschein Wir alle wissen, dass der Erwerb eines deutschen Führerscheins nicht so einfach ist. Allerdings bringt ein deutscher Führerschein zahlreiche Vorteile mit sich und der Besitz lohnt sich. Wer heute seinen Führerschein über eine Fahrschule machen möchte, muss neben allen anderen Kosten auch mit einer Grundgebühr rechnen.https://www.echtedokumente.at/kaufen-fuhrerschein

Schnelldokumente.de on Mon, 25th Dec 2023 9:09 am

Der Kauf eines deutschen Führerscheins war noch nie so einfach. Ob Sie sich in Brandenburg, Bayern, Hessen oder einem anderen Bundesland oder auch außerhalb Deutschlands befinden, wir sind für Sie da, um Ihnen einen registrierten deutschen Führerschein zu besorgen.https://www.schnelldokumente.de/kaufen-deutschen-fuhrerschein

Schnelldokumente.de on Tue, 16th Jan 2024 7:19 am

Wir setzen uns dafür ein, dass Menschen, die Schwierigkeiten haben, problemlos einen Führerschein zu erhalten, dies in kürzerer Zeit tun können. Wir arbeiten mit mehreren Schulen und Ämtern zusammen, um den Prozess legal und authentisch zu gestalten.https://www.schnelldokumente.de/kaufen-einen-fuhrerschein

Papa’s freezeria on Thu, 22nd Aug 2024 11:31 pm

I really like the information you provide on this blog. It is really helpful and easy to understand, some websites that I know also contain useful information for you.

slope game on Mon, 26th Aug 2024 3:18 am

In its 2023 World Oil Outlook, OPEC predicts global oil demand to hit 110.2 million b/d by 2028, with significant growth in non-OECD regions like India, China, and Africa. This rise, alongside sector-specific increases in road transportation and aviation, contrasts recent IEA forecasts of peak oil demand by 2030. OPEC also forecasts a shift in the energy mix towards renewables, while oil retains a dominant share, reflecting evolving global energy needs.

geometry dash on Thu, 6th Feb 2025 2:03 am

OPEC projects global oil demand to hit 116 million b/d by 2045, with growth driven by non-OECD regions like India and China. Renewables will rise but oil remains dominant. As energy demand evolves, gamers might still find time to beat levels in Geometry Dash, proving resilience amidst change. Fossil fuel reliance will drop to 69%, while renewables grow to 11.7%. OPEC’s outlook contrasts with IEA’s 2030 peak prediction.

Miao on Fri, 7th Feb 2025 9:04 am

India, Other Asia, China, Africa, and the Middle East are expected to contribute the largest increases in non-OECD oil demand. Check insurance company attorney

Geral Dortiz on Thu, 12th Jun 2025 9:31 pm

This OPEC report provides an intriguing glimpse into the future of global oil demand. It’s fascinating how non-OECD countries, especially India and China, will significantly drive this growth. It’s essential to seek sustainable alternatives as we look ahead. On a lighter note, if anyone’s in need of a fun escape from these heavy topics, I highly recommend playing Snow Rider 3D. It’s a refreshing break that allows you to enjoy some winter fun!